Is Zhejiang Chengchang Technology Co., Ltd.'s (SZSE:001270) Stock Price Struggling As A Result Of Its Mixed Financials?

Is Zhejiang Chengchang Technology Co., Ltd.'s (SZSE:001270) Stock Price Struggling As A Result Of Its Mixed Financials?

Zhejiang Chengchang Technology (SZSE:001270) has had a rough three months with its share price down 13%. We, however decided to study the company's financials to determine if they have got anything to do with the price decline. Long-term fundamentals are usually what drive market outcomes, so it's worth paying close attention. Specifically, we decided to study Zhejiang Chengchang Technology's ROE in this article.

浙江誠昌科技(深圳證券交易所:001270)經歷了艱難的三個月,其股價下跌了13%。但是,我們決定研究公司的財務狀況,以確定它們是否與價格下跌有關。長期基本面通常是推動市場結果的因素,因此值得密切關注。具體而言,我們決定在本文中研究浙江誠昌科技的投資回報率。

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits.

股本回報率或投資回報率是用於評估公司管理層利用公司資本效率的關鍵指標。換句話說,它揭示了公司成功地將股東投資轉化爲利潤。

How Do You Calculate Return On Equity?

你如何計算股本回報率?

The formula for return on equity is:

股本回報率的公式是:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

股本回報率 = 淨利潤(來自持續經營業務)÷ 股東權益

So, based on the above formula, the ROE for Zhejiang Chengchang Technology is:

因此,根據上述公式,浙江誠昌科技的投資回報率爲:

3.8% = CN¥53m ÷ CN¥1.4b (Based on the trailing twelve months to March 2024).

3.8% = 5300萬元人民幣 ÷ 14元人民幣(基於截至2024年3月的過去十二個月)。

The 'return' is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each CN¥1 of shareholders' capital it has, the company made CN¥0.04 in profit.

“回報” 是過去十二個月的稅後收入。將其概念化的一種方法是,公司每擁有1元人民幣的股東資本,公司就會獲得0.04元的利潤。

What Is The Relationship Between ROE And Earnings Growth?

投資回報率與收益增長之間有什麼關係?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company's earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

到目前爲止,我們已經了解到,投資回報率衡量的是公司創造利潤的效率。然後,我們能夠評估公司的收益增長潛力,具體取決於公司對這些利潤進行再投資或 “保留” 了多少及其有效性。假設其他一切保持不變,那麼與不一定具有這些特徵的公司相比,投資回報率和利潤保留率越高,公司的增長率就越高。

A Side By Side comparison of Zhejiang Chengchang Technology's Earnings Growth And 3.8% ROE

浙江誠昌科技的收益增長和3.8%的投資回報率的並排比較

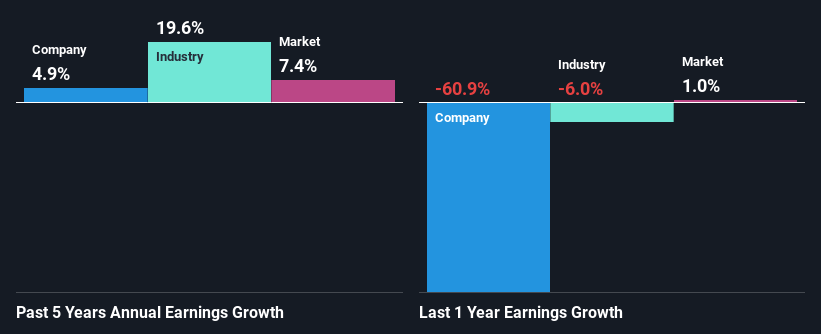

It is hard to argue that Zhejiang Chengchang Technology's ROE is much good in and of itself. Even compared to the average industry ROE of 5.8%, the company's ROE is quite dismal. Accordingly, Zhejiang Chengchang Technology's low net income growth of 4.9% over the past five years can possibly be explained by the low ROE amongst other factors.

很難說浙江誠昌科技的投資回報率本身就非常好。即使與5.8%的行業平均投資回報率相比,該公司的投資回報率也相當慘淡。因此,浙江誠昌科技在過去五年中淨收入增長率低至4.9%,這可能是由投資回報率低等因素造成的。

We then compared Zhejiang Chengchang Technology's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 20% in the same 5-year period, which is a bit concerning.

然後,我們將浙江誠昌科技的淨收入增長與該行業進行了比較,發現該公司的增長數字低於同期50%的行業平均增長率,這有點令人擔憂。

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Zhejiang Chengchang Technology's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

收益增長是對股票進行估值時要考慮的重要指標。投資者接下來需要確定的是,預期的收益增長或缺乏收益是否已經包含在股價中。通過這樣做,他們將知道股票是走向清澈的藍色海水,還是沼澤的水域在等着你。如果你想知道浙江誠昌科技的估值,可以看看這個衡量其與行業相比的市盈率指標。

Is Zhejiang Chengchang Technology Efficiently Re-investing Its Profits?

浙江誠昌科技是否有效地將其利潤再投資?

Despite having a normal three-year median payout ratio of 30% (or a retention ratio of 70% over the past three years, Zhejiang Chengchang Technology has seen very little growth in earnings as we saw above. So there might be other factors at play here which could potentially be hampering growth. For example, the business has faced some headwinds.

儘管浙江誠昌科技的三年派息率中位數正常爲30%(或過去三年的留存率爲70%),但正如我們在上面看到的那樣,浙江誠昌科技的收益幾乎沒有增長。因此,這裏可能還有其他因素在起作用,這些因素可能會阻礙增長。例如,該業務面臨一些阻力。

Only recently, Zhejiang Chengchang Technology started paying a dividend. This means that the management might have concluded that its shareholders prefer dividends over earnings growth.

就在最近,浙江誠昌科技才開始派發股息。這意味着管理層可能已經得出結論,其股東更喜歡分紅而不是收益增長。

Summary

摘要

On the whole, we feel that the performance shown by Zhejiang Chengchang Technology can be open to many interpretations. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. Having said that, looking at the current analyst estimates, we found that the company's earnings are expected to gain momentum. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

總的來說,我們認爲浙江誠昌科技表現出的表現可以有多種解讀。儘管該公司的利潤保留率確實很高,但其低迴報率可能會阻礙其收益增長。話雖如此,從分析師目前的估計來看,我們發現該公司的收益有望增強。要了解有關公司未來收益增長預測的更多信息,請查看這份關於分析師預測的免費報告,以了解更多信息。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,發送電子郵件至 editorial-team@simplywallst.com