The Japanese Yen Fell To A Six-Week Low After The Bank Of Japan Ended Its Meeting

The Japanese Yen Fell To A Six-Week Low After The Bank Of Japan Ended Its Meeting

By RoboForex Analytical Department

由RoboForex分析部門提供

The Japanese yen exchange rate paired with the US dollar looks unimpressive by the end of this week. The USD/JPY pair rose to almost 158.00 immediately after the end of the June meeting of the Bank of Japan, which left the interest rate unchanged. Everything went according to expectations.

本週日元兌美元匯率並不理想。在日本銀行6月會議結束後,美元/日元匯率曾一度升至接近158.00。此次會議未改變利率,符合市場預期。

In March, the BoJ raised the rate for the first time in seven years, moving it from negative territory to zero.

三月,日本銀行首次在七年內升息,將利率從負值提高至零。

In its comments, the regulator noted that it will continue to buy Japanese government bonds at the same pace as agreed in March until its July meeting. Thus, market expectations were ignored, which worked against the JPY. Investors hoped that the BoJ would at least carefully consider gradually reducing its balance sheet through government bonds as part of a smooth monetary policy transition from quantitative easing to tightening.

監管機構在評論中指出,將繼續以三月份同意的速度購買日本政府債券,直至七月份會議。因此,市場預期被忽視,對日元不利。投資者希望日本銀行考慮通過政府債券進行平緩貨幣政策過渡,逐步減少其負債表。

Previously, Bank of Japan Governor Kazuo Ueda confirmed the regulator's intention to gradually reduce its substantial balance sheet in the future. However, the timing of this action remains uncertain.

在此之前,日本銀行行長上田和夫確認監管機構在未來逐漸減少其大幅負債表的意圖。但此行動的時間仍不確定。

USD/JPY Technical Analysis

美元/日元技術面分析

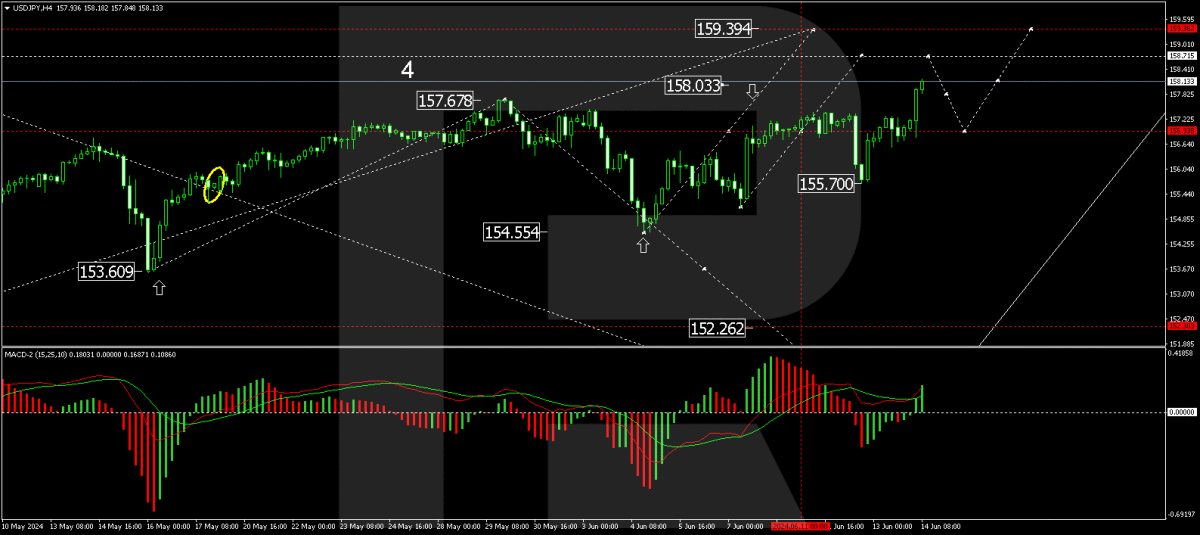

On the H4 USD/JPY chart, the market has breached 157.47 upwards and is continuing to develop a growth wave towards 158.74. After reaching this level, a correction down to the level of 157.47 is a possibility (test from above). We will then assess the probability of continuing the growth wave to 159.36. Technically, this scenario is supported by the MACD indicator, with its signal line above the zero level and pointing upwards.

在H4美元/日元圖表上,市場已上漲至157.47以上,正在發展一波漲勢,目標爲158.74。達到該水平後,回落到157.47的修正波浪可能性(從上方測試)很大。我們將評估繼續漲勢至159.36的可能性。從技術上來說,MACD指標支持該情景,其信號線在零軸上方並向上指向。

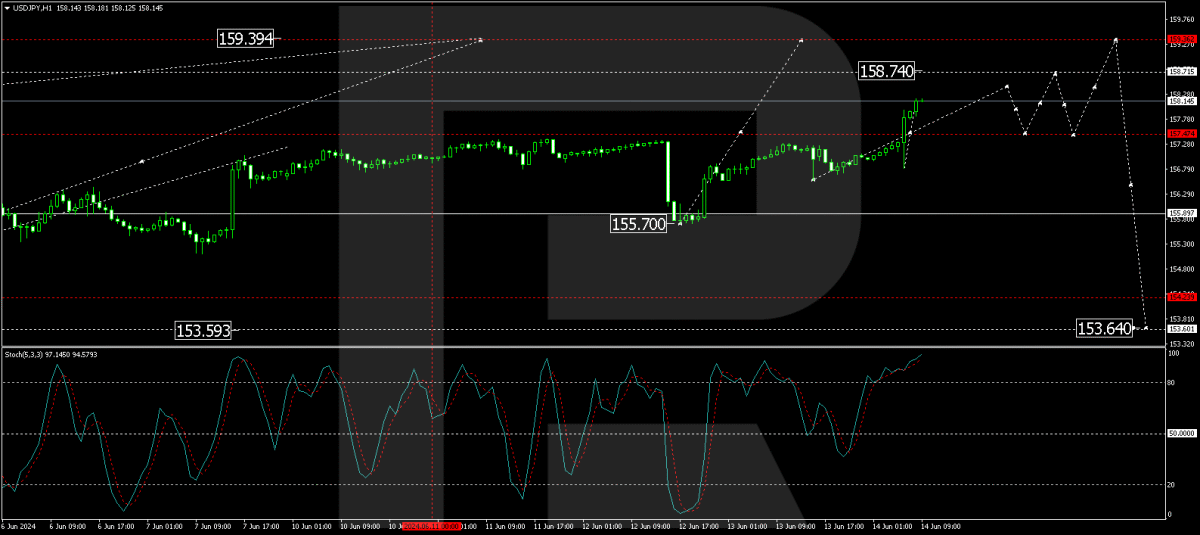

On the H1 USD/JPY chart, the market continues to develop a wave of growth to the level of 158.40. Further, a correction wave to 157.47 is possible, followed by growth to 158.74, the local target. Technically, this scenario is confirmed by the Stochastic oscillator, with its signal line above level 80 and preparing to decline to level 20.

在H1美元/日元圖表上,市場繼續發展至158.40水平的一波創業板浪。此外,可能會出現157.47的回調浪,然後再上漲至158.74萬億的本地目標。從技術上講,隨着隨機振盪器的信號線高於80水平並準備下降到20水平,這種情況得到了確認。

Disclaimer

免責聲明

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

任何包含在此處的預測都基於作者的觀點。本分析不應被視爲交易建議。RoboForex對基於本文的交易建議和評論所產生的交易結果不承擔任何責任。

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

本文來自非報酬的外部投稿人。它不代表Benzinga的報道,並且沒有因爲內容或準確性而被編輯。

In its comments, the regulator noted that it will continue to buy Japanese government bonds at the same pace as agreed in March until its July meeting. Thus, market expectations were ignored, which worked against the JPY. Investors hoped that the BoJ would at least carefully consider gradually reducing its balance sheet through government bonds as part of a smooth monetary policy transition from quantitative easing to tightening.

In its comments, the regulator noted that it will continue to buy Japanese government bonds at the same pace as agreed in March until its July meeting. Thus, market expectations were ignored, which worked against the JPY. Investors hoped that the BoJ would at least carefully consider gradually reducing its balance sheet through government bonds as part of a smooth monetary policy transition from quantitative easing to tightening.