Looking At AbbVie's Recent Unusual Options Activity

Looking At AbbVie's Recent Unusual Options Activity

High-rolling investors have positioned themselves bearish on AbbVie (NYSE:ABBV), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in ABBV often signals that someone has privileged information.

賭徒投資者看淡了艾伯維公司(紐交所:ABBV),零售交易者要注意。我們通過Benzinga跟蹤的公開期權數據,今天注意到了這種活動。這些投資者的身份不確定,但ABBV的如此重大變化通常意味着有人擁有特權信息。

Today, Benzinga's options scanner spotted 8 options trades for AbbVie. This is not a typical pattern.

今天,Benzinga的期權掃描器發現了8個艾伯維的期權交易,這不是一個典型的模式。

The sentiment among these major traders is split, with 25% bullish and 62% bearish. Among all the options we identified, there was one put, amounting to $32,558, and 7 calls, totaling $350,955.

這些主要交易商的情緒分裂,看漲25%,看跌62%。我們確定的所有期權中,有一個看跌期權,金額爲32558美元,7個看漲期權,總額爲350955美元。

Projected Price Targets

預計價格目標

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $140.0 to $180.0 for AbbVie during the past quarter.

分析這些合同的成交量和未平倉量,似乎大戶已經關注了艾伯維公司在過去一個季度期間價格窗口從140.0美元到180.0美元的區間。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

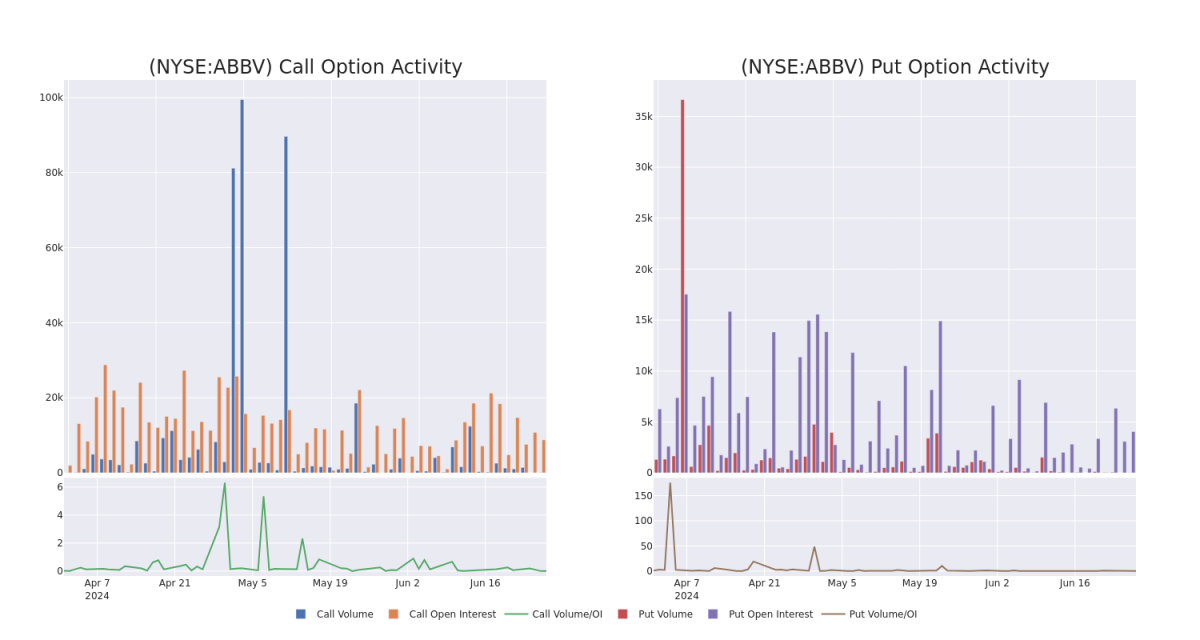

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for AbbVie's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across AbbVie's significant trades, within a strike price range of $140.0 to $180.0, over the past month.

檢查成交量和未平倉量提供了關鍵的股票研究見解。這些信息對於評估特定鬥價的艾伯維公司期權的流動性和利益水平非常重要。在下面,我們提供了過去一個月內涉及艾伯維公司的重要交易中,在140.0美元至180.0美元的行情區間內,看跌期權和看漲期權的成交量和未平倉量趨勢的快照。

AbbVie 30-Day Option Volume & Interest Snapshot

艾伯維公司30天期權成交量和持倉量快照

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABBV | CALL | SWEEP | BEARISH | 07/19/24 | $9.65 | $9.0 | $9.08 | $160.00 | $118.1K | 1.3K | 0 |

| ABBV | CALL | TRADE | BEARISH | 03/21/25 | $12.9 | $12.65 | $12.65 | $170.00 | $59.4K | 203 | 3 |

| ABBV | CALL | SWEEP | BULLISH | 09/20/24 | $4.1 | $4.1 | $4.1 | $175.00 | $41.4K | 3.1K | 1 |

| ABBV | CALL | TRADE | NEUTRAL | 03/21/25 | $13.2 | $11.85 | $12.5 | $170.00 | $41.2K | 203 | 57 |

| ABBV | PUT | SWEEP | BEARISH | 07/19/24 | $1.46 | $1.44 | $1.45 | $165.00 | $32.5K | 4.0K | 20 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 艾伯維公司 | 看漲 | SWEEP | 看淡 | 07/19/24 | $9.65 | 9.0美元 | $9.08 | $160.00 | $118.1K | 1.3K | 0 |

| 艾伯維公司 | 看漲 | 交易 | 看淡 | 03/21/25 | $12.9 | $12.65 | $12.65 | $170.00 | $59.4K | 203 | 3 |

| 艾伯維公司 | 看漲 | SWEEP | 看好 | 09/20/24 | $4.1 | $4.1 | $4.1 | $175.00 | $41.4K | 3.1K | 1 |

| 艾伯維公司 | 看漲 | 交易 | 中立 | 03/21/25 | $13.2 | 11.85美元 | $12.5 | $170.00 | $41.2K | 203 | 57 |

| 艾伯維公司 | 看跌 | SWEEP | 看淡 | 07/19/24 | $1.46 | $1.44 | $1.45 | 165.00美元 | $32.5K | 4.0K | 20 |

About AbbVie

關於艾伯維公司

AbbVie is a pharmaceutical firm with a strong exposure to immunology (with Humira, Skyrizi, and Rinvoq) and oncology (with Imbruvica and Venclexta). The company was spun off from Abbott in early 2013. The 2020 acquisition of Allergan added several new products and drugs in aesthetics (including Botox).

AbbVie是一家藥品公司,其在免疫學(包括Humira、Skyrizi和Rinvoq)和腫瘤學(包括Imbruvica和Venclexta)方面擁有強大的業務。該公司於2013年初從Abbott分拆而來。2020年收購雅培使其在美容業務(包括Botox)中新增了一些產品和藥品。

After a thorough review of the options trading surrounding AbbVie, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

經過對艾伯維周邊期權交易的詳細審查,我們進一步審查公司的細節,包括對其當前市場狀態和表現的評估。

Where Is AbbVie Standing Right Now?

艾伯維目前處於什麼狀態?

- Currently trading with a volume of 1,080,843, the ABBV's price is down by -1.3%, now at $168.93.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 28 days.

- 目前成交量爲1,080,843,ABBV的價格下跌了-1.3%,現在爲168.93美元。

- RSI讀數表明該股目前可能接近超買水平。

- 預期業績發佈在28天后。

Expert Opinions on AbbVie

關於艾伯維公司的專家意見

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $191.66666666666666.

在過去一個月中,有3位行業分析師分享了他們對這隻股票的見解,提出了一個平均目標價191.66666666666666美元。

- An analyst from Piper Sandler persists with their Overweight rating on AbbVie, maintaining a target price of $190.

- An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $200.

- An analyst from HSBC has elevated its stance to Buy, setting a new price target at $185.

- 派傑投資(Piper Sandler)的分析師堅持其對AbbVie的超配評級,保持目標價爲$190。

- 康泰納菲(Cantor Fitzgerald)的一位分析師將其評級降級爲超配,設定了一個$200的目標價。

- 摩根士丹利(HSBC)的一位分析師將其立場提高到買入,設定了一個新的目標價在$185。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $140.0 to $180.0 for AbbVie during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $140.0 to $180.0 for AbbVie during the past quarter.