Top 3 Consumer Stocks That Could Blast Off In June

Top 3 Consumer Stocks That Could Blast Off In June

The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

消費者板塊中最過度賣出的股票提供了一個買入被低估公司的機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指標是一種動量指標,它比較了股票在價格上漲時的強度與在價格下跌時的強度。與股票的價格走勢進行比較,可以給交易者更好的了解股票短期內表現的良好程度。當RSI低於30時,資產通常被認爲是超賣的,根據Benzinga Pro的數據。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行業板塊最近的主要超賣股票列表,RSI接近或低於30。

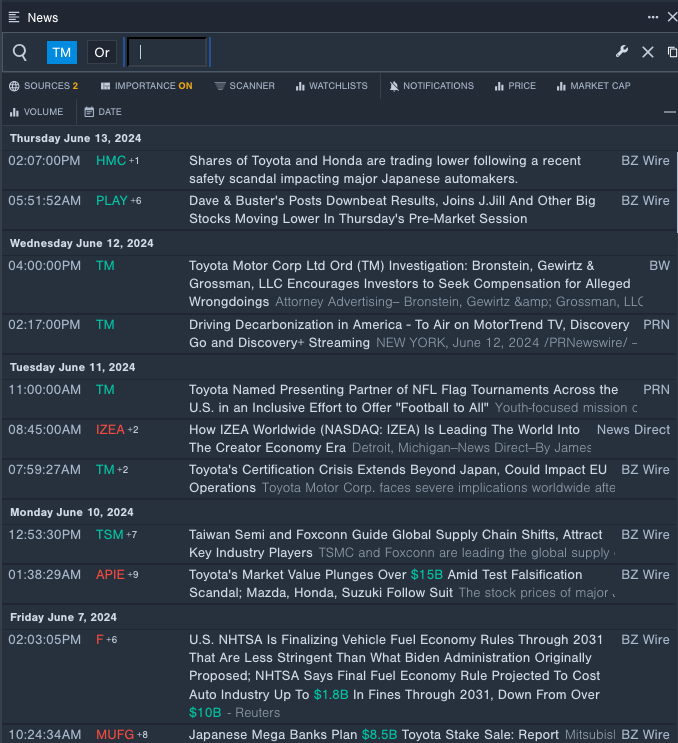

Toyota Motor Corp (NYSE:TM)

豐田汽車公司 (紐交所:TM)

- The U.S. National Highway Traffic Safety Administration said on June 4 that Japanese automaker Toyota Motor is recalling over 100,000 vehicles in the U.S. over concerns that debris in its engines might cause them to stall and cause loss of driving power. The company's stock fell around 8% over the past month and has a 52-week low of $152.78.

- RSI Value: 29.77

- TM Price Action: Shares of Toyota Motor fell 3.1% to close at $199.35 on Thursday.

- Benzinga Pro's real-time newsfeed alerted to latest Toyota's news.

- 美國國家公路交通安全管理局於6月4日表示,日本汽車製造商豐田汽車公司正在召回100,000多輛汽車,因其發動機中的雜物可能導致發動機熄火併導致失去駕駛動力。該公司的股票在過去一個月下跌了近8%,並且有52周最低價爲$ 152.78。

- RSI價值:29.77

- TM價格表現:豐田汽車的股票下跌3.1%,收於週四的199.35美元。

- Benzinga Pro的實時新聞提醒了最新的豐田汽車新聞。

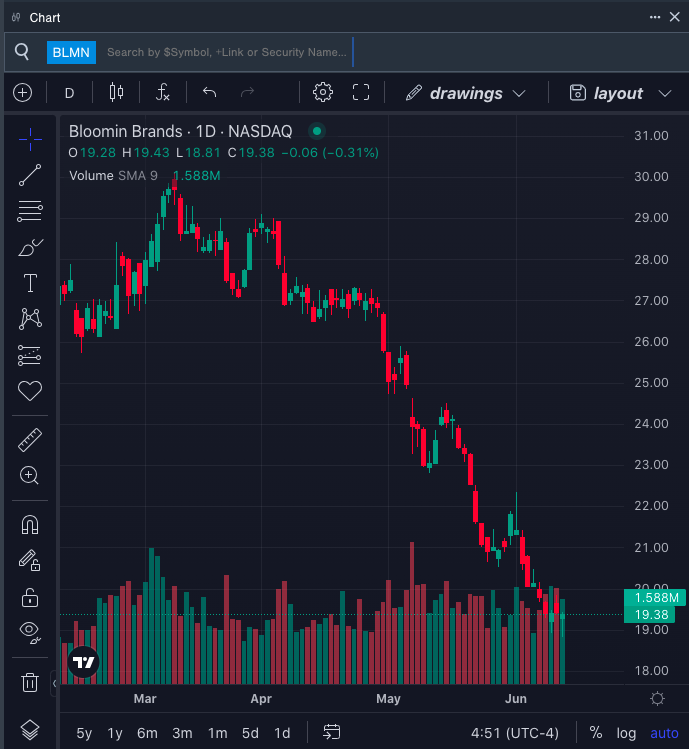

Bloomin' Brands Inc (NASDAQ:BLMN)

Bloomin'Brands Inc (納斯達克:BLMN)

- On May 7, Bloomin' Brands reported first-quarter adjusted earnings per share of 70 cents, missing the analyst consensus of 74 cents. "We have completed all restaurant closures under the 2023 Closure Initiative and incurred severance and closure charges of $13.0 million during Q1 2024," the company said. The company's stock fell around 20% over the past month. It has a 52-week low of $18.81.

- RSI Value: 22.875

- BLMN Price Action: Shares of Bloomin' Brands fell 0.3% to close at $19.38 on Thursday.

- Benzinga Pro's charting tool helped identify the trend in BLMN's stock.

- 5月7日,Bloomin' Brands報告了第一季度每股調整收益爲70美分,低於分析師共識的74美分。公司表示:“我們已經完成了2023年關閉計劃下的所有餐廳關閉工作,並在2024年第一季度承擔了1300萬美元的解僱和關閉費用。”該公司的股票在過去一個月左右下跌了20%。它有52周最低價爲$ 18.81。

- RSI值:22.875

- BLMN價格表現:Bloomin' Brands的股票下跌0.3%,收於週四的19.38美元。

- Benzinga Pro的圖表工具幫助確定了BLMN股票的趨勢。

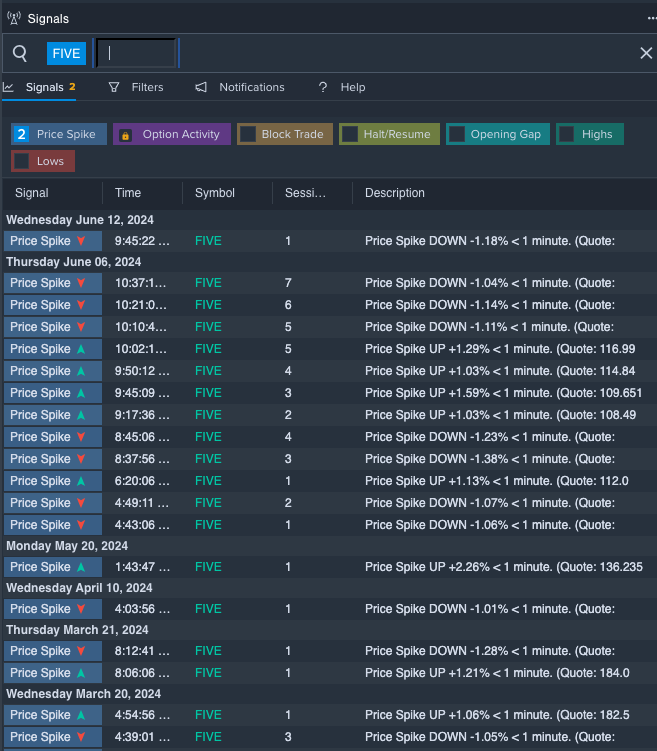

Five Below Inc (NASDAQ:FIVE)

Five Below Inc (納斯達克:FIVE)

- On June 5, Five Below reported worse-than-expected first-quarter earnings and lowered its guidance. "While our first quarter sales were disappointing, disciplined cost management enabled us to deliver adjusted EPS within our earnings outlook. Needs-based items such as those in our Candy, Food and Beauty departments outperformed expectations and drove positive sales results. We also saw positive comparable sales from our higher income customers; however, the macro environment disproportionately impacted our core lower income customers, resulting in overall comparable sales declines," said Joel Anderson, President and CEO of Five Below. The company's stock fell around 20% over the past month and has a 52-weeklow of $106.21.

- RSI Value: 28.09

- FIVE Price Action: Shares of Five Below fell 2.4% to close at $113.75 on Thursday.

- Benzinga Pro's signals feature notified of a potential breakout in Five Below's shares.

- 在6月5日,Five Below報告了比預期更糟糕的第一季度收益並降低了其指導。 Five Below的總裁兼首席執行官喬爾·安德森(Joel Anderson)表示:“雖然我們的第一季度銷售令人失望,但我們的成本管理使我們能夠以調整後的每股收益達到我們的盈利前景。我們的糖果,食品和美容部門等需求型物品表現優異,推動了積極的銷售業績。我們還看到高收入客戶的同店銷售額上漲;但是,宏觀環境對我們的核心低收入客戶影響更大,導致整體同店銷售額下降。”該公司的股票在過去一個月左右下跌了20%,並且有52周最低價爲$ 106.21。

- RSI值:28.09

- FIVE價格表現:Five Below的股票下跌2.4%,收於週四的113.75美元。

- Benzinga Pro的信號功能通知了Five Below股票的潛在突破。

Now Read This: Over $105M Bet On This Oil Giant? Check Out These 3 Stocks Insiders Are Buying

現在閱讀這篇文章:是否有超過1.05億美元的賭注押在這個石油巨頭上?看看這3只股票的內部人士正在購買