Xiangtan Electric Manufacturing (SHSE:600416) Shareholders Are Still up 64% Over 5 Years Despite Pulling Back 10% in the Past Week

Xiangtan Electric Manufacturing (SHSE:600416) Shareholders Are Still up 64% Over 5 Years Despite Pulling Back 10% in the Past Week

It hasn't been the best quarter for Xiangtan Electric Manufacturing Co. Ltd. (SHSE:600416) shareholders, since the share price has fallen 24% in that time. Looking further back, the stock has generated good profits over five years. After all, the share price is up a market-beating 64% in that time. While the long term returns are impressive, we do have some sympathy for those who bought more recently, given the 44% drop, in the last year.

Since the long term performance has been good but there's been a recent pullback of 10%, let's check if the fundamentals match the share price.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

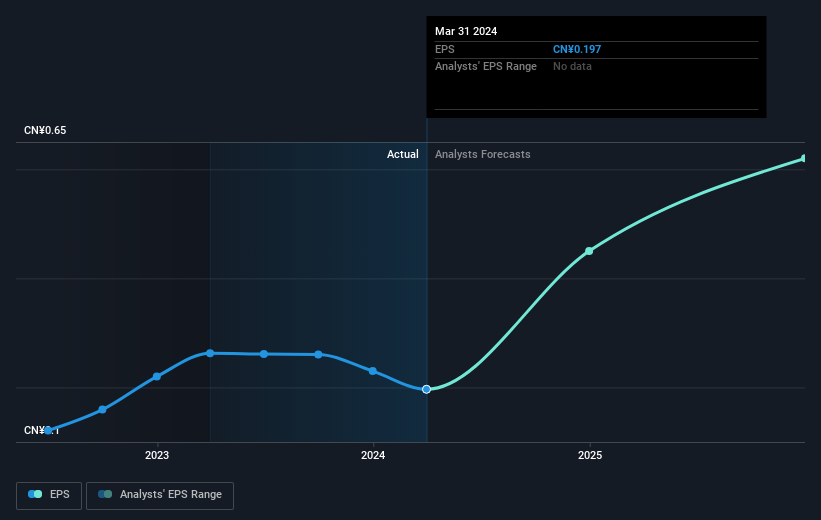

During the last half decade, Xiangtan Electric Manufacturing became profitable. That would generally be considered a positive, so we'd hope to see the share price to rise. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. We can see that the Xiangtan Electric Manufacturing share price is down 33% in the last three years. In the same period, EPS is up 2.1% per year. So there seems to be a mismatch between the positive EPS growth and the change in the share price, which is down -12% per year.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Xiangtan Electric Manufacturing's earnings, revenue and cash flow.

A Different Perspective

While the broader market lost about 16% in the twelve months, Xiangtan Electric Manufacturing shareholders did even worse, losing 44%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 10% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Is Xiangtan Electric Manufacturing cheap compared to other companies? These 3 valuation measures might help you decide.

But note: Xiangtan Electric Manufacturing may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com