Markets Weekly Update (June 28) : US new home sales plunge, inventory reaches over 16-year peak

Markets Weekly Update (June 28) : US new home sales plunge, inventory reaches over 16-year peak

Macro Matters

宏觀事項

US New Home Sales Plunge, Inventory Reaches over 16-Year Peak

美國新房銷售暴跌,庫存達到16年高峰。

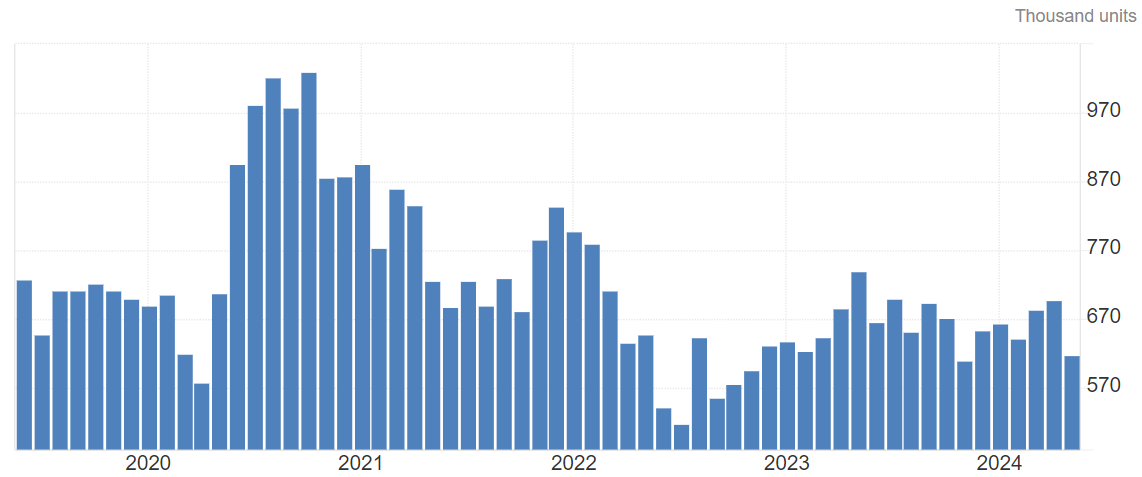

New home sales declined 11.3% to a seasonally adjusted annual rate of 619,000 units last month, the lowest level since November, the Commerce Department's Census Bureau said. The percentage-based drop was the biggest since September 2022.

上個月,季調後年銷售新房量降至619,000套,是自去年11月以來的最低水平,美國商務部人口普查局稱。這一基於百分比的下降是自2022年9月以來最大的。

Graph: US New Home Sales Number Trend

圖表:美國新房銷售數量趨勢

The median new house price fell 0.9% to $417,400 in May from a year ago. Nearly half of the new homes sold last month were priced under $399,000. The average rate on the popular 30-year fixed-rate mortgage reached a six-month high of 7.22% in early May before retreating to 7.03% by the end of the month, data from mortgage finance agency Freddie Mac showed.

5月,新房中位價格同比下降0.9%,至417,400美元。上個月出售的新房中有近一半售價低於39.9萬美元。房貸金融機構房地美數據顯示,流行的30年期固定房貸利率在5月初達到了6個月以來的最高點7.22%,其後回落至7.03%。

At May's sales pace it would take 9.3 months to clear the supply of houses on the market. That was the most months since November 2022 and up from 8.1 months in April.

按照5月的銷售步伐,市場上的住房供應需要9.3個月才能消化。這是自2022年11月以來最長的月份,也比4月的8.1個月增加了。

India's Gdp Growth Is Expected to Slow Modestly This Fiscal Year and Next

印度GDP增長預計在本財年和下一個財年都會略有放緩。

Forecasts for a mild slowdown in India's fast-growing economy held steady in the first Reuters poll of economists since the ruling Bharatiya Janata Party (BJP) lost its parliamentary majority in phased national elections that ended in early June.

自印度人民黨在6月初結束的全國選舉中失去議會多數派以來,第一次經濟學家的路透調查表明,印度快速增長的經濟將出現輕微放緩。

Asia's third-largest economy grew 8.2% in the last fiscal year, the fastest among major economies. But growth is set to slow to 7.0% and then 6.7% in the current and next fiscal years, according to a June 19-27 Reuters poll of over 50 economists.

亞洲第三大經濟體在上個財年增長了8.2%,是主要經濟體中增長最快的。然而,根據路透於6月19日至27日對50多名經濟學家的調查,增長率將在本財年和下個財年分別降至7.0%和6.7%。

US May Core Pce Increased by 2.6% as Expected

美國5月核心PCE同比增長2.6%,符合預期。

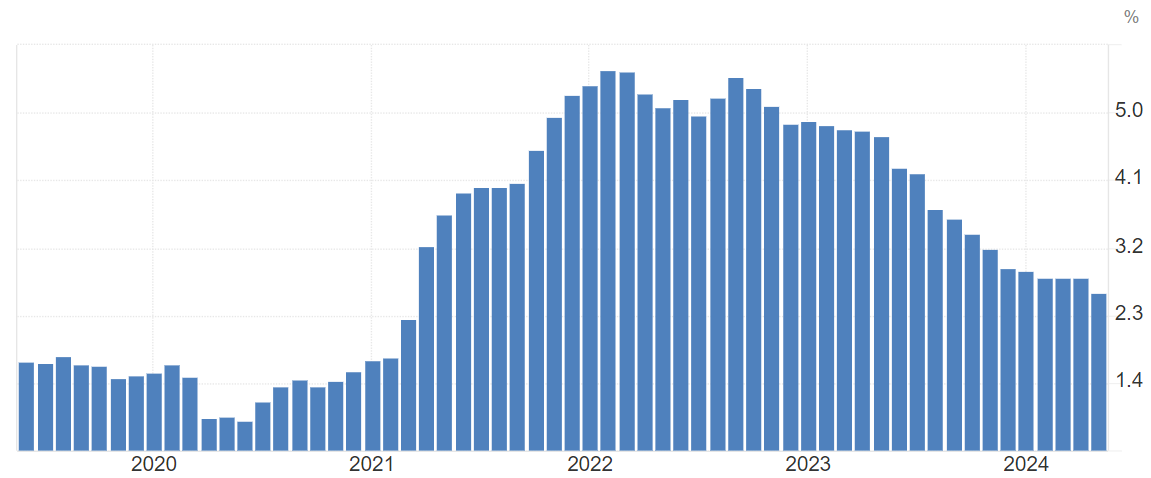

The annual PCE inflation rate in the US decreased to 2.6% in May 2024 from 2.7% in each of the previous two months, in line with market forecasts. The core PCE inflation gauge for the US economy also fell to 2.6% in May 2024, the lowest since March 2021, down from 2.8% in April and matching market forecasts.

美國PCE的年通脹率從前兩個月的2.7%降至2024年5月的2.6%,與市場預期一致。美國經濟的核心PCE通脹率也在2024年5月降至2.6%,自2021年3月以來最低,比4月份的2.8%下降,並符合市場預期。

Graph: US Core PCE Inflation Data

圖表:美國核心PCE通脹數據

Smart Money Flow

智能資金流

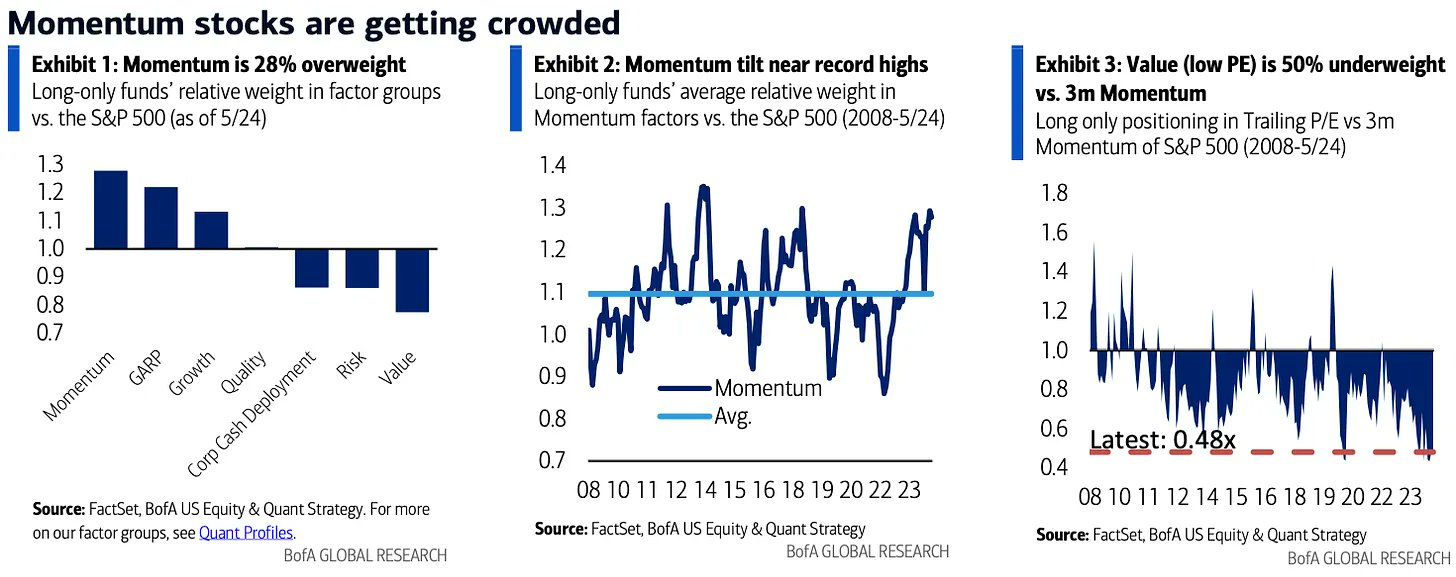

Momentum is now the most crowded factor group, where funds have shifted from a record low 14% underweight in 2022 to nearly 30% overweight today. Meanwhile, Value remains the most underweight group.

動量現在是最擁擠的因子組,基金已從2022年最低記錄的14%偏輕,轉變爲現在近30%偏股。而價值仍是最輕倉位的組合。

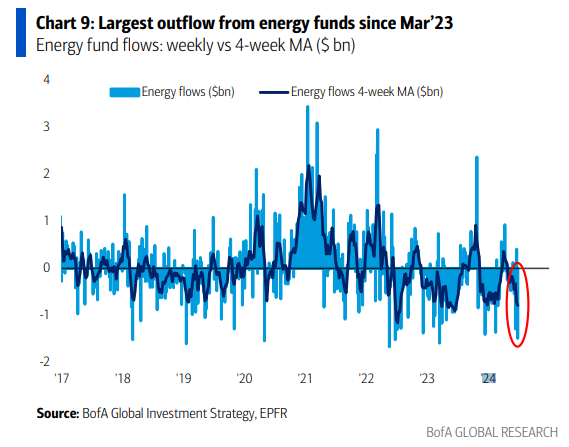

Largest weekly outflow from energy funds since Mar’23.

自Mar’23以來,能源基金的流出量創下了歷史新高。

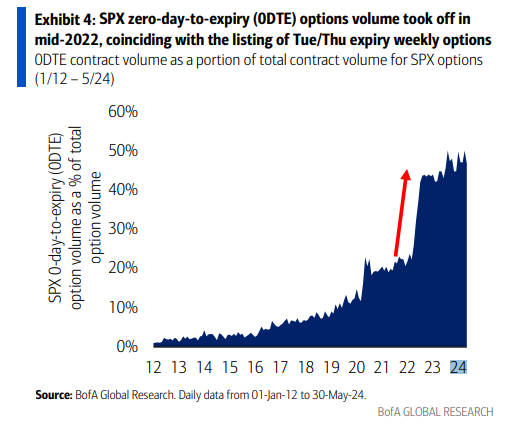

SPX 0DTE options have grown from ~10% of total SPX options volume pre-Covid, to~20% in 2021, to 45-50% so far in 2024.

SPX 0DTE期權已從Covid前的總SPX期權成交量的~10%增長至2021年的~20%,到目前爲止在2024年已達到45-50%。

Top Corporate News

頭條公司新聞

Apple's iPhone Shipments in China Surge 40% in May Amid Aggressive Discounting

在強力折扣推動下,蘋果在中國的iPhone出貨量在5月份增長了近40%,延續了4月份的反彈,中國政府附屬的研究機構中國信息通信研究院(CAICT)的數據顯示。

Apple's, opens new tab smartphone shipments in China rose nearly 40% in May from a year earlier, extending a rebound seen in April, data from a research firm affiliated with the Chinese government showed on Friday.

週五,一家與中國政府有關的研究公司的數據顯示,蘋果在中國的智能手機出貨量同比增長近40%,延續了4月份的反彈。

Shipments of foreign-branded phones in China increased by 1.425 million in May to 5.028 million units from 3.603 million a year earlier, calculations based on the data from the China Academy of Information and Communications Technology (CAICT) showed.

根據由中國信息通信技術研究院(CAICT)提供的數據估算,中國外品牌手機的出貨量從去年同期的3,603萬臺增至5,028萬臺,較去年增加1,425萬臺。

Nike Tumbles on Sales Warning as Rival Adidas Pushes Ahead

隨着競爭對手阿迪達斯繼續推進,耐克的股價下跌。該公司預測,本財年其營收將下降中個位數,未達到分析師預測的2%上升。這一展望未達到市場預期,引發了對需求減弱和來自On、Hoka和阿迪達斯等品牌的競爭加劇的擔憂。此舉導致股價在盤前交易中下跌16%,市值蒸發了超過220億美元。如果這種下降趨勢持續下去,耐克將面臨自2020年3月以來最大程度的下跌,擴大上一年所經歷的17%的下降。

Nike Inc.'s shares plummeted, as the company projected a mid-single-digit revenue drop for the current fiscal year, defying analysts' forecasts of a 2% increase. This outlook, falling short of market expectations, has fueled concerns about diminishing demand and rising competition from brands like On, Hoka, and Adidas AG. In response, shares tumbled by 16% in premarket trading, erasing over $22 billion in market value. Should this downward trend persist, Nike is on track for its most significant decline since March 2020, exacerbating the 17% decrease experienced over the previous year.

預期收入下降,耐克公司的股價暴跌。該公司預測,本財年其營收將下降中個位數,未達到分析師預測的2%的增長。這一預期未達到市場預期,引發了關於需求下降和來自On、Hoka和阿迪達斯等品牌競爭加劇的擔憂,股價在盤前交易中下跌了16%,市值蒸發了超過220億美元。如果這種下降趨勢持續下去,耐克將面臨自2020年3月以來最大程度的下跌,擴大上一年所經歷的17%的下降。

Micron Shares Slide After Revenue Forecast Fails to Top Estimates

Micron的股價在營收預測未能超過預期後下滑。

Despite Micron reporting stronger-than-anticipated fiscal third-quarter results with an adjusted earnings per share of 62 cents over the expected 51 cents, and revenue of $6.81 billion surpassing the $6.67 billion forecast, shares declined by roughly 7% in extended trading on Wednesday. The drop was attributed to investors' reactions to the company's revenue guidance for the current quarter, which, at $7.6 billion, aligned with analysts' predictions, without exceeding them. Micron, a key player in computer memory and storage riding the wave of the artificial intelligence surge, anticipates adjusted earnings per share of $1.08, closely matching analysts' expectations of $1.05. Over the past year, Micron's shares have more than doubled, bolstered by the demand for its advanced memory crucial for AI GPUs, such as those developed by Nvidia, enabling the company to capitalize on the burgeoning need for AI technologies like OpenAI's ChatGPT.

美光公司發佈了第三財季業績,表現比預期強勁,調整後每股收益爲62美分,高於預期的51美分,營收爲68.1億美元,超過預期的66.7億美元。然而,週三盤後,該公司的股價下跌了近7%。此次下跌歸因於投資者對公司對於當前季度的營收指導的反應,預計爲76億美元,與分析師的預測相符,並未超出。作爲計算機內存和存儲領域的重要參與者,美光公司正在乘上人工智能浪潮的浪頭並獲得發展。該公司預計調整後每股收益爲1.08美元,與分析師的預期基本相符。過去一年,受其在人工智能圖形處理器中使用的先進內存方案所需求,在Nvidia等公司的帶動下,美光公司的股價翻了一番以上,從而能夠利用對話機器人GPT-3等人工智能技術迅猛增長的需求賺取利潤。

Carnival Stock Breaks Out As 2025 Bookings Already Top Full Year 2024

嘉年華郵輪的股票突破上漲,預測2025年的預訂已超過2024年的全年預訂。

Carnival Corporation reported a turnaround with an adjusted profit of 11 cents per share, beating the expected 1 cent loss and recording $5.78 billion in revenue, surpassing estimates. The company's bookings for 2025 are already outpacing 2024, with higher prices and occupancy. Carnival raised its 2024 income forecast to $1.55 billion, above analyst expectations, and projects a 35% increase in Q3 adjusted net income to $1.58 billion, just above forecasts.

嘉年華公司公佈業績,調整後每股盈利爲11美分,超出預期的1美分虧損,並創下5.78億美元的高收入,超過了市場預估。公司預訂的2025年預訂已經超過2024年,價格和出租率都要更高。嘉年華將其2024年收入預測升至15.5億美元,高於分析師的預期,預計第三季度調整後的淨收入將增長35%至15.8億美元,略高於預期。

FedEx Stock Soars on Better-Than-Expected Earnings Driven By Cost Cutting

聯邦快遞公佈業績,超過預期,節省成本帶動收益增長,該公司的股價在盤後交易中出現了高漲。本財季收入達到221億美元,超出分析師的預期。本季度淨收入爲14.7億美元,每股攤薄收益爲5.94美元,雖然較去年略有下降,但仍超出分析師的預期。調整收益同比增長近10%,達到每股5.41美元。今年全年聯邦快遞的收入雖有所下降,但淨收入卻攀升至44億美元,超過了上一個財政年度的結果和分析師的預測。

FedEx reported a robust fiscal fourth quarter with revenue rising to $22.1 billion, exceeding analysts' expectations and contributing to a share price surge in extended trading. The company's net income for the quarter was $1.47 billion, or $5.94 per diluted share, a slight decrease from the previous year but still above projections. Adjusted earnings saw a near 10% increase to $5.41 per share. Over the full year, FedEx's revenue dipped to $87.7 billion, yet net income climbed to $4.33 billion, surpassing both the previous fiscal year's results and analyst forecasts.

聯邦快遞公佈了強勁的第四季度業績,收入增長至221億美元,超出分析師的預期,並在盤後交易中帶動股價大幅上漲。該季度淨收入爲14.7億美元,或每股攤薄收益5.94美元,雖然較上一年略有下降,但仍高於預期。調整後的收益同比增長近10%,達到每股5.41美元。今年全年聯邦快遞的收入雖有所下降,但淨收入攀升至43.3億美元,超過了上一個財政年度的結果及分析師的預測。

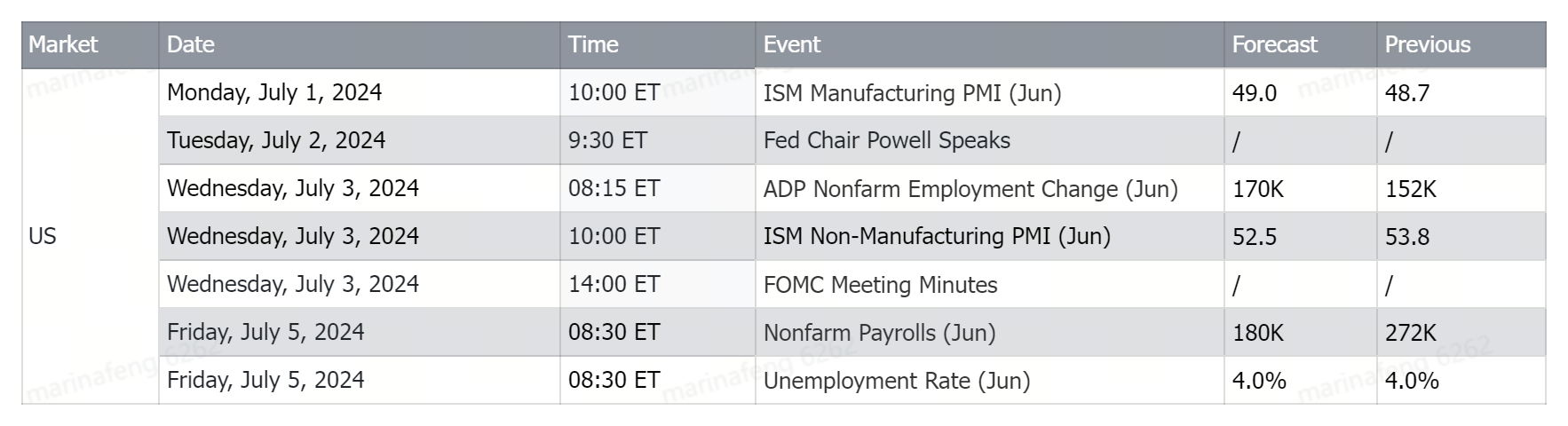

Upcoming Economic Data

免責聲明:本演示僅供信息和教育目的;不是任何特定投資或投資策略的建議或認可。在此提供的投資信息具有一般性質,僅供說明目的,並可能不適合所有投資者。它是在沒有考慮個人投資者的財務知識水平、財務狀況、投資目標、投資時間範圍或風險承受能力的情況下提供的。在做出任何投資決策之前,您應考慮此信息是否適合您的相關個人情況。過去的投資業績並不表明或保證未來的成功。收益將有所不同,所有投資都存在風險,包括本金損失。

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

moomoo 是由 Moomoo Technologies Inc 提供的一款金融信息和交易應用程序,在美國,Moomoo Financial Inc 爲投資者提供投資產品和服務,爲 FINRA/SIPC 的成員。

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

Moomoo 是由 Moomoo Technologies Inc 提供的一款金融信息和交易應用程序,在美國,Moomoo Financial Inc 爲投資者提供投資產品和服務,爲 FINRA/SIPC 的成員。