Market Whales and Their Recent Bets on AMD Options

Market Whales and Their Recent Bets on AMD Options

High-rolling investors have positioned themselves bullish on Advanced Micro Devices (NASDAQ:AMD), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in AMD often signals that someone has privileged information.

投機的投資者們看好美國超微公司(納斯達克:AMD),零售交易者們也應該注意這個現象。通過Benzinga跟蹤公開期權數據,我們今天注意到了這種活動。這些投資者的身份不確定,但AMD的如此重大舉動往往意味着有人擁有特權信息。

Today, Benzinga's options scanner spotted 9 options trades for Advanced Micro Devices. This is not a typical pattern.

Benzinga的期權掃描儀今日發現了9個美國超微公司的期權交易,這並不是一種典型的模式。

The sentiment among these major traders is split, with 77% bullish and 22% bearish. Among all the options we identified, there was one put, amounting to $59,630, and 8 calls, totaling $285,048.

這些主要交易者的情緒分化,77%看漲,22%看淡。在我們找到的所有期權中,有一個看跌期權,總額爲59630美元,而有8個看漲期權,總額爲285048美元。

What's The Price Target?

價格目標是什麼?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $75.0 and $165.0 for Advanced Micro Devices, spanning the last three months.

經過評估成交量和持倉量,很明顯市場主要的交易者們將美國超微公司的價格區間聚焦在75.0美元到165.0美元之間,時間跨度爲三個月。

Insights into Volume & Open Interest

成交量和持倉量分析

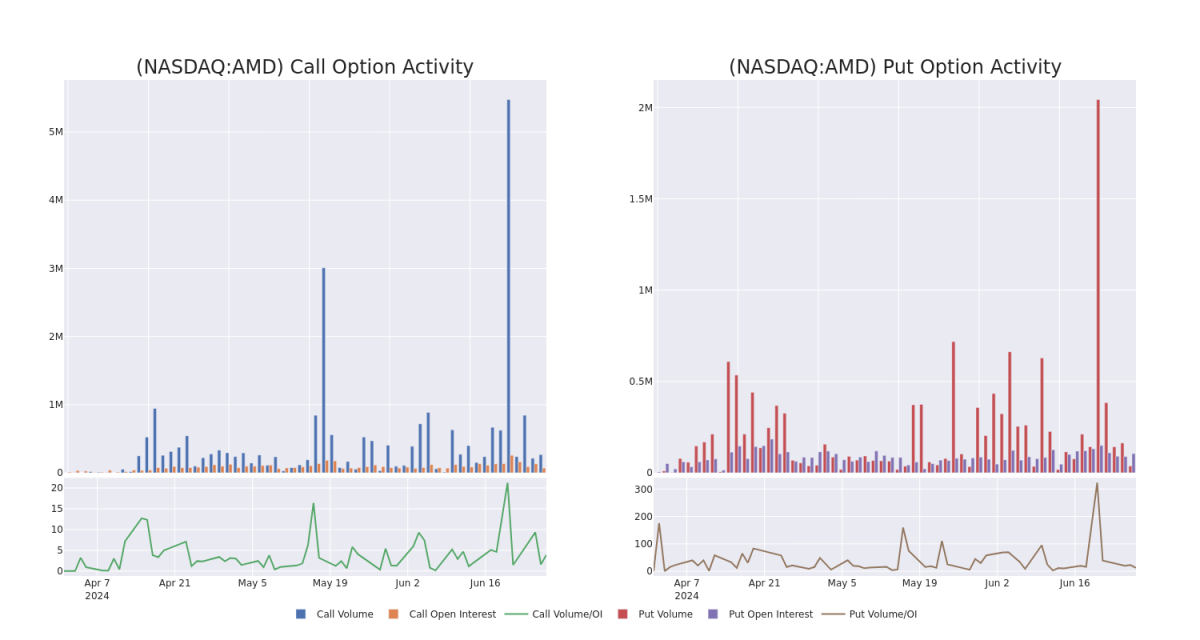

In today's trading context, the average open interest for options of Advanced Micro Devices stands at 6628.2, with a total volume reaching 35,678.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Advanced Micro Devices, situated within the strike price corridor from $75.0 to $165.0, throughout the last 30 days.

在今天的交易背景下,美國超微公司期權的平均持倉量爲6628.2,總成交量達到35678.00。附帶的表格描述了過去30天高價值交易的看漲和看跌期權成交量和持倉量在美國超微公司(分佈在75.0美元到165.0美元的執行價格走廊內)的演變過程。

Advanced Micro Devices 30-Day Option Volume & Interest Snapshot

美國超微公司30天期權成交量和興趣快照

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMD | PUT | TRADE | BULLISH | 06/18/26 | $3.4 | $3.35 | $3.35 | $75.00 | $59.6K | 390 | 0 |

| AMD | CALL | SWEEP | BULLISH | 07/05/24 | $2.5 | $2.48 | $2.5 | $165.00 | $50.0K | 8.4K | 3.2K |

| AMD | CALL | SWEEP | BULLISH | 07/05/24 | $2.19 | $2.16 | $2.19 | $165.00 | $48.3K | 8.4K | 1.4K |

| AMD | CALL | TRADE | BULLISH | 07/05/24 | $4.15 | $4.05 | $4.12 | $160.00 | $41.2K | 6.0K | 939 |

| AMD | CALL | TRADE | BEARISH | 07/12/24 | $3.2 | $3.15 | $3.15 | $167.50 | $32.4K | 500 | 183 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMD (納斯達克:AMD) | 看跌 | 交易 | 看好 | 06/18/26 | $3.4 | $3.35 | $3.35 | $75.00 | $59.6K | 390 | 0 |

| AMD (納斯達克:AMD) | 看漲 | SWEEP | 看好 | 07/05/24 | $2.5 | $2.48 | $2.5 | 165.00美元 | $50.0K | 8.4K | 3.2K |

| AMD (納斯達克:AMD) | 看漲 | SWEEP | 看好 | 07/05/24 | $2.19 | $2.16 | $2.19 | 165.00美元 | $48.3K | 8.4K | 1.4千 |

| AMD (納斯達克:AMD) | 看漲 | 交易 | 看好 | 07/05/24 | $4.15 | $4.05 | $4.12 | $160.00 | $41.2K | 6.0K | 939 |

| AMD (納斯達克:AMD) | 看漲 | 交易 | 看淡 | 07/12/24 | $3.2 | $3.15 | $3.15 | $167.50 | $32.4K應翻譯爲$32,400 | 500 | 183 |

About Advanced Micro Devices

關於Advanced Micro Devices

Advanced Micro Devices designs a variety of digital semiconductors for markets such as PCs, gaming consoles, data centers, industrial, and automotive applications, among others. AMD's traditional strength was in central processing units, CPUs, and graphics processing units, or GPUs, used in PCs and data centers. Additionally, the firm supplies the chips found in prominent game consoles such as the Sony PlayStation and Microsoft Xbox. In 2022, the firm acquired field-programmable gate array, or FPGA, leader Xilinx to diversify its business and augment its opportunities in key end markets such as the data center and automotive.

Advanced Micro Devices爲諸如PC、遊戲機、數據中心、工業、汽車應用等市場設計各種數字半導體。AMD的傳統優勢在於用於PC和數據中心中的中央處理器(CPU)和圖形處理器(GPU)。此外,該公司還爲一些著名遊戲機,如Sony PlayStation和Microsoft Xbox供應芯片。2022年,該公司收購了FPGA領導者Xilinx,以實現業務多元化,並增加在數據中心和汽車等關鍵終端市場的機會。

Advanced Micro Devices's Current Market Status

美國超微公司的當前市場狀態

- Trading volume stands at 701,893, with AMD's price up by 0.46%, positioned at $160.21.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 32 days.

- 交易量爲701893,AMD的價格上漲了0.46%,位於160.21美元。

- RSI指標顯示該股票目前處於超買和超賣之間的中立狀態。

- 收益公告將於32天后發佈。

What Analysts Are Saying About Advanced Micro Devices

關於美國超微公司,分析師的說法

In the last month, 2 experts released ratings on this stock with an average target price of $188.0.

在過去的一個月中,有2位專家對這隻股票進行了評級,目標價平均爲188.0美元。

- Consistent in their evaluation, an analyst from Susquehanna keeps a Positive rating on Advanced Micro Devices with a target price of $200.

- An analyst from Morgan Stanley downgraded its action to Equal-Weight with a price target of $176.

- 一位Susquehanna的分析師一致認爲,美國超微公司股票積極評價,目標價爲$200.00。

- 摩根士丹利的一位分析師將其評級下調爲相等重量,並設定了$176.00的目標價。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Advanced Micro Devices with Benzinga Pro for real-time alerts.

交易期權涉及更高的風險,但也提供了更高的利潤可能性。精明的交易者通過持續教育、戰略性交易調整、利用各種因子以及保持對市場動態的敏感來減少這些風險。使用Benzinga Pro進行實時提醒,了解美國超微公司的最新期權交易。