We Think GH Research (NASDAQ:GHRS) Can Afford To Drive Business Growth

We Think GH Research (NASDAQ:GHRS) Can Afford To Drive Business Growth

Just because a business does not make any money, does not mean that the stock will go down. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

僅因業務不盈利並不意味着股票會下跌。例如,像軟件即服務業務Salesforce.com一樣,儘管多年來一直在增加經常性收入但沒有盈利,如果你自2005年以來持有股份,那麼你的確做得很好。但是,雖然歷史讚揚了那些罕見的成功,但失敗的人通常會被遺忘; 誰還記得Pets.com呢?

Given this risk, we thought we'd take a look at whether GH Research (NASDAQ:GHRS) shareholders should be worried about its cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

考慮到這種風險,我們會看一下GH Research (納斯達克:GHRS)的現金流量狀況是否讓股東感到擔憂。在本報告中,我們將考慮公司每年的自由現金流負值,稱之爲 '現金燒損',我們將從比較現金燒損和現金儲備開始,計算其現金剩餘時間。

How Long Is GH Research's Cash Runway?

GH Research的現金剩餘時間有多長?

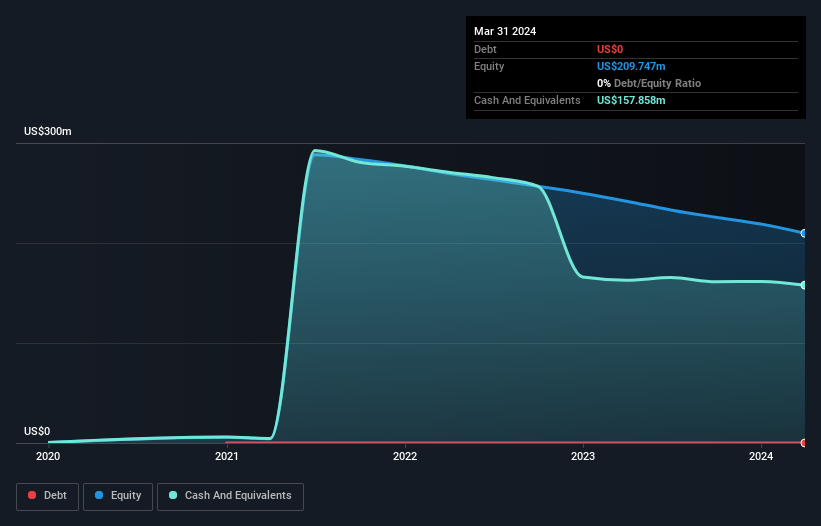

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at March 2024, GH Research had cash of US$158m and no debt. Importantly, its cash burn was US$36m over the trailing twelve months. That means it had a cash runway of about 4.4 years as of March 2024. There's no doubt that this is a reassuringly long runway. Depicted below, you can see how its cash holdings have changed over time.

公司的現金剩餘時間是通過將其現金儲備除以其現金燒損進行計算的。截至2024年3月,GH Research持有1.58億美元現金,無債務。其現金燒損在過去12個月中爲3600萬美元。這意味着截至2024年3月,其現金剩餘時間約爲4.4年。毫無疑問,這是一個讓人放心的較長時間段。下圖顯示了其現金持有量的變化。

How Is GH Research's Cash Burn Changing Over Time?

GH Research的現金燒損如何隨時間變化?

GH Research didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Over the last year its cash burn actually increased by 33%, which suggests that management are increasing investment in future growth, but not too quickly. However, the company's true cash runway will therefore be shorter than suggested above, if spending continues to increase. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

GH Research在過去一年中沒有記錄任何營業收入,這表明它仍然是一個正在發展業務的早期階段公司。因此,雖然我們不能通過銷售來了解其成長情況,但我們可以查看現金燒損的變化情況,了解支出隨時間趨勢如何。過去一年,其現金燒損實際上增加了33%,這表明管理層正在加大對未來增長的投資,但投資速度並不是太快。然而,如果支出繼續增加,公司的實際現金剩餘時間將比上述數據較短。但是,關鍵因素顯然是公司是否會在未來發展業務。因此,您可能需要看一下公司在未來幾年中的增長預期。

Can GH Research Raise More Cash Easily?

GH Research能輕鬆籌集更多現金嗎?

While GH Research does have a solid cash runway, its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

儘管GH Research具有穩健的現金剩餘時間,但其現金燒損軌跡可能讓一些股東提前思考公司何時可能需要籌集更多現金。上市公司籌集更多資金的最常見方式是發行新股份或負債。公開上市公司持有的主要優勢之一是他們可以向投資者出售股票以籌集現金併爲公司的增長提供資金。通過將公司的現金燒損與其市值進行比較,我們可以了解如果公司需要籌集足夠的資金來支付另一年的現金燒損所需的股東被稀釋的程度。

GH Research has a market capitalisation of US$622m and burnt through US$36m last year, which is 5.8% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

GH Research的市值爲6.22億美元,去年燒掉了3600萬美元,佔公司市值的5.8%。這是很低的比例,因此我們認爲公司將能夠募集更多資金以支持增長,並承擔一些稀釋,甚至可以借貸一些資金。

So, Should We Worry About GH Research's Cash Burn?

因此,我們應該擔心GH Research的現金燒損嗎?

As you can probably tell by now, we're not too worried about GH Research's cash burn. For example, we think its cash runway suggests that the company is on a good path. While its increasing cash burn wasn't great, the other factors mentioned in this article more than make up for weakness on that measure. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. On another note, GH Research has 3 warning signs (and 2 which are concerning) we think you should know about.

正如您現在可能已經注意到的那樣,我們對GH Research的現金燒損並不擔心。例如,我們認爲其現金剩餘時間表明公司的發展前景良好。雖然其不斷增加的現金燒損並不理想,但本文提到的其他因素已經充分彌補了這一缺點。在考慮了本報告中提到的各種指標之後,我們相信公司的現金使用方式是合理的,因爲它似乎在中期內能夠滿足其需求。另外,GH Research有3個警示信號(其中2個令人擔憂),我們認爲您應該了解一下。

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies with significant insider holdings, and this list of stocks growth stocks (according to analyst forecasts)

當然,您可能通過在其他地方尋找發現一筆極好的投資。所以請查看這份擁有重要內部持股的公司免費榜單,以及這份根據分析師預測的增長率列出的股票榜單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有反饋?關於內容有所顧慮?直接和我們聯繫。或電郵 editorial-team (at) simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

對本文有反饋?關於內容有所顧慮?直接和我們聯繫。或者,也可以發送電子郵件至editorial-team@simplywallst.com