The Market Doesn't Like What It Sees From CytomX Therapeutics, Inc.'s (NASDAQ:CTMX) Revenues Yet As Shares Tumble 28%

The Market Doesn't Like What It Sees From CytomX Therapeutics, Inc.'s (NASDAQ:CTMX) Revenues Yet As Shares Tumble 28%

To the annoyance of some shareholders, CytomX Therapeutics, Inc. (NASDAQ:CTMX) shares are down a considerable 28% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 12% in that time.

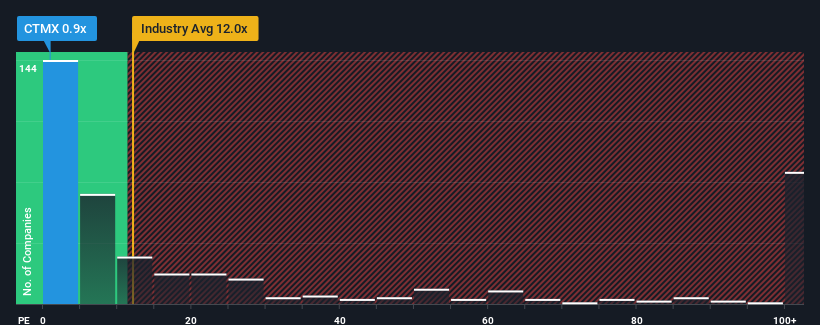

After such a large drop in price, CytomX Therapeutics may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.9x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 12x and even P/S higher than 65x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

How Has CytomX Therapeutics Performed Recently?

CytomX Therapeutics could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think CytomX Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For CytomX Therapeutics?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like CytomX Therapeutics' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 76% gain to the company's top line. The latest three year period has also seen an excellent 79% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue growth is heading into negative territory, declining 28% per annum over the next three years. With the industry predicted to deliver 205% growth per year, that's a disappointing outcome.

With this information, we are not surprised that CytomX Therapeutics is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

CytomX Therapeutics' P/S looks about as weak as its stock price lately. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that CytomX Therapeutics maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, CytomX Therapeutics' poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Before you take the next step, you should know about the 5 warning signs for CytomX Therapeutics (3 are significant!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com