Wall Street's Most Accurate Analysts Weigh In On 3 Real Estate Stocks With Over 8% Dividend Yields

Wall Street's Most Accurate Analysts Weigh In On 3 Real Estate Stocks With Over 8% Dividend Yields

During times of turbulence and uncertainty in the markets, even when markets are at all-time highs, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

在市場動盪和不確定時期,即使市場處於歷史新高,許多投資者也會轉向股息收益率股票。這些公司通常具有較高的自由現金流,並以高額的股息支付來獎勵股東。

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting our Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Benzinga的讀者可以通過訪問我們的分析師股票評級頁面來查看分析師對他們最喜歡的股票的最新看法。交易者可以對Benzinga龐大的分析師評級數據庫進行排序,包括按分析師的準確性進行排序。

Below are the ratings of the most accurate analysts for three high-yielding stocks in the real estate sector.

以下是房地產行業三隻高收益股票的最準確分析師的評級。

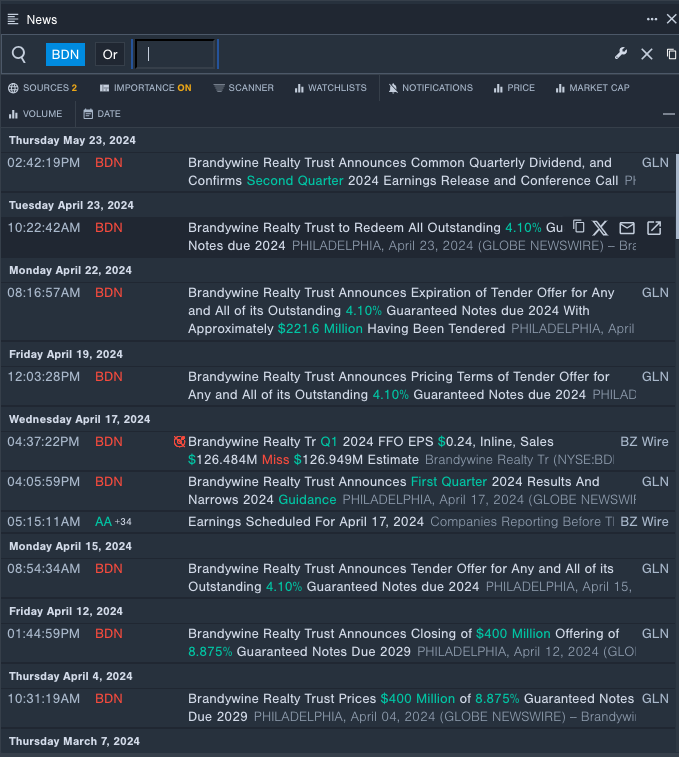

Brandywine Realty Trust (NYSE:BDN)

Brandywine 房地產信託基金(紐約證券交易所代碼:BDN)

- Dividend Yield: 13.27%

- Truist Securities analyst Michael Lewis maintained a Buy rating and cut the price target from $7 to $6 on Feb. 13. This analyst has an accuracy rate of 65%.

- Deutsche Bank analyst Omotayo Okusanya initiated coverage on the stock with a Hold rating and a price target of $5.5 on Jan. 30. This analyst has an accuracy rate of 61%.

- Recent News: Brandywine Realty Trust will release second quarter earnings after the closing bell on Tuesday, July 23.

- Benzinga Pro's real-time newsfeed alerted to latest Brandywine Realty Trust's news

- 股息收益率:13.27%

- Truist Securities分析師邁克爾·劉易斯維持買入評級,並於2月13日將目標股價從7美元下調至6美元。該分析師的準確率爲65%。

- 德意志銀行分析師Omotayo Okusanya於1月30日開始對該股進行報道,評級爲持有,目標股價爲5.5美元。該分析師的準確率爲61%。

- 最新消息:Brandywine Realty Trust將在7月23日星期二收盤後發佈第二季度業績。

- Benzinga Pro 的實時新聞提醒注意了 Brandywine Realty Trust 的最新消息

Service Properties Trust (NYSE:SVC)

服務物業信託(紐約證券交易所代碼:SVC)

- Dividend Yield: 16.10%

- B. Riley Securities analyst Bryan Maher maintained a Buy rating and cut the price target from $10 to $9 on May 13. This analyst has an accuracy rate of 62%.

- Wells Fargo analyst Dori Kesten maintained an Underweight rating and lowered the price target from $7.5 to $5.75 on March 21. This analyst has an accuracy rate of 61%.

- Recent News: On June 17, Service Properties Trust named Jesse Abair as Vice President.

- Benzinga Pro's charting tool helped identify the trend in SVC's stock.

- 股息收益率:16.10%

- B. 萊利證券分析師布萊恩·馬赫爾維持買入評級,並於5月13日將目標股價從10美元下調至9美元。這位分析師的準確率爲62%。

- 富國銀行分析師多麗·凱斯滕維持減持評級,並於3月21日將目標股價從7.5美元下調至5.75美元。該分析師的準確率爲61%。

- 最新消息:6月17日,服務地產信託任命傑西·阿拜爾爲副總裁。

- Benzinga Pro的圖表工具幫助確定了SVC股票的走勢。

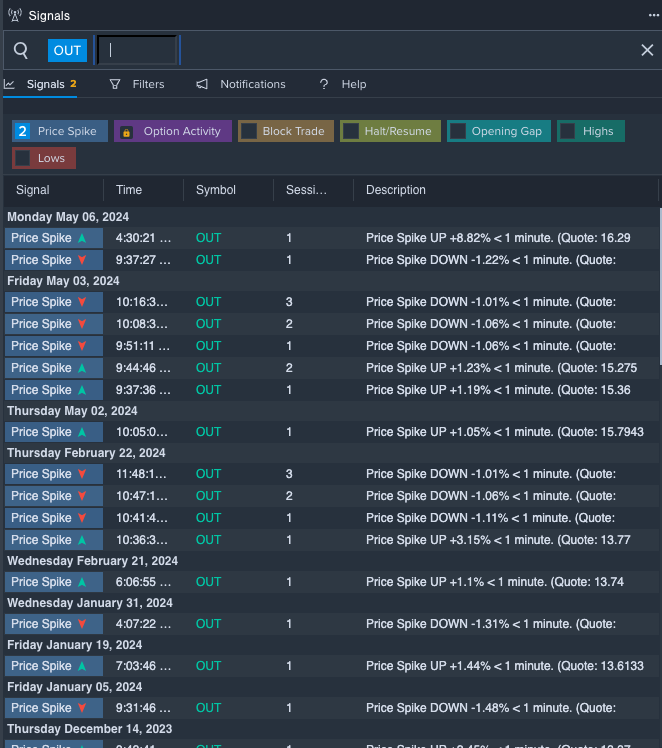

OUTFRONT Media Inc. (NYSE:OUT)

OUTFRONT 媒體公司(紐約證券交易所代碼:OUT)

- Dividend Yield: 8.78%

- Morgan Stanley analyst Benjamin Swinburne maintained an Equal-Weight rating and cut the price target from $15 to $12 on Oct. 9, 2023. This analyst has an accuracy rate of 76%.

- Citigroup analyst Jason Bazinetmaintained a Buy rating and lowered the price target from $21 to $18 on Aug. 14, 2023. This analyst has an accuracy rate of 70%.

- Recent News: On June 10, OUTFRONT Media and Bell Media announced closing of the sale of OUTFRONT Media's Canadian business.

- Benzinga Pro's signals feature notified of a potential breakout in OUTFRONT Media's shares.

- 股息收益率:8.78%

- 摩根士丹利分析師本傑明·斯威本維持同等權重評級,並於2023年10月9日將目標股價從15美元下調至12美元。這位分析師的準確率爲76%。

- 花旗集團分析師傑森·巴齊內特維持買入評級,並於2023年8月14日將目標股價從21美元下調至18美元。該分析師的準確率爲70%。

- 最新消息:6月10日,OUTFRONT Media和Bell Media宣佈結束對OUTFRONT Media加拿大業務的出售。

- Benzinga Pro的信號功能顯示,OUTFRONT Media的股票可能出現突破。