What the Options Market Tells Us About Deere

What the Options Market Tells Us About Deere

Whales with a lot of money to spend have taken a noticeably bearish stance on Deere.

Looking at options history for Deere (NYSE:DE) we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 8% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $195,770 and 7, calls, for a total amount of $217,158.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $370.0 and $480.0 for Deere, spanning the last three months.

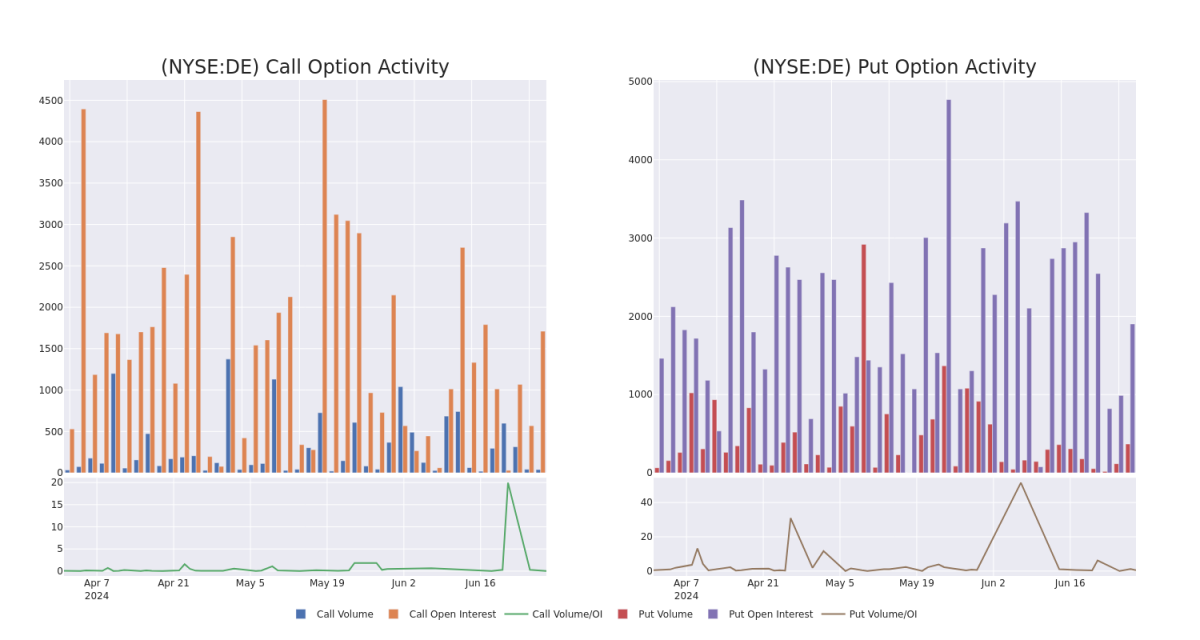

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Deere's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Deere's significant trades, within a strike price range of $370.0 to $480.0, over the past month.

Deere Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DE | PUT | SWEEP | BEARISH | 07/19/24 | $4.0 | $3.75 | $4.0 | $370.00 | $68.0K | 1.3K | 15 |

| DE | CALL | SWEEP | BULLISH | 03/21/25 | $16.0 | $15.3 | $16.0 | $430.00 | $46.4K | 347 | 0 |

| DE | PUT | TRADE | BEARISH | 07/19/24 | $4.25 | $3.75 | $4.05 | $370.00 | $40.5K | 1.3K | 348 |

| DE | CALL | SWEEP | BEARISH | 06/20/25 | $24.9 | $23.85 | $23.85 | $420.00 | $35.9K | 96 | 4 |

| DE | PUT | TRADE | NEUTRAL | 01/16/26 | $68.85 | $61.0 | $64.3 | $430.00 | $32.1K | 27 | 0 |

About Deere

Deere is the world's leading manufacturer of agricultural equipment, producing some of the most recognizable machines in the heavy machinery industry in their green and yellow livery. The company is divided into four reportable segments: production and precision agriculture, small agriculture and turf, construction and forestry, and John Deere Capital. Its products are available through an extensive dealer network, which includes over 2,000 dealer locations in North America and approximately 3,700 locations globally. John Deere Capital provides retail financing for machinery to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Deere product sales.

Following our analysis of the options activities associated with Deere, we pivot to a closer look at the company's own performance.

Current Position of Deere

- Currently trading with a volume of 1,239,225, the DE's price is up by 0.87%, now at $378.6.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 49 days.

Professional Analyst Ratings for Deere

In the last month, 2 experts released ratings on this stock with an average target price of $407.5.

- In a cautious move, an analyst from Raymond James downgraded its rating to Outperform, setting a price target of $420.

- In a cautious move, an analyst from Citigroup downgraded its rating to Neutral, setting a price target of $395.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Deere options trades with real-time alerts from Benzinga Pro.