Broadcom Pulls A Nvidia As Shares Reverse, Appear Likely To Refill Gap: Chart

Broadcom Pulls A Nvidia As Shares Reverse, Appear Likely To Refill Gap: Chart

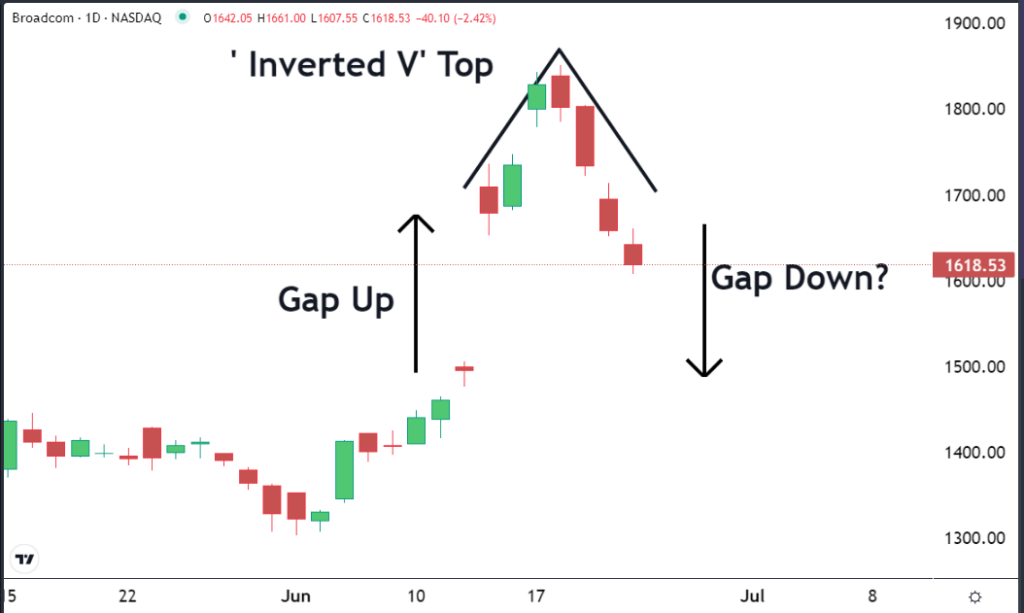

Shares of Broadcom Inc. (NASDAQ:AVGO) have reversed, and they also could be about to refill a gap. This means the stock may make a meaningful move lower.

Broadcom股票(NASDAQ:AVGO)已經反轉,也可能會重新填補一個間隙。這意味着股票可能會有明顯下跌。

This is why the trading team has identified Broadcom as our 'Stock of the Day'.

這就是爲什麼我們的交易團隊認爲Broadcom是我們的“今日之股”。

When the leadership of a market is changing from bears to bulls or bulls to bears, the price action can show up on a chart as a reversal pattern. If the reversal takes place in one day, the action may appear as a 'bearish engulfing pattern'.

當市場領導權從空頭轉向多頭或從多頭轉向空頭時,價格行動會在圖表上顯示爲一個反轉模式。如果反轉在一天內發生,行動可能顯示爲“看淡吞沒模式”。

This happened with Nvidia (NASDAQ:NVDA) last week.

這種情況上週發生在Nvidia(NASDAQ:NVDA)身上。

If the change is slow and takes place over an extended, a 'rounded bottom' or 'rounded top' may form on the chart. If the change takes place over a few time-periods, it can appear as a 'V bottom' or an 'inverted V' top.

如果變化緩慢且長時間,圖表上可能會形成“圓底”或“圓頂”。如果變化發生在幾個時間段內,它可能會出現爲“V底部”或“倒V”頂部。

As you can see on the chart, Broadcom just completed an inverted 'V top' pattern. The green team (bulls) took over the market in early June and pushed the price higher. But last week the red team (bears) gained control and have been pushing the price lower ever since.

如圖所示,Broadcom剛剛完成了倒“V”頂部模式。綠色團隊(多頭)在6月初接管市場並推高了價格。但是上週,紅色團隊(空頭)獲得了控制權,並一直將價格推低。

Now the shares may be about to refill a gap. This means the move lower may accelerate.

現在股票可能將重新填補一個間隙。這意味着下跌可能會加速。

One reason why support forms in markets is seller's remorse. Sometimes, people regret selling if the market moves higher after they do. And sometimes they decide that they will buy their shares back if they can get them for the same price they were sold for.

市場中支撐位形成的原因之一是賣家後悔。有時,如果市場在他們賣出後上漲,人們會後悔賣出。有時,他們會決定,如果能以出售時相同的價格買回他們的股票,他們將買回它們。

A stock can close at one price and open the next day at a substantially higher price. That was the case recently with AVGO. The shares closed on Wednesday, June 12 around $1,495. The next morning, they opened close to $1,710.

股票可能以一個價格收盤,在第二天早上以一個相當高的價格開盤。這就是最近AVGO的情況。股票於6月12日星期三收盤價約爲1495美元。第二天早上,它們開盤接近1710美元。

Because there was no trading at the prices in between the open and the close, it appears on the chart as a blank space or a gap. And because there was no trading within these levels, there were no traders or investors who sold who have become remorseful and will be trying to buy their shares back.

因爲在開盤價和收盤價之間沒有交易,所以在圖表上似乎是一個空白區域或間隙。由於在這些水平上沒有交易,沒有交易人或投資者賣出後後悔並試圖購買他們的股票。

That means that there may not be a lot of buy interest in between these two prices. So, if the shares reverse and move back into this range going in the opposite direction, people who want to sell may have a difficult time finding others to buy their shares.

這意味着這兩個價格之間可能沒有多少買入興趣。因此,如果股票反轉並朝相反方向回到這個區間,想要賣出的人可能很難找到其他人來買他們的股票。

As a result, they will need to be aggressive and offer their shares at a discount. This could result in a rapid selloff that 'refills' the gap. Within a few days, Broadcom may end up right back where they started from when they gapped up.

因此,他們將需要積極出擊並以打折的價格出售股票。這可能導致快速拋售填平間隙。幾天內,Broadcom可能回到啓動間隙的地方。

This happened with Nvidia (NASDAQ:NVDA) last week.

This happened with Nvidia (NASDAQ:NVDA) last week.