Vale Unusual Options Activity For June 11

Vale Unusual Options Activity For June 11

Financial giants have made a conspicuous bearish move on Vale. Our analysis of options history for Vale (NYSE:VALE) revealed 9 unusual trades.

金融巨頭們對VALE做了顯著的看淡動作。我們對VALE(紐交所:VALE)期權歷史的分析顯示出9筆異常交易。

Delving into the details, we found 33% of traders were bullish, while 66% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $1,144,635, and 4 were calls, valued at $272,354.

詳細調查後,我們發現33%的交易者看好,而66%的交易者短視厭惡。我們發現了5筆看跌期權交易,價值1144635美元,4筆看漲期權交易,價值272354美元。

Expected Price Movements

預期價格波動

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $11.0 to $17.0 for Vale over the last 3 months.

結合這些期權合約的成交量和未平倉合約量,似乎鯨魚們在過去3個月中一直以110到170美元的價格區間爲目標。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

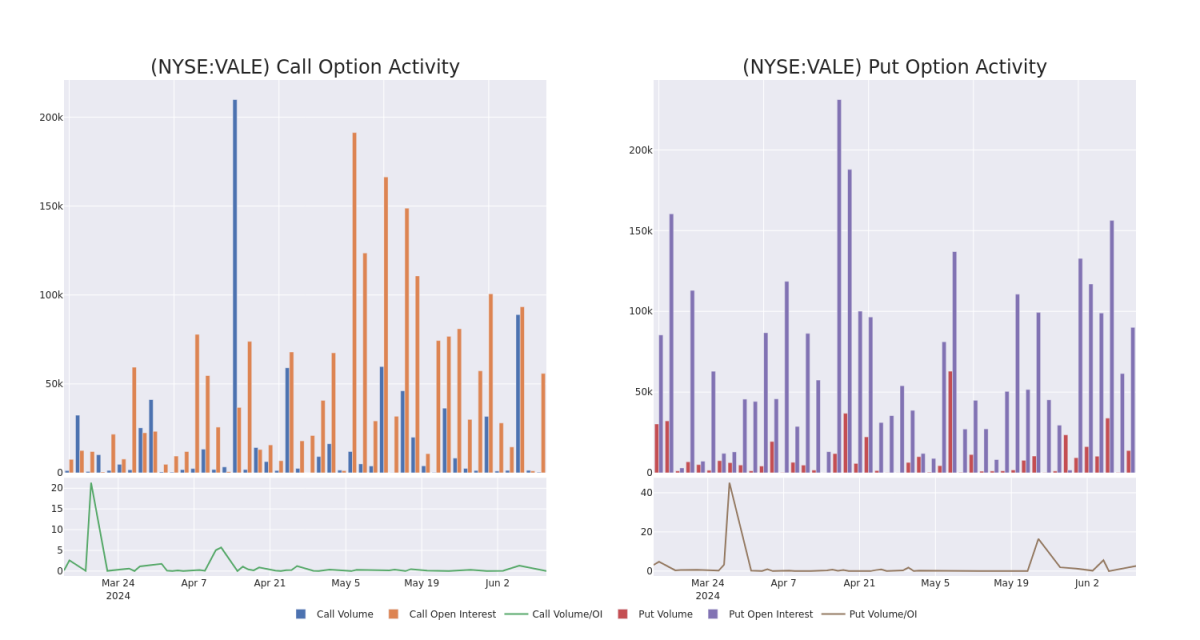

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Vale's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Vale's substantial trades, within a strike price spectrum from $11.0 to $17.0 over the preceding 30 days.

評估成交量和未平倉合約量是期權交易中一個戰略性的步驟。這些指標爲指定執行價格的VALE期權的流動性和投資者需求提供了參考。即將發佈的數據將在過去30天中,涉及VALE突出交易的看漲和看跌期權的成交量和未平倉合約量之間呈現出一個110到170美元執行價格區域的變動。

Vale 30-Day Option Volume & Interest Snapshot

淡水河谷公司30天期權成交量快照

Biggest Options Spotted:

最大的期權交易

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VALE | PUT | TRADE | BEARISH | 01/17/25 | $0.99 | $0.88 | $0.97 | $11.00 | $485.0K | 5.0K | 11 |

| VALE | PUT | TRADE | BEARISH | 01/17/25 | $0.99 | $0.88 | $0.97 | $11.00 | $291.0K | 5.0K | 5.0K |

| VALE | PUT | SWEEP | BEARISH | 01/17/25 | $0.95 | $0.93 | $0.95 | $11.00 | $190.0K | 5.0K | 8.0K |

| VALE | CALL | SWEEP | BEARISH | 01/17/25 | $0.85 | $0.82 | $0.82 | $12.00 | $141.5K | 29.8K | 60 |

| VALE | PUT | TRADE | BULLISH | 01/17/25 | $5.95 | $5.7 | $5.8 | $17.00 | $123.5K | 51.1K | 751 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VALE | 看跌 | 交易 | 看淡 | 01/17/25 | $0.99 | $0.88 | $0.97 | 11.00美元 | 485000美元 | 5.0K | 11 |

| VALE | 看跌 | 交易 | 看淡 | 01/17/25 | $0.99 | $0.88 | $0.97 | 11.00美元 | 291000美元 | 5.0K | 5.0K |

| VALE | 看跌 | Sweep | 看淡 | 01/17/25 | 0.95美元 | $0.93 | 0.95美元 | 11.00美元 | $190.0千美元 | 5.0K | 8.0K |

| VALE | 看漲 | Sweep | 看淡 | 01/17/25 | $0.85 | $0.82 | $0.82 | 12.00美元 | 141500美元 | 29800股 | 60 |

| VALE | 看跌 | 交易 | 看好 | 01/17/25 | $5.95 | $5.7 | $5.8 | $17.00 | 123500美元 | 51100股 | 751 |

About Vale

關於Vale

Vale is a large global miner and the world's largest producer of iron ore and pellets. In recent years the company has sold noncore assets such as its fertilizer, coal, and steel operations to concentrate on iron ore, nickel, and copper. Earnings are dominated by the bulk materials division, primarily iron ore and iron ore pellets. The base metals division is much smaller, consisting of nickel mines and smelters along with copper mines producing copper in concentrate. Vale has agreed to sell a minority 13% stake in energy transition metals, its base metals business, which is expected to become effective in 2024, and which is likely the first step in separating base metals and iron ore.

Vale是一家全球性大型礦業公司,也是世界上最大的鐵礦石和小球團生產商。近年來,該公司已出售其肥料、煤炭和鋼鐵業務等非核心資產,集中於鐵礦石、鎳和銅方面。公司的利潤主要來自大宗材料部門,主要是鐵礦石和鐵礦球。基礎金屬部門規模較小,由鎳礦山和冶煉廠以及生產銅精礦的銅礦組成。Vale已同意出售13%的少數股權給能源轉型金屬,其基礎金屬業務,預計將於2024年生效,這可能是分離基礎金屬和鐵礦石的第一步。

Following our analysis of the options activities associated with Vale, we pivot to a closer look at the company's own performance.

在我們對VALE關聯期權交易的分析之後,我們將轉向更加詳細地了解該公司的表現。

Current Position of Vale

VALE的當前持倉狀態

- Trading volume stands at 37,681,442, with VALE's price down by -0.18%, positioned at $11.38.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 44 days.

- 交易量爲37681442股,VALE的價格下跌了-0.18%,定位於11.38美元。

- RSI指標顯示該股票可能已被超賣。

- 預計在44天后公佈收益報告。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。