French Stocks Set For Worst Week Since Russia's War In Ukraine, Yields Versus Bund Hit 12-Year Highs On Snap Election Jitters

French Stocks Set For Worst Week Since Russia's War In Ukraine, Yields Versus Bund Hit 12-Year Highs On Snap Election Jitters

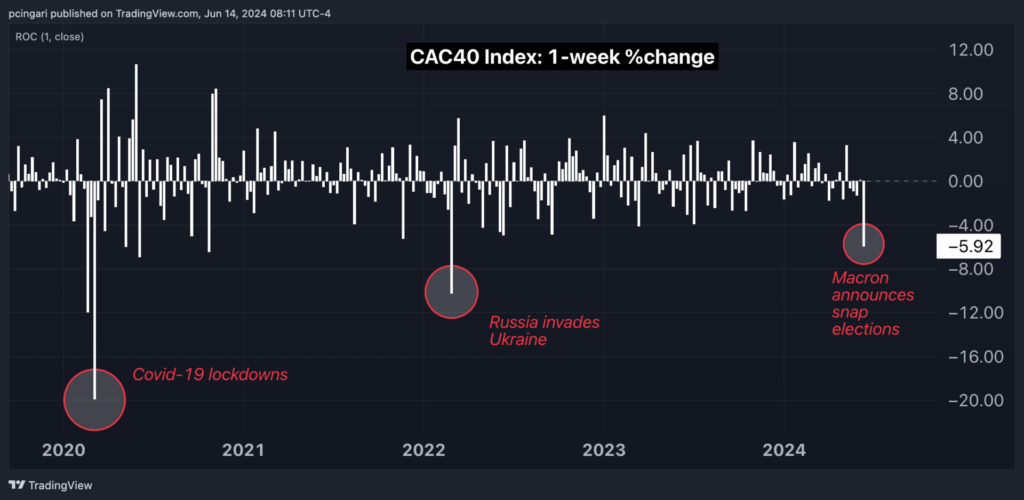

The French stock market is on track to register its worst weekly performance since late February 2022.

法國股市可能面臨自2022年2月底以來的最糟糕的一週表現。

Following the announcement of snap elections last Sunday, the Paris CAC 40 index — as tracked by the iShares MSCI France Index Fund (NYSE:EWQ) — fell by 2.4% at 8:10 a.m. ET, heading into the final hours of the European session.

上週日宣佈提前舉行大選後,巴黎CAC 40指數(由iShares MSCI France Index基金(紐交所:EWQ)跟蹤)在美國東部時間早上8:10下跌2.4%,進入歐洲交易的最後幾小時。

On a weekly basis, the decline extends to 6%, marking the worst performance since late February 2022, when Russia's invasion of Ukraine triggered a drop of over 10% for the CAC 40.

從周線來看,下跌幅度擴大至6%,是自2022年2月底以來最糟糕的表現,當時俄羅斯入侵烏克蘭導致CAC 40下跌10%以上。

Chart: France Equities Tumble The Most Since Russian Invasion Of Ukraine

圖表:法國股票的跌幅達到俄羅斯入侵烏克蘭以來的最高點。

Risks Of Broader Contagion

更廣泛的感染風險。

The main declines this week are among banking stocks, hit by the wave of sell-offs due to political uncertainties. France's largest financial institution, BNP Paribas, fell over 13%, while Societe Generale is down by over 16% this week.

本週主要下跌的是銀行股,受到政治不確定性導致的拋售浪潮的影響。 法國最大的金融機構BNP Paribas下跌逾13%,而Societe Generale本週下跌逾16%。

An exchange-traded fund tracking broader European financial institutions – the iShares MSCI Europe Financials ETF (NYSE:EUFN) – is down by 7% for the week, indicating that France's political risks are spreading throughout the region.

跟蹤更廣泛的歐洲金融機構的交易所交易基金 - iShares MSCI Europe Financials ETF(紐交所:EUFN) - 本週下跌7%,表明法國的政治風險正在在整個地區蔓延。

The broader iShares MSCI Eurozone ETF (NYSE:EZU) fell 4.6% this week, on track for its worst week since September 2022.

跟蹤整個歐元區的更廣泛的iShares MSCI Eurozone ETF(紐交所:EZU)本週下跌4.6%,準備迎來自2022年9月以來最糟糕的一週。

The euro fell by 0.5% on Friday and by over 1% for the week, eyeing its worst weekly performance in over two months.

歐元本週下跌0.5%,本週下跌超過1%,並盯着自兩個月以來最糟糕的一週表現。

"The risk premium in European assets could build further," Chris Turner, global head of markets at ING analyst, wrote on a note Friday.

“歐洲資產的風險溢價可能進一步上升,” ING分析師全球市場主管克里斯·特納(Chris Turner)在星期五的便條中寫道。

Why Are French And European Assets Tumbling This Much?

爲什麼法國和歐洲的資產會如此動盪?

The decisive victory of Marine Le Pen's far-right National Rally party in last Sunday's European Parliament elections led President Emmanuel Macron to dissolve the French National Assembly and call for new parliamentary elections. France will vote in the first round in two weeks, followed by a runoff on July 7.

馬琳·勒龐(Marine Le Pen)極右翼國民集會在上週日的歐洲議會選舉中取得決定性勝利,引發了總統埃馬紐埃爾·馬克龍(Emmanuel Macron)解散法國國民議會並召開新的議會選舉。法國將在兩週內進行第一輪投票,其次是7月7日的決選。

With a budget deficit already particularly high at around 6%, investors fear the risk of French fiscal accounts deteriorating further if Le Pen's party secures a majority in the national parliament.

由於法國的預算赤字已經非常高,約爲6%,投資者擔心勒龐的政黨在國家議會中獲得多數席位將進一步惡化法國的財政狀況。

According to ING, "Frexit" is no longer seen as a risk, but markets are jittery ahead of the snap parliamentary election.

根據ING的說法,“法國退歐”不再被視爲一種風險,但市場在預期提前舉行的議會選舉之前感到不安。

In addition to far-right-wing fears, French left-wing parties are forming a coalition to run a single candidate per district, which could further erode support for President Macron's party.

除了極右翼的恐懼之外,法國左翼黨派正在組成一項議會選舉中的聯盟,每個選區只有一個候選人,這可能進一步削弱支持總統馬克龍的政黨的支持率。

The yields on French 10-year government bonds have been trending upward, and the spread with the German Bund has shot up to 83 basis points, the highest level since July 2012.

法國10年期政府債券收益率一直在上升,與德國國債(Bund)的利差飆升至83個點子,是自2012年7月以來的最高水平。

Read Now: US Stocks To End Record-Clinching Week On Subdued Note, GameStop Slides, Adobe Soars: Fed Speeches And More To Watch Heading Into Friday

立即閱讀: 美國股票市場在創紀錄的交投周收盤時低調結束,遊戲驛站下跌,adobe飆升:聯邦官員講話等將在週五觀察。

Image: Pixabay

圖片:Pixabay