Growth Stocks Leave Value Stocks In The Dust: 4 Reasons For Biggest Monthly Lead In Over A Year

Growth Stocks Leave Value Stocks In The Dust: 4 Reasons For Biggest Monthly Lead In Over A Year

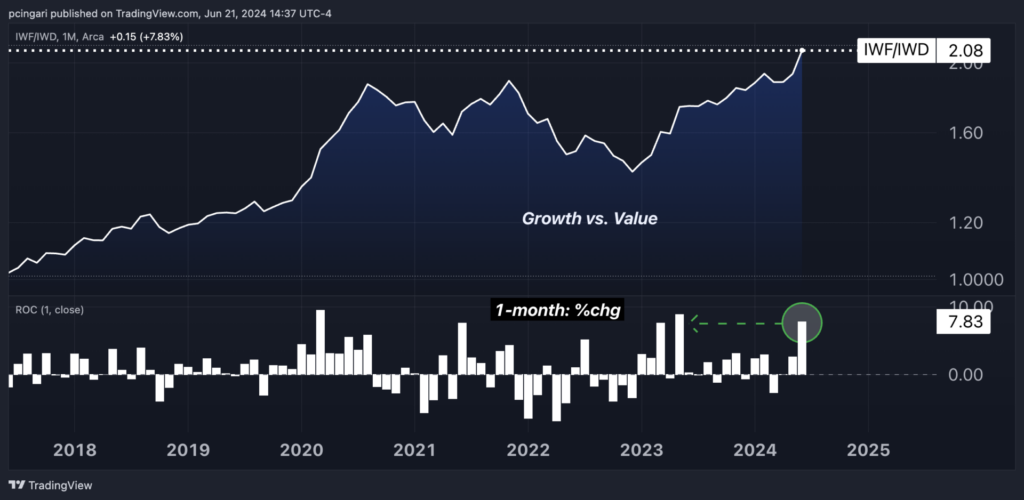

Growth stocks are experiencing a remarkable resurgence, posting their best month in over a year when compared to value stocks, as the rally in tech and mega caps continues to dominate market dynamics.

成長股目前正在經歷顯著回升,同價值股相比,表現出了自去年以來最好的一個月份。科技和巨型股的上漲仍然主導了市場走向。

The iShares Russell 1000 Growth ETF (NYSE:IWF) has surged by 6.5% so far in June 2024. This gain puts it on track for its seventh month of increases in the last eight.

截至2024年6月,瑞信1000成長指數etf-ishares(紐交所:iwf)大漲6.5%。這個漲幅已經讓它在過去8個月中的第7個月處於增長狀態。

Investors have shown elevated confidence in growth-oriented sectors, particularly technology, which continues to benefit from strong earnings reports, heightened expectations for future cash flows and positive market sentiment, especially towards AI-related industries.

投資者對成長型板塊表現出了更高的信心,特別是科技板塊。科技板塊繼續從強勁的業績、未來現金流預期增長以及市場對人工智能相關產業的積極情緒中受益。與此形成鮮明對比的是,瑞信1000價值指數etf-ishares(紐交所:iwd)這一代表另一主要股票風格的etf在6月份下跌了1.4%。

In stark contrast, the iShares Russell 1000 Value ETF (NYSE:IWD), representing the other major equity style, has declined by 1.4% in June.

這種分化凸顯了價值股面臨的挑戰,這些股票通常包括金融、能源、公共事業和必需消費品等板塊。這些板塊由於表現較差和收益預期低迷,難以吸引投資者的興趣。

This divergence highlights the challenges facing value stocks, which typically encompass sectors like financials, energy, utilities, and consumer staples. These sectors have struggled to attract investor interest due to their less impressive performance and subdued earnings expectations.

2024年6月,成長股與價值股之間的表現差距達到了驚人的7.9個百分點,這標誌着自2023年5月以來月度表現差異最大的一次。

The performance gap between growth and value in June 2024 stands at a striking 7.9 percentage points, marking the most substantial monthly performance difference since May 2023.

截至月底,如果差距超過2020年3月達到的9.6個百分點,那麼這將標誌着成長股和價值股表現差距最大的一個月份。

With one trading week remaining in the month, if the gap exceeds 9.6 percentage points, previously reached in March 2020, it will mark the largest one-month outperformance of growth over value ever recorded.

成長股的超額表現驅動因素有四個:

4 Key Factors Driving Growth's Outperformance Over Value

成長型etf中科技板塊的主導地位是推動超額表現的主要因素。在瑞信1000成長指數etf中,科技公司佔據組合的47%。與此形成鮮明對比的是,瑞信1000價值指數etf只將9.5%的資產分配給科技公司。

Technology Sector's Dominance in Growth ETFs: The technology sector's heavy weighting in growth-related ETFs has been the main driver of their outperformance. In the Russell 1000 Growth ETF, tech stocks comprise a substantial 47% of the portfolio. In stark contrast, the Russell 1000 Value ETF allocates only 9.5% to tech stocks.

芯片製造商在成長型基金中的重要性是另一個關鍵因素,因爲他們是目前人工智能推動的行情中主要受益者之一。其佔成長型etf的比重爲17%,而其在價值型etf中只佔4.2%。

Impact of Chipmakers on Growth Performance: Within the tech sector, the substantial weighting of chipmakers in growth funds has been another critical factor, as they have been the main beneficiaries of the current AI-driven rally. The semiconductor sector represents 17% of the growth ETF, compared to a mere 4.2% in the value ETF.

值得注意的是,美國銀行所稱的“六大神話”——英偉達公司(納斯達克:nvda)、微軟公司(紐交所:msft)、蘋果公司(納斯達克:aapl)、alphabet inc(納斯達克:goog、googl)、亞馬遜公司(納斯達克:amzn)和meta platforms inc(納斯達克:meta)——均不在價值型etf之中,但是在成長型etf中佔比達到了50%。

Absence of Nvidia, Magnificent 6 In Value ETFs: Notably, "The Magnificent 6" – as named by Bank of America – Nvidia Corp. (NASDAQ:NVDA), Microsoft Corp. (NYSE:MSFT), Apple Inc. (NASDAQ:AAPL), Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL), Amazon Inc. (NASDAQ:AMZN), and Meta Platforms Inc. (NASDAQ:META) – are absent from the value-linked ETF but collectively hold a 50% weight in the growth ETF.

成長型etf中個股集中度比價值型etf高,這是另一個至關重要的因素,特別是在當前市場廣度較差的情況下。瑞信1000成長指數etf中的前十大股票佔組合總比重的57%,而價值型etf中的前十大股票僅佔總比重的17%。

Stock Concentration and Market Breadth Differences: The higher stock concentration in growth-related ETFs compared to value socks is another crucial factor, especially in the current context of poor market breadth. The top 10 stocks in the Russell 1000 Growth ETF comprise 57% of the overall portfolio, whereas the top 10 in the value-related ETF account for only 17% of the total weight.

6月份表現最佳的成長型股票前七名:

Top 7 Performing Growth Stocks In June

價格變化(月至今)

| Name | Price Chg. % (MTD) |

| Broadcom Inc. (NASDAQ:AVGO) | 26.85% |

| Texas Pacific Land Corporation (NYSE:TPL) | 22.95% |

| Sarepta Therapeutics, Inc. (NASDAQ:SRPT) | 22.88% |

| Adobe Inc. (NASDAQ:ADBE) | 19.95% |

| Oracle Corporation (NYSE:ORCL) | 19.91% |

| CrowdStrike Holdings, Inc. (NASDAQ:CRWD) | 19.48% |

| Autodesk, Inc. (NASDAQ:ADSK) | 19.04% |

| 姓名 | 月至今價格變化率 |

| broadcom corp 8.00% mandatory convertible prf sr a(納斯達克:AVGO) | 26.85% |

| 德克薩斯太平洋土地公司(紐交所:tpl) | 22.95% |

| Sarepta Therapeutics,Inc。(納斯達克:srpt) | 22.88% |

| Adobe公司(納斯達克股票代碼:ADBE) | 19.95% |

| 甲骨文公司(紐交所:ORCL) | 19.91% |

| CrowdStrike Holdings, Inc. (納斯達克:CRWD) | 19.48% |

| Autodesk,Inc。(納斯達克:adsk) | 19.04% |

Top 7 Performing Value Stocks In June

6月份表現最佳的價值型股票前七名:

| Name | Price Chg. % (MTD) |

| Coherent Corp. (NYSE:COHR) | 24.68% |

| DC Technology Company (NYSE:DXC) | 20.23% |

| Guidewire Software, Inc. (NYSE:GWRE) | 19.58% |

| Universal Display Corporation (NASDAQ:OLED) | 18.71% |

| Ollie's Bargain Outlet Holdings, Inc. (NASDAQ:OLLI) | 18.52% |

| Zillow Group, Inc. (NYSE:ZG) | 17.88% |

| Hewlett Packard Enterprise Company (NYSE:HPE) | 16.29% |

| 姓名 | 月至今價格變化率 |

| Coherent Corp. (紐交所:COHR) | 24.68% |

| DC Technology Company (紐交所:DXC) | 20.23% |

| Guidewire Software, Inc. (紐交所:GWRE) | 19.58% |

| Universal Display Corporation (納斯達克:oled概念) | 18.71% |

| Ollie's Bargain Outlet Holdings, Inc. (納斯達克:ollie's bargain outlet) | 18.52% |

| Zillow Group, Inc. (紐交所:ZG) | 17.88% |

| 慧與科技公司 (紐交所:HPE) | 16.29% |

Read now: 5 Charts Expose Troubling Weaknesses In Record-High Stock Market: 'This Is Not Normal'

立即閱讀:5張圖揭示創紀錄的股市存在令人擔憂的弱點:“這不是正常現象”

Image created using artificial intelligence via Midjourney.

圖像由Midjourney通過人工智能創建。