Heilongjiang Agriculture's (SHSE:600598) Investors Will Be Pleased With Their Respectable 35% Return Over the Last Five Years

Heilongjiang Agriculture's (SHSE:600598) Investors Will Be Pleased With Their Respectable 35% Return Over the Last Five Years

Stock pickers are generally looking for stocks that will outperform the broader market. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. To wit, the Heilongjiang Agriculture share price has climbed 17% in five years, easily topping the market return of 3.3% (ignoring dividends).

股票選擇者通常尋找能夠超越整個市場的股票。雖然積極的選股行爲存在風險(需要分散化投資),但它也可以提供超額回報。毋庸置疑,北大荒的股價在5年內上漲了17%,遠高於市場回報率3.3%(忽略分紅)。

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

鑑於此,值得看看該公司的基本面是否一直是長期業績的驅動因素,或者是否存在一些不一致之處。

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

雖然有效市場假說仍然被一些人教授,但被證明市場是過度反應的動態系統,投資者並不總是理性的。檢查市場情緒如何隨時間變化的一種方法是看一個公司的股價與其每股收益(EPS)之間的交互作用。

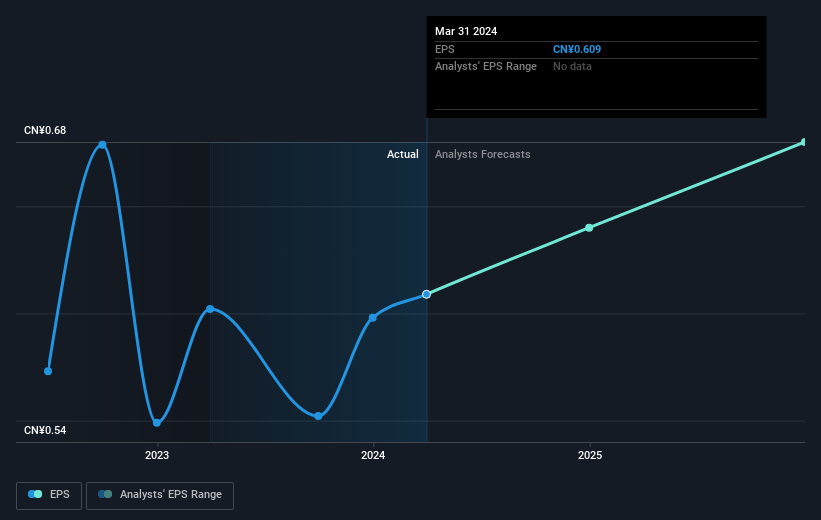

During five years of share price growth, Heilongjiang Agriculture achieved compound earnings per share (EPS) growth of 2.4% per year. This EPS growth is slower than the share price growth of 3% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth.

在股價五年增長期間,北大荒實現了每股收益2.4%的複合增長率。這種增長速度比同期3%的股價增長速度慢。這表明現在市場參與者對公司的看法更高。考慮到過去五年的收益增長記錄,這並不令人驚訝。

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

下面可以看到每股收益隨時間的變化情況(通過點擊圖像來查看確切數值)。

It might be well worthwhile taking a look at our free report on Heilongjiang Agriculture's earnings, revenue and cash flow.

我們的免費報告涵蓋了北大荒的收益、營業收入和現金流等方面,值得一看。

What About Dividends?

那麼分紅怎麼樣呢?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Heilongjiang Agriculture the TSR over the last 5 years was 35%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

在考慮投資回報時,重要的是考慮總股東回報(TSR)和股票回報之間的差異。 TSR包括任何剝離或折讓的資本籌集(基於股息被重新投資的假設),以及任何股息。因此,對於支付慷慨的股息公司而言,TSR通常比股票回報高得多。就中國神威藥業集團而言,其TSR在過去5年中達到了75%。這超過了我們之前提到的股票回報。該公司支付的股息已經提高了總股東回報。總股東回報和股票回報儘管股價回報僅反映了股價的變化,TSR包括了股息的價值(假定它們被再投資)以及任何折扣的融資或拆分的利益。因此,對於那些支付豐厚股息的公司,TSR通常要比股價回報高得多。我們注意到,對於北大荒,過去5年的TSR爲35%,比上述股價回報要好。該公司支付的股息因此增加了其收入。總股東回報。

A Different Perspective

不同的觀點

While it's never nice to take a loss, Heilongjiang Agriculture shareholders can take comfort that , including dividends,their trailing twelve month loss of 2.0% wasn't as bad as the market loss of around 14%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 6% for each year. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. It's always interesting to track share price performance over the longer term. But to understand Heilongjiang Agriculture better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Heilongjiang Agriculture , and understanding them should be part of your investment process.

雖然虧損從未是好事,但北大荒的股東可以寬心,即包括股息在內,他們過去12個月的虧損率爲2.0%,並沒有像市場虧損約14%那樣糟糕。當然,長期回報更爲重要的是,好消息是,在5年內,股票每年回報6%。也許這家公司只是面臨一些短期問題,但股東應該密切關注其基本面。追蹤股價在更長的時間範圍內的表現總是有趣的。但要更好地了解北大荒,我們需要考慮許多其他因素。例如,投資風險這個永遠存在的幽靈。我們已經確認了1個警告信號,必須理解它們作爲您的投資過程的一部分。

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

如果您願意查看另一家公司(具有潛在的更好財務狀況),請不要錯過這個免費的公司列表,證明它們可以增長收益。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

請注意,本文引用的市場回報反映了目前在中國交易所上市的股票的市場加權平均回報。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有反饋?關於內容有所顧慮?直接和我們聯繫。或電郵 editorial-team (at) simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

對本文有反饋?關於內容有所顧慮?直接和我們聯繫。或者,也可以發送電子郵件至editorial-team@simplywallst.com