Bank Of Canada Cuts Rates By 0.25% As Policy 'No Longer Needs To Be Restrictive': Canadian Stocks Rally, Loonie Drops

Bank Of Canada Cuts Rates By 0.25% As Policy 'No Longer Needs To Be Restrictive': Canadian Stocks Rally, Loonie Drops

The Bank of Canada announced on Wednesday a 25 basis point reduction in interest rates, marking the first cut since March 2020, as widely anticipated by market participants.

加拿大銀行週三宣佈25個點子的利率下調,這是自2020年3月以來的首次降息,市場參與者普遍預計。

Consequently, the benchmark overnight rate and the deposit rate have been lowered to 4.75%, while the Bank Rate is now at 5%.

因此,基準夜間利率和存款利率降至4.75%,而銀行利率現在爲5%。

The decision to lower rates stems from evidence indicating that underlying inflation is easing. The Governing Council concluded that monetary policy "no longer needs to be restrictive," leading to a 25 basis point reduction in interest rates.

降息的決定源於指標下降的證據。決策委員會得出結論,貨幣政策“不再需要收緊”,導致利率降低了25個點子。

Policymakers noted that Canada's economic growth was slower than expected in the first quarter, primarily due to weaker inventory investment affecting overall activity.

政策制定者指出,由於採購被影響,頭季度加拿大的經濟增長低於預期。

Labor market data indicates that businesses continue to hire, although the rate of employment growth has not kept pace with the growth of the working-age population.

勞動力市場數據表明,企業繼續招聘,儘管就業增長率沒有跟上勞動年齡人口的增長。

In April, the annual inflation rate further decreased to 2.7%. The Bank's preferred measures of core inflation also showed a slowdown, with three-month measures indicating a continued downward trend.

四月份,年通貨膨脹率進一步降至2.7%。銀行的首選核心通貨膨脹衡量指標也顯示出放緩,三個月的指標表明繼續下降趨勢。

"Recent data has increased our confidence that inflation will continue to move towards the 2% target," the Bank of Canada stated. "However, shelter price inflation remains high," policymakers added.

“最近的數據增強了我們對通貨膨脹將繼續朝向2%目標前進的信心”,加拿大銀行表示。“然而,住房價格通貨膨脹仍然很高,”政策制定者補充說。

Regarding forward guidance, the central bank is closely monitoring core inflation trends and is particularly focused on the balance between supply and demand in the economy, inflation expectations, wage growth, and corporate pricing behavior. The Bank remains committed to restoring price stability for Canadians.

關於前瞻指引,央行密切關注核心通貨膨脹趨勢,特別關注經濟中供求平衡、通貨膨脹預期、工資增長和企業定價行爲之間的平衡。央行致力於恢復加拿大人的價格穩定。

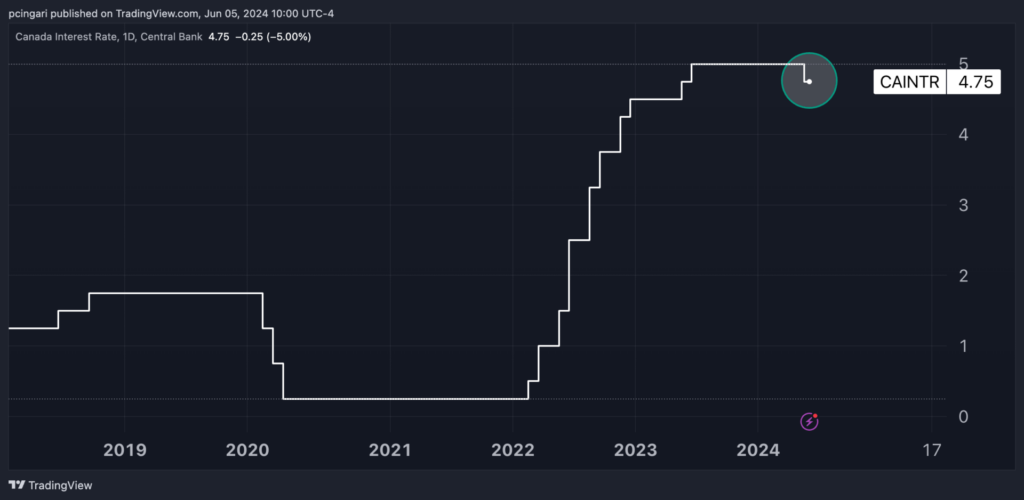

Chart: Bank of Canada Cuts Interest Rates To 4.75% In June 2024

圖表:2024年6月加拿大銀行將利率削減至4.75%

Market Reactions: The iShares MSCI Canada Index Fund (NYSE:EWC), which includes 94 Canadian stocks, experienced a 0.4% increase shortly after the interest rate decision was announced.

市場反應:包含94家加拿大股票的加拿大MSCI指數基金(NYSE:EWC)在利率決定公佈後不久增長了0.4%。

The top performers within the fund were GFL Environmental Inc. (NYSE:GFL), First Quantum Minerals Ltd. (OTCPK: FQVLF), and Ivanhoe Mines Ltd. (OTCPK: IVPAF), with gains of 4%, 2.4%, and 2.3%, respectively.

基金中表現最好的是GFL Environmental Inc.(NYSE:GFL)、First Quantum Minerals Ltd.(OTCPK:FQVLF)和Ivanhoe Mines Ltd.(OTCPK:IVPAF),分別增長了4%、2.4%和2.3%。

Meanwhile, the Canadian dollar, or Loonie, weakened by 0.3% against the U.S. dollar, crossing the 1.37 level per USD.

與此同時,加元兌美元貶值了0.3%,穿過每個美元1.37個加元的水平。

Read now: 152,000 New Jobs Added In May, Missing Expectations: 'Notable Pockets Of Weakness'

立即閱讀:五月新增15.2萬個工作崗位,低於預期:“顯著的弱點區域”

Photo: JHVEPhoto/Shutterstock

圖片:JHVEPhoto / Shutterstock