ETFs Bet High On Weight Loss Drugs, But Industry Observers Question Long-Term Potential

ETFs Bet High On Weight Loss Drugs, But Industry Observers Question Long-Term Potential

With more than 10% of the global population now suffering from obesity, the share prices of companies providing the latest weight-loss drugs have surged.

全球超過10%的人口現在患有肥胖症,提供最新減肥藥物的公司股價飆升。

However, according to industry observers, investors considering exposure through the newly launched weight-loss exchange-traded funds (ETFs) need to evaluate their potential.

然而,行業觀察員表示,投資者要通過新推出的減肥交易基金(ETF)獲得暴露度,需要評估其潛力。

The Roundhill GLP-1 Weight Loss ETF (NASDAQ:OZEM) and the Amplify Weight Loss Drug and Treatment ETF (NYSE:THNR) debuted on May 21 with an expense ratio of 0.59%.

Roundhill GLP-1減肥ETF(納斯達克:OZEM)和Amplify減肥藥物和治療ETF(紐交所:THNR)於5月21日首次亮相,費用比率爲0.59%。

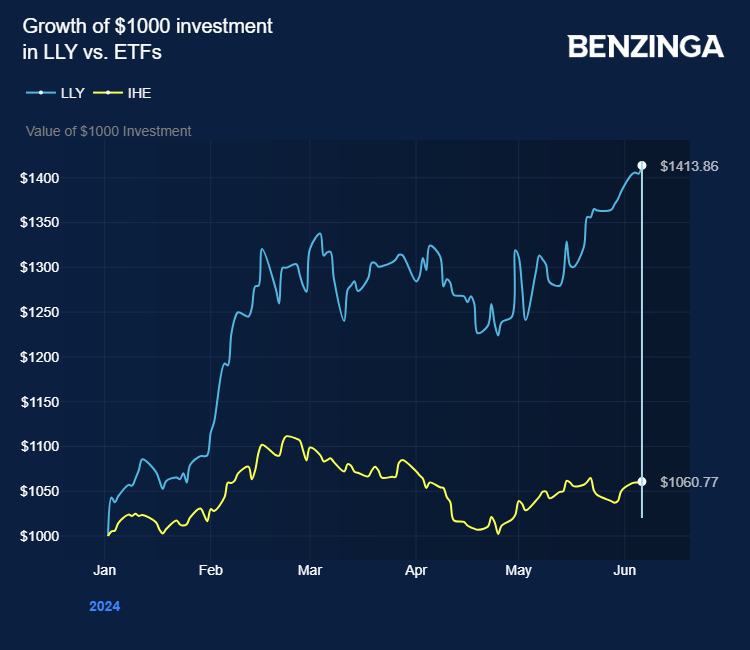

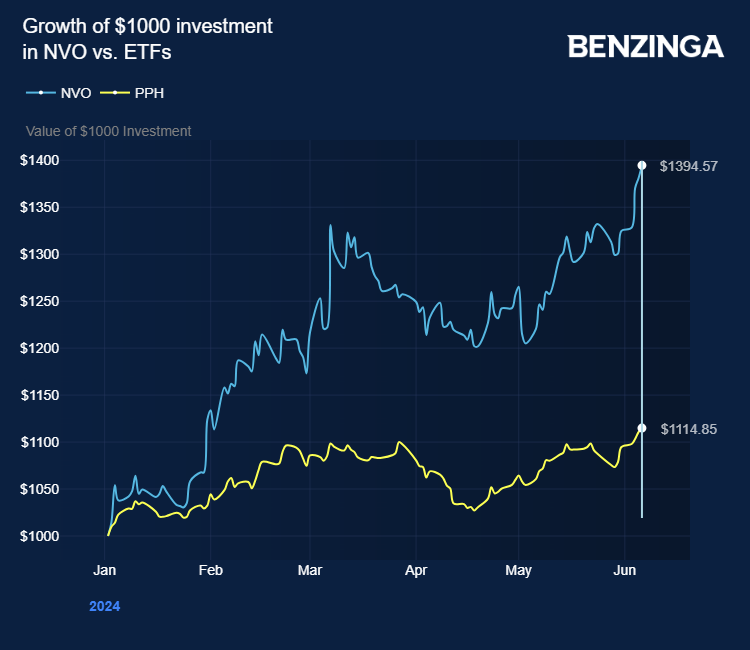

Both ETFs have significant weightings in industry giants Eli Lilly And Co (NYSE:LLY) and Novo Nordisk A/S (NYSE:NVO), with OZEM and THNR allocating about 40% and 30%, respectively, to these companies.

這兩個交易基金在行業巨頭Eli Lilly And Co(紐交所:LLY)和Novo Nordisk A / S(紐交所:NVO),其中OZEM和THNR分別分配約40%和30%的重要權重。

Eli Lilly and Novo Nordisk are the only companies licensed to supply GLP-1 agonist drugs for weight loss.

Eli Lilly和Novo Nordisk是唯一獲得供應GLP-1激動劑減肥藥物許可的公司。

Recent trials have shown that they can also reduce the risk of heart attacks and strokes, and there are anecdotal reports of their effectiveness in curbing cravings for substances like alcohol.

最近的試驗表明,它們還可以降低心臟病和中風的風險,有傳言稱它們可以有效地抑制對酒精等物質的渴望。

The Financial Times noted that industry observers are cautious about the long-term prospects of these drugs.

《金融時報》指出,行業觀察員對這些藥物的長期前景持謹慎態度。

Kenneth Lamont, senior research analyst with Morningstar, said "solving obesity" has been a long-sought goal with many setbacks.

晨星的高級研究分析師Kenneth Lamont表示,“解決肥胖問題”一直是一個長期追求的目標,並且面臨許多挫敗。

A VettaFi research paper highlighted the historical pattern of promising weight-loss drugs eventually facing serious issues, such as the 1933 drug 2,4-Dinitrophenol and various amphetamines over the decades.

一份VettaFi的研究報告強調了充滿前景的減肥藥物歷史模式,最終面臨嚴重問題,例如1933年的藥物2,4-二硝基苯酚和幾十年來的各種苯丙胺。

The Financial Times added that investors should also be aware Eli Lilly and Novo Nordisk's current advantages might be challenged by new drugs in the pipeline which could offer benefits like less frequent administration, oral options instead of injections and fewer side effects.

《金融時報》補充說,投資者還應該意識到Eli Lilly和Novo Nordisk目前的優勢可能會被管道中的新藥物挑戰,這些藥物可能會提供諸如更少的注射頻率,口服選項而不是注射以及更少的副作用等優勢。

There is also a case for considering ETFs to capture the weight-loss drug market's potential.

還有一種情況考慮使用ETF來捕捉減肥藥物市場的潛力。

THNR, for instance, includes companies expected to bring new drugs to market soon and Fujifilm Holdings, which manufactures injection devices that are currently in shortage.

例如,THNR包括預計即將推出新藥品的公司,以及富士膠片控股有限公司,該公司生產的注射器目前供不應求。

Christian Magoon, CEO of Amplify, believed this shortage indicated potential growth in the injectable GLP-1 drug market, especially given that many insurance companies do not cover these drugs as part of regular medical expenses.

Amplify的首席執行官Christian Magoon認爲,這種短缺表明可注射GLP-1藥品市場的潛力增長,尤其是考慮到許多保險公司不覆蓋這些藥品作爲常規醫療費用。

Dave Mazza, CEO of Roundhill, emphasized the importance of active management in his fund, given the industry's fast-paced developments.

Roundhill的首席執行官Dave Mazza強調了他的基金中主動管理的重要性,考慮到該行業的快速發展。

However, Lamont questioned whether ETFs such as OZEM and THNR are the best approach, noting their concentrated bets and questioning the need to pay an annual fee of 0.59% when investors could achieve similar exposure by buying a few key stocks directly.

然而,Lamont質疑像OZEM和THNR這樣的ETF是否是最好的方法,指出它們的集中下注並質疑爲什麼需要支付0.59%的年費,而投資者可以直接購買一些關鍵股票獲得類似的曝光度。

NVO, LLY Price Action: Novo Nordisk shares are up 0.25% at $142.76, and Eli Lilly shares are down 0.27% at $835.02 at last check Friday.

NVO,LLY價格行動:Novo Nordisk股價上漲0.25%至142.76美元,Eli Lilly股價最近一次下跌0.27%至835.02美元。

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

免責聲明:本內容部分使用人工智能工具生成,並經Benzinga編輯審核發佈。

Photo: I Yunmai via Unsplash

照片:I Yunmai通過Unsplash

Both ETFs have significant weightings in industry giants Eli Lilly And Co (NYSE:LLY) and Novo Nordisk A/S (NYSE:NVO), with OZEM and THNR allocating about 40% and 30%, respectively, to these companies.

Both ETFs have significant weightings in industry giants Eli Lilly And Co (NYSE:LLY) and Novo Nordisk A/S (NYSE:NVO), with OZEM and THNR allocating about 40% and 30%, respectively, to these companies.