Smart Money Is Betting Big In GME Options

Smart Money Is Betting Big In GME Options

Financial giants have made a conspicuous bullish move on GameStop. Our analysis of options history for GameStop (NYSE:GME) revealed 13 unusual trades.

金融巨頭對GameStop採取了引人注目的看漲策略。我們對GameStop (NYSE:GME)期權歷史進行分析,發現了13次不尋常的交易。

Delving into the details, we found 46% of traders were bullish, while 30% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $167,000, and 11 were calls, valued at $435,120.

深入分析後,我們發現46%的交易者看漲,而30%表現出看跌的傾向。我們發現所有交易中有2次是看跌期權,價值167,000美元,而11次是看漲期權,價值435,120美元。

Expected Price Movements

預期價格波動

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $20.0 to $30.0 for GameStop during the past quarter.

分析這些合同的成交量和持倉量,似乎大型機構已經在過去一個季度內將GameStop的股票價格視爲20.0到30.0美元之間的價位範圍。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

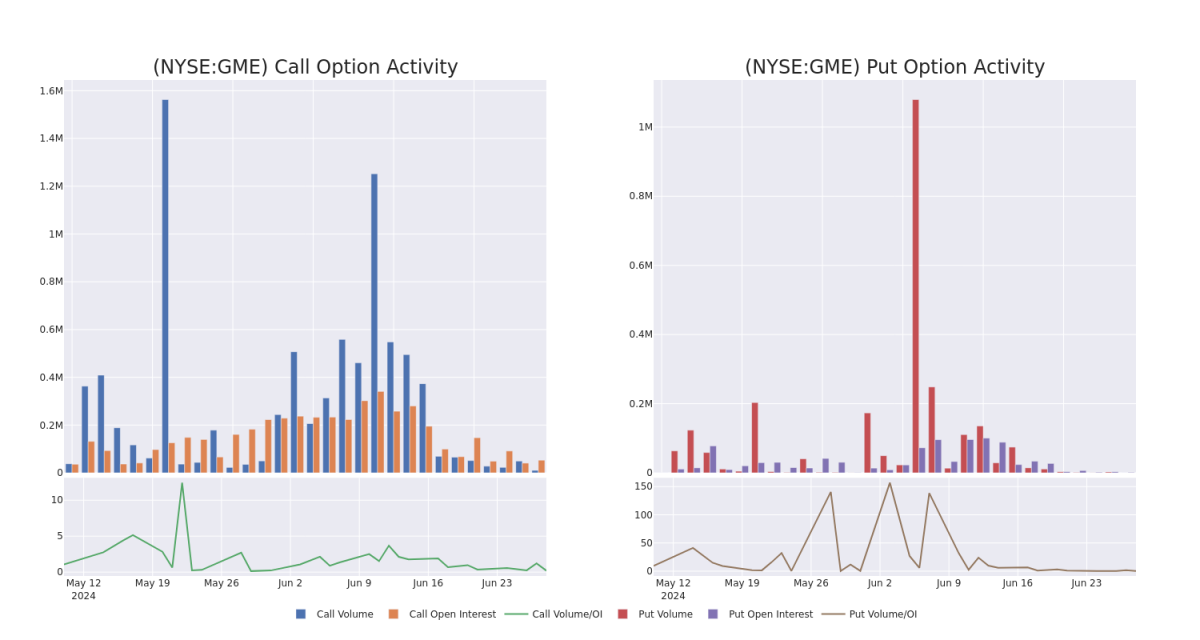

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in GameStop's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to GameStop's substantial trades, within a strike price spectrum from $20.0 to $30.0 over the preceding 30 days.

評估成交量和持倉量是期權交易的戰略步驟。這些指標揭示了在特定執行價格下,GameStop期權的流動性和投資者興趣。即將公佈的數據可視化了過去30天內從20.0到30.0美元的執行價格範圍內與GameStop的實質交易相關聯的看漲期權和看跌期權的成交量和持倉量波動。

GameStop 30-Day Option Volume & Interest Snapshot

遊戲驛站30天期權成交量和持倉量快照

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | PUT | TRADE | BEARISH | 01/16/26 | $14.0 | $13.75 | $13.99 | $30.00 | $139.9K | 649 | 81 |

| GME | CALL | TRADE | BULLISH | 06/28/24 | $5.15 | $4.85 | $5.15 | $20.00 | $77.2K | 4.1K | 77 |

| GME | CALL | SWEEP | BEARISH | 01/17/25 | $9.1 | $8.6 | $8.76 | $25.00 | $65.6K | 2.4K | 39 |

| GME | CALL | SWEEP | BULLISH | 06/28/24 | $0.67 | $0.66 | $0.67 | $25.00 | $40.3K | 19.5K | 2.1K |

| GME | CALL | TRADE | NEUTRAL | 01/17/25 | $10.35 | $8.9 | $9.53 | $22.00 | $36.2K | 171 | 0 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | 看跌 | 交易 | 看淡 | 01/16/26 | $14.0 | $13.75 | $13.99 | $30.00 | $139.9K | 649 | 81 |

| GME | 看漲 | 交易 | 看好 | 06/28/24 | $5.15 | $4.85 | $5.15 | $20.00 | $77.2K | 4.1K | 77 |

| GME | 看漲 | SWEEP | 看淡 | 01/17/25 | $9.1 | $8.6美元 | $8.76 | $25.00 | $65.6K | 2.4K | 39 |

| GME | 看漲 | SWEEP | 看好 | 06/28/24 | $0.67 | $0.66 | $0.67 | $25.00 | $40.3K | 19.5K | 2.1K |

| GME | 看漲 | 交易 | 中立 | 01/17/25 | $10.35 | $8.9 | $9.53 | $22.00 | 36200美元 | 171 | 0 |

About GameStop

關於遊戲驛站

GameStop Corp is a U.S. multichannel video game, consumer electronics, and services retailer. The company operates across Europe, Canada, Australia, and the United States. GameStop sells new and second-hand video game hardware, physical and digital video game software, and video game accessories, mainly through GameStop, EB Games, and Micromania stores and international e-commerce sites. The majority of sales are from the United States.

遊戲驛站公司是一家美國多渠道視頻遊戲、消費電子和服務零售商,在歐洲、加拿大、澳大利亞和美國均有業務。遊戲驛站通過遊戲驛站、EB Games和Micromania商店以及國際電商網站銷售新舊視頻遊戲硬件、實體和數字視頻遊戲軟件和視頻遊戲配件,銷售的大部分來自美國。

After a thorough review of the options trading surrounding GameStop, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

經過對圍繞GameStop的期權交易的全面審查,我們轉而更詳細地審查該公司。其中包括對其當前的市場狀態和表現進行評估。

GameStop's Current Market Status

GameStop目前的市場狀況

- Trading volume stands at 12,577,570, with GME's price down by -0.36%, positioned at $25.0.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 68 days.

- 交易量爲12,577,570股,GME的價格下跌了-0.36%,位於25.0美元。

- RSI指標顯示該股票可能接近超買。

- 預計68天內公佈盈利報告。

Expert Opinions on GameStop

專家對GameStop的看法

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $11.0.

過去30天中共有1位專業分析師對該股票發表了意見,並設定了平均價格目標爲11.0美元。

- An analyst from Wedbush has decided to maintain their Underperform rating on GameStop, which currently sits at a price target of $11.

- Wedbush的一位分析師決定維持他們對GameStop的跑輸大盤評級,目前的價格目標爲11.0美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest GameStop options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在回報。精明的交易者通過不斷地自我教育、調整他們的策略、監視多個因子並密切關注市場變動來管理這些風險。通過本站實時提醒了解最新的GameStop期權交易。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in GameStop's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to GameStop's substantial trades, within a strike price spectrum from $20.0 to $30.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in GameStop's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to GameStop's substantial trades, within a strike price spectrum from $20.0 to $30.0 over the preceding 30 days.