Chengtun Mining Group Co., Ltd. (SHSE:600711) Looks Inexpensive After Falling 30% But Perhaps Not Attractive Enough

Chengtun Mining Group Co., Ltd. (SHSE:600711) Looks Inexpensive After Falling 30% But Perhaps Not Attractive Enough

Chengtun Mining Group Co., Ltd. (SHSE:600711) shareholders won't be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 23% share price drop.

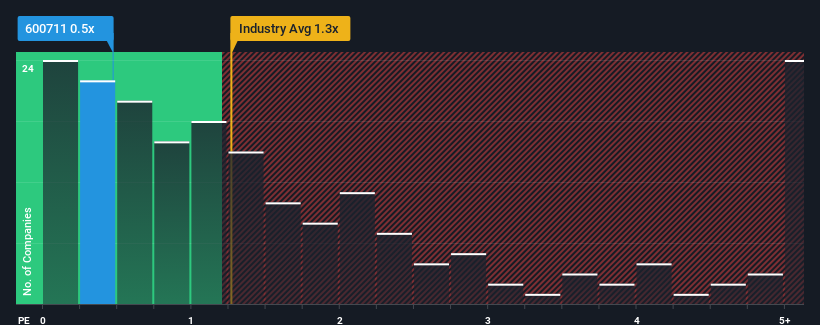

Following the heavy fall in price, given about half the companies operating in China's Metals and Mining industry have price-to-sales ratios (or "P/S") above 1.3x, you may consider Chengtun Mining Group as an attractive investment with its 0.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Chengtun Mining Group Has Been Performing

For example, consider that Chengtun Mining Group's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Chengtun Mining Group will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Chengtun Mining Group will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Chengtun Mining Group?

Chengtun Mining Group's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.1%. This means it has also seen a slide in revenue over the longer-term as revenue is down 42% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 15% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's understandable that Chengtun Mining Group's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Chengtun Mining Group's P/S?

The southerly movements of Chengtun Mining Group's shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Chengtun Mining Group confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 3 warning signs for Chengtun Mining Group you should be aware of, and 1 of them is concerning.

If you're unsure about the strength of Chengtun Mining Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.