Wall Street's Most Accurate Analysts' Views On 3 Utilities Stocks With Over 4% Dividend Yields

Wall Street's Most Accurate Analysts' Views On 3 Utilities Stocks With Over 4% Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

在市場動盪和不確定的時期,許多投資者會轉向股息收益股,這些通常是具有較高的自由現金流並以高紅利派息獎勵股東的公司。

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting our Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Benzinga的讀者可以查看我們的分析師股票評級頁面,查看最新的分析師對他們最喜愛的股票的看法。交易員可以瀏覽Benzinga的廣泛分析師評級數據庫,包括按分析師準確性排序。

Below are the ratings of the most accurate analysts for three high-yielding stocks in the utilities sector.

以下是公用事業板塊三隻高股息精準分析師的評級。

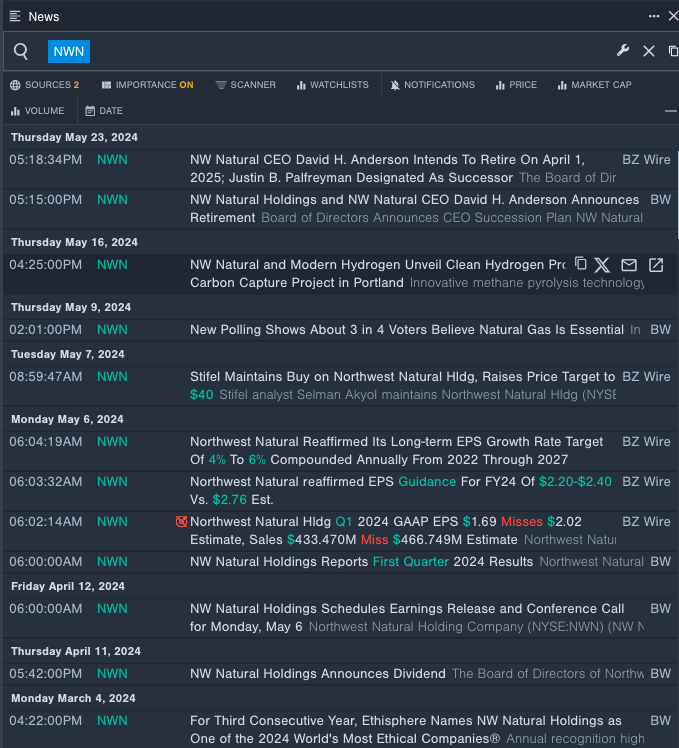

Northwest Natural Holding Co (NYSE:NWN)

西北天然氣控股股份有限公司(紐約證券交易所:NWN)

- Dividend Yield: 5.19%

- Stifel analyst Selman Akyol maintained a Buy rating and raised the price target from $39 to $40 on May 7. This analyst has an accuracy rate of 69%.

- Janney Montgomery Scott analyst Michael Gaugler initiated coverage on the stock with a Neutral rating and a price target of $39 on Jan. 31. This analyst has an accuracy rate of 74%.

- Recent News: On May 23, NW Natural CEO David H. Anderson announced his intent to retire on April 1, 2025.

- Benzinga Pro's real-time newsfeed alerted to latest Northwest Natural's news

- 股息收益率:5.19%

- Stifel分析師Selman Akyol 於5月7日維持買入評級,並將價格指標從39美元上調至40美元。該分析師的準確率爲69%。

- Janney Montgomery Scott 分析師Michael Gaugler於1月31日發佈中性評級,並給出了39美元的價格目標。該分析師的準確率爲74%。

- 最近新聞:5月23日,西北天然氣首席執行官David H.Anderson 宣佈打算於2025年4月1日退休。

- Benzinga Pro 的即時新聞提醒最新的西北天然氣消息。

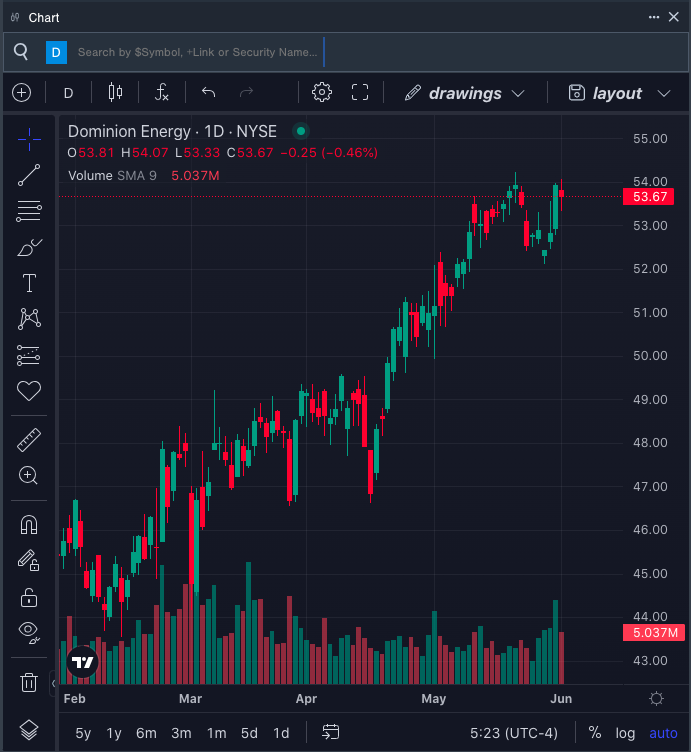

Dominion Energy Inc (NYSE:D)

Dominion Energy Inc(紐約證券交易所:D)

- Dividend Yield: 4.97%

- B of A Securities analyst Julien Dumoulin-Smith upgraded the stock from Underperform to Neutral and increased the price target from $43 to $54 on May 10. This analyst has an accuracy rate of 69%.

- BMO Capital analyst James Thalacker maintained a Market Perform rating and boosted the price target from $51 to $52 on May 6. This analyst has an accuracy rate of 68%.

- Recent News: On May 7, Dominion Energy declares quarterly dividend of 66.75 cents per share.

- Benzinga Pro's charting tool helped identify the trend in Dominion Energy's stock.

- 股息收益率:4.97%

- 美國銀行證券分析師Julien Dumoulin-Smith於5月10日將該股票評級從“賣出”上調爲“中性”,並將價格指標從43美元上調至54美元。該分析師的準確率爲69%。

- BMO Capital 分析師James Thalacker於5月6日維持市場表現評級,並將價格指標從51美元上調至52美元。該分析師的準確率爲68%。

- 最近新聞:5月7日,Dominion Energy宣佈每股股息爲66.75美分的季度股息。

- Benzinga Pro 的圖表工具幫助識別了Dominion Energy股票的趨勢。

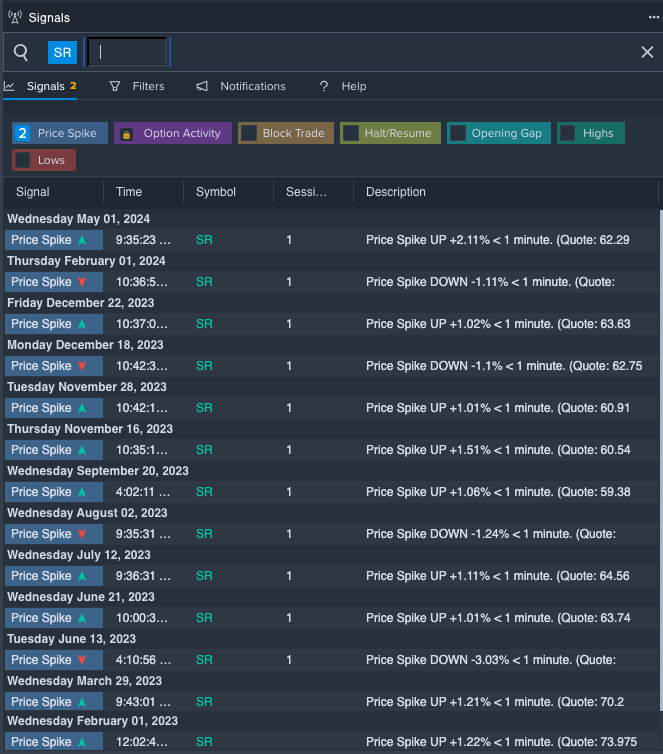

Spire Inc (NYSE:SR)

Spire Inc(紐約證券交易所:SR)

- Dividend Yield: 4.93%

- Wells Fargo analyst Sarah Akers maintained an Equal-Weight rating and raised the price target from $64 to $66 on May 2. This analyst has an accuracy rate of 68%.

- Mizuho analyst GabrielMoreendowngraded the stock from Buy to Neutral and slashed the price target from $64 to $62 on May 2. This analyst has an accuracy rate of 70%.

- Recent News: On May 1, Spire posted weaker-than-expected quarterly results.

- Benzinga Pro's signals feature notified of a potential breakout in Spire shares.

- 股息收益率:4.93%

- 富國銀行分析師Sarah Akers於5月2日維持平權評級,並將價格指標從64美元上調至66美元。該分析師的準確率爲68%。

- 瑞穗證券分析師Gabriel Moreen於5月2日將該股票評級從買入下調至中性,並將價格指標從64美元下調至62美元。該分析師的準確率爲70%。

- 最近新聞:5月1日,Spire發佈了不及預期的季報。

- Benzinga Pro 的信號功能通知了Spire股票潛在的突破。

Read More: How to Find Dividend Stocks: Scan, Analyze, and Capture with Benzinga Pro

閱讀更多:如何使用Benzinga Pro查找分紅股票:掃描、分析和捕捉