Here's Why Qingdao Gaoce Technology (SHSE:688556) Can Manage Its Debt Responsibly

Here's Why Qingdao Gaoce Technology (SHSE:688556) Can Manage Its Debt Responsibly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Qingdao Gaoce Technology Co., Ltd (SHSE:688556) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Qingdao Gaoce Technology's Net Debt?

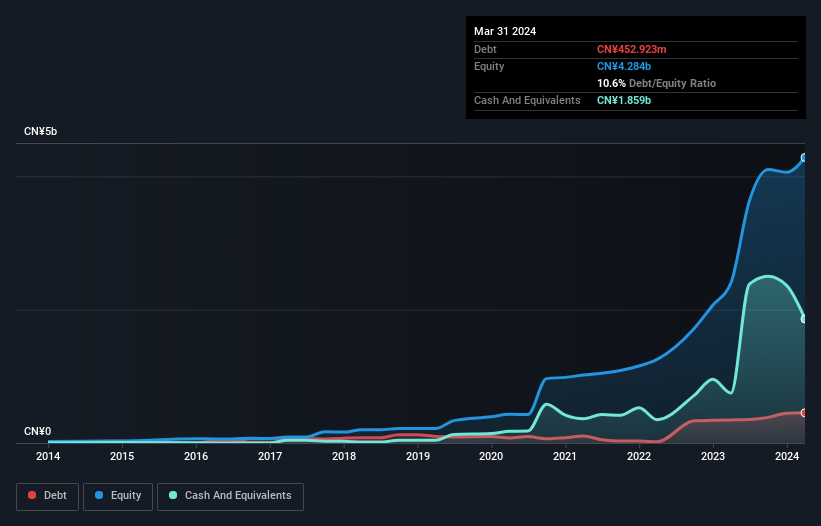

You can click the graphic below for the historical numbers, but it shows that as of March 2024 Qingdao Gaoce Technology had CN¥452.9m of debt, an increase on CN¥346.8m, over one year. But on the other hand it also has CN¥1.86b in cash, leading to a CN¥1.41b net cash position.

How Strong Is Qingdao Gaoce Technology's Balance Sheet?

According to the last reported balance sheet, Qingdao Gaoce Technology had liabilities of CN¥4.31b due within 12 months, and liabilities of CN¥656.0m due beyond 12 months. On the other hand, it had cash of CN¥1.86b and CN¥3.67b worth of receivables due within a year. So it actually has CN¥563.2m more liquid assets than total liabilities.

This short term liquidity is a sign that Qingdao Gaoce Technology could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, Qingdao Gaoce Technology boasts net cash, so it's fair to say it does not have a heavy debt load!

In addition to that, we're happy to report that Qingdao Gaoce Technology has boosted its EBIT by 34%, thus reducing the spectre of future debt repayments. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Qingdao Gaoce Technology's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Qingdao Gaoce Technology has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Qingdao Gaoce Technology reported free cash flow worth 17% of its EBIT, which is really quite low. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Summing Up

While it is always sensible to investigate a company's debt, in this case Qingdao Gaoce Technology has CN¥1.41b in net cash and a decent-looking balance sheet. And it impressed us with its EBIT growth of 34% over the last year. So we don't think Qingdao Gaoce Technology's use of debt is risky. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 3 warning signs for Qingdao Gaoce Technology (1 shouldn't be ignored!) that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com