REIT Watch - Singapore-based Retail S-Reits Record Growth on Higher Sales, Positive Rent Reversion

REIT Watch - Singapore-based Retail S-Reits Record Growth on Higher Sales, Positive Rent Reversion

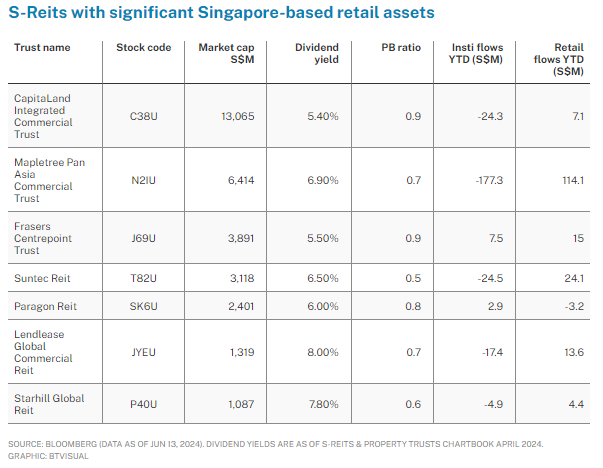

The seven Singapore real estate investment trusts (Reits) with significant exposure to Singapore-based retail assets have observed continued improved operating metrics, supported by the tourism recovery as well as recent asset enhancement initiatives (AEIs) undertaken to maximise space and improve malls' attractiveness.

擁有新加坡零售資產的七個新加坡房地產投資信託(REITs)繼續觀察到經營指標的改善,得到了旅遊業復甦以及最近進行的資產增值措施(AEIs)的支持,以最大化空間和提高購物中心的吸引力。

The seven are: CapitaLand Integrated Commercial Trust (CICT), Frasers Centrepoint Trust (FCT), Lendlease Global Commercial Reit (Lendlease Reit), Mapletree Pan Asia Commercial Trust : N2IU (MPACT), Paragon Reit, Starhill Global Reit and Suntec Reit. We look at their recent business updates and financials.

這七個新加坡房地產投資信託(REITs)分別是:凱德商業信託(CICT),星獅地產信託(FCT),lendlease reit,南洋地產信託 : N2IU(MPACT),百利保產業信託,stargill global reit和新達產業信託。我們查看他們最近的業務更新和財務情況。

CICT reported improved Q1 2024 gross revenue and net property income (NPI) for its retail assets. Shopper traffic and tenant sales grew 3.6 per cent and 2.1 per cent year on year (yoy), respectively.

CICT報告了其零售資產在2024財年第一季度的毛收入和淨物業收入(NPI)的改善。購物者流量和承租人銷售額同比增長了3.6%和2.1%。

Downtown malls led the growth in traffic, while suburban malls saw sustained resilience from food and beverage demand. Rent reversion for both downtown and suburban malls sustained growth at over 7 per cent. CICT's committed retail occupancy increased from 98.5 per cent in the last quarter to 98.7 per cent as at Mar 31, 2024.

市區購物中心引領了流量增長,而郊區購物中心則在食品和飲料需求方面保持了穩定的抵抗力。市區和郊區購物中心的租金回歸率維持在7%以上。CICT的零售佔用率從上一季度的98.5%增至2024年3月31日的98.7%。

FCT reported lower H1 2024 gross revenue and NPI of 7.2 per cent and 8.4 per cent yoy, respectively, with declines due to lower contributions from Changi City Point, which was divested in October 2023, and Tampines 1's ongoing AEI works.

FCT報告了H1 2024毛收入和NPI的降幅分別爲7.2%和8.4%,其中包括Changi City Point於2023年10月被剝離和Tampines 1 ongoing AEI工程的貢獻降低。

Excluding these effects, gross revenue and NPI would have risen 2.9 per cent and 2.1 per cent, respectively.

剔除這些影響,毛收入和NPI將分別上升2.9%和2.1%。

FCT's retail portfolio committed occupancy improved to 99.9 per cent as at Mar 31, 2024, and observed an 8.1 per cent and 4.3 per cent yoy growth in shopper traffic and tenant sales for Q2 2024, respectively, with overall positive rent reversion at 7.5 per cent.

FCT的零售投資組合承租人佔用率在2024年3月31日達到了99.9%,Q2 2024購物者流量和承租人銷售額同比增長了8.1%和4.3%,整體租金回歸率爲7.5%。

Lendlease Reit noted that its retail portfolio saw tenant sales increase 2.6 per cent and shopper traffic improve 6.1 per cent yoy in Q3 2024, exceeding pre-Covid levels. Committed occupancy for both the JEM and 313@somerset malls averaged 99.4 per cent as at Mar 31, 2024.

Lendlease Reit注意到其零售業務組合在2024年第三季度看到承租人銷售額同比增長2.6%、購物者流量提高6.1%,超過了疫情前的水平。JEM和313@somerset購物中心的承租人佔用率平均爲99.4%,截至2024年3月31日。

MPACT's retail mall, VivoCity, has seen its occupancy rate improve to 100 per cent as at Mar 31, 2024, and recorded 14 per cent positive rent reversion.

MPACT的零售購物中心維多利亞城市(VivoCity)的佔用率在2024年3月31日提高至100%,租金回歸率爲14%。

VivoCity's recent sixth AEI completed in May 2023 saw over 80,000 square feet of reconfigured new retail space, and MPACT noted a return on investment of more than 20 per cent based on revenue on a stabilised basis and capital expenditure of approximately S$10 million.

維多利亞城市最近的第六個AEI於2023年5月完成,重新配置了超過80,000平方英尺的新零售空間,MPACT表示,基於穩定基礎上的收入和約1,000萬新元的資本支出,回報率超過20%。

Shopper traffic and tenant sales in Q4 2024 recorded increases of 10.1 per cent and 2.6 per cent yoy, respectively, and full-year tenant sales set a new record at nearly S$1.1 billion.

2024年第四季度的購物者流量和承租人銷售額同比分別增加了10.1%和2.6%,全年承租人銷售額創下了近11億新元的新紀錄。

Paragon Reit reported 2.5 per cent yoy growth in gross revenue, driven by Paragon Mall and The Clementi Mall, which recorded higher gross revenue and visitor traffic for Q1 2024, with both malls at full occupancy rates.

Paragon Reit報告了總毛收入同比增長2.5%,收入增長是由Paragon Mall和The Clementi Mall所驅動,這兩個購物中心的總收入和訪客流量都達到了近乎100%的佔用率。

The Reit plans to explore future acquisition opportunities, and has a right of first refusal on its sponsor's The Woodleigh Mall, which opened in May 2023.

該信託計劃探索未來的收購機會,並在其發起的The Woodleigh Mall上享有優先購買權(該購物中心於2023年5月開業)。

Starhill Global Reit reported that tenant sales at its Wisma Atria property increased 6.5 per cent while shopper traffic grew 12.7 per cent yoy in Q3 2024, despite ongoing interior enhancement works which were completed in February 2024.

Starhill Global Reit報告稱,在進行了2024年2月的內部提升工程後,其Wisma Atria物業的租戶銷售額同比增長6.5%,購物者流量同比增長12.7%。

Suntec Reit's retail portfolio reported a 3 per cent yoy growth in gross revenue and 1.3 per cent growth in NPI for Q1 2024. Its Suntec City mall recorded 21.7 per cent rent reversion in Q1 2024, registering positive rent reversion for eight consecutive quarters.

Suntec Reit的零售組合報告稱,2024年第一季度的毛收入同比增長3%,NPI同比增長1.3%。其Suntec City購物中心在2024年第一季度的租金回歸率爲21.7%,連續八個季度實現租金回歸率爲正數。

The mall saw a 5 per cent yoy improvement in both tenant sales and shopper traffic for Q1 2024.

該購物中心在2024年第一季度的承租人銷售額和購物者流量同比分別提高了5%。

Suntec Reit expects the retail sales outlook to remain stable, with healthy demand and limited supply supporting rent growth and occupancy.

Suntec Reit預計零售銷售前景將保持穩定,有限的供應支持租金增長和佔用率。

Source: SGX Research S-REITs & Property Trusts Chartbook.

資料來源:SGX研究S-REITs和房地產信託基金圖表手冊。

REIT Watch is a regular column on The Business Times, read the original version.

REIT Watch是《商業時報》上的常規專欄。 原版。

Enjoying this read?

閱讀愉快?

- Subscribe now to the SGX My Gateway newsletter for a compilation of latest market news, sector performances, new product release updates, and research reports on SGX-listed companies.

- Stay up-to-date with our SGX Invest Telegram channel.

- 立即訂閱新加坡交易所 My Gateway收集最新市場資訊、板塊表現、新產品發佈更新和在新加坡交易所上市公司的研報的簡報。

- 請關注我們的實時資訊電報頻道。新加坡交易所 Invest電報頻道。

CICT reported improved Q1 2024 gross revenue and net property income (NPI) for its retail assets. Shopper traffic and tenant sales grew 3.6 per cent and 2.1 per cent year on year (yoy), respectively.

CICT reported improved Q1 2024 gross revenue and net property income (NPI) for its retail assets. Shopper traffic and tenant sales grew 3.6 per cent and 2.1 per cent year on year (yoy), respectively.