Nvidia Dominates GPU Market as Generative AI Adoption Grows, Analyst Says

Nvidia Dominates GPU Market as Generative AI Adoption Grows, Analyst Says

Piper Sandler analyst Brent Bracelin said the breadth of enterprise adoption of generative AI has surprised him again. Nearly half of enterprises (49%) last year were testing Generative Artificial Intelligence. Today, nearly half of enterprises (48%) are implementing GenAI driven by the most popular departmental use cases across support and operations.

派傑投資分析師Brent Bracelin表示,生成人工智能的企業應用的廣度再次讓他感到驚訝。去年將近一半(49%)的企業正在測試生成式人工智能。如今,將近一半(48%)的企業正在根據支持和運營領域最受歡迎的部門用例實施GenAI。

Majority (>50%) still view Microsoft Corp (NASDAQ:MSFT) and OpenAI as the most strategic AI vendors, while interest in Alphabet Inc (NASDAQ:GOOG) (NASDAQ:GOOGL) Google Cloud Platform, Meta Platforms Inc (NASDAQ:META), and Oracle Corp (NYSE:ORCL) ticked up.

大多數(>50%)人仍然認爲微軟公司(納斯達克代碼:MSFT)和OpenAI是最具戰略意義的人工智能供應商,而對Alphabet Inc(納斯達克代碼:GOOG)(納斯達克代碼:GOOGL),Google Cloud Platform,meta platforms inc(納斯達克代碼:META)和Oracle Corp(紐交所代碼:ORCL)的興趣有所增加。

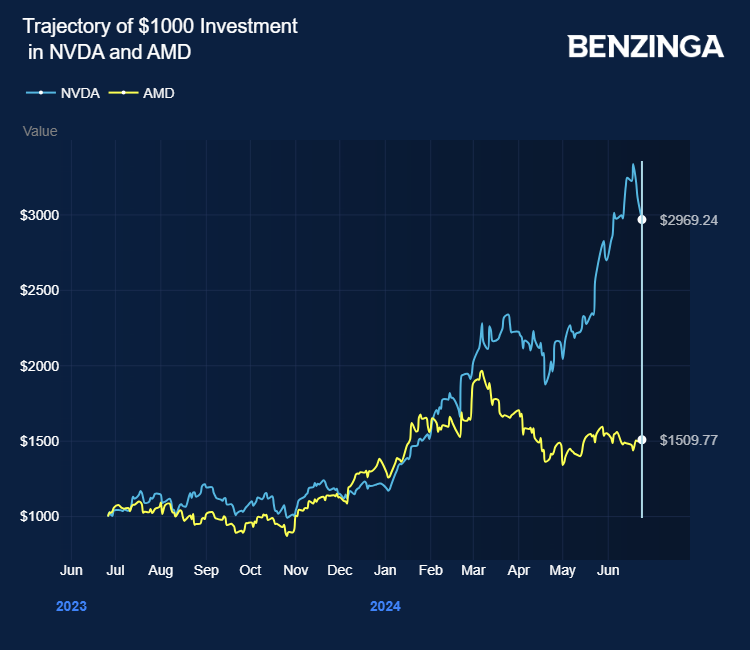

Analyst Harsh Kumar noted GPU accelerators could be an over $400 billion opportunity by 2027E with sustained double-digit CAGR growth. In the GPU space, Kumar noted Nvidia Corp (NASDAQ:NVDA) as the clear leader with over 70% of the total market with Advanced Micro Devices, Inc (NASDAQ:AMD) and Intel Corp (NASDAQ:INTC) competing for the rest of the market. In networking, Broadcom Inc (NASDAQ:AVGO) continues to be the clear leader relative to Marvell Technology, Inc (NASDAQ:MRVL) when it comes to enterprise adoption, as per Kumar.

分析師Harsh Kumar指出,由於持續的兩位數複合年增長率增長,GPU加速器可能成爲2027E超過4000億美元的機遇。在GPU領域,庫馬爾指出,Nvidia Corp(納斯達克代碼:NVDA)是市場總額70%以上的明顯領導者,而Advanced Micro Devices,Inc(納斯達克代碼:AMD)和Intel Corp(納斯達克代碼:INTC)在剩下的市場上競爭。在網絡方面,Broadcom Inc(納斯達克代碼:AVGO)在企業應用方面繼續比Marvell Technology,Inc(納斯達克代碼:MRVL)更爲明顯地領先,如庫馬爾所述。

Kumar noted that 58% of respondents who use Apple Inc (NASDAQ:AAPL) devices expect it to grow as a percentage of total devices (46% in December 2023, and 41% in July 2023), and 42% expect the proportion of Apple devices in their company will remain the same (42% in December 2023, 51% in July 2023).

庫馬爾指出,使用蘋果公司(納斯達克代碼:AAPL)設備的58%的受訪者預計其設備在總設備中所佔比例將增長(2023年12月46%,2023年7月41%),而42%的受訪者預計其公司中蘋果設備的比例將保持不變(2023年12月42%,2023年7月51%)。

Photo by PopTika on Shutterstock

由Shutterstock的PopTika拍攝

Kumar noted that 58% of respondents who use Apple Inc (NASDAQ:AAPL) devices expect it to grow as a percentage of total devices (46% in December 2023, and 41% in July 2023), and 42% expect the proportion of Apple devices in their company will remain the same (42% in December 2023, 51% in July 2023).

Kumar noted that 58% of respondents who use Apple Inc (NASDAQ:AAPL) devices expect it to grow as a percentage of total devices (46% in December 2023, and 41% in July 2023), and 42% expect the proportion of Apple devices in their company will remain the same (42% in December 2023, 51% in July 2023).