Behind the Scenes of Walmart's Latest Options Trends

Behind the Scenes of Walmart's Latest Options Trends

Financial giants have made a conspicuous bullish move on Walmart. Our analysis of options history for Walmart (NYSE:WMT) revealed 13 unusual trades.

金融巨頭對沃爾瑪採取了明顯的看好動作。我們對沃爾瑪(NYSE:WMT)期權歷史的分析發現了13個不尋常的交易。

Delving into the details, we found 46% of traders were bullish, while 46% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $163,618, and 8 were calls, valued at $653,660.

深入細節,我們發現46%的交易者看好,而46%顯示出看淡的趨勢。我們發現所有的交易中,有5種是看跌期權,價值爲163,618美元,有8種是看漲期權,價值爲653,660美元。

Expected Price Movements

預期價格波動

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $50.0 to $75.0 for Walmart during the past quarter.

分析這些合約的成交量和持倉量,似乎大玩家們在過去一個季度裏一直在關注沃爾瑪50.0美元到75.0美元的價格區間。

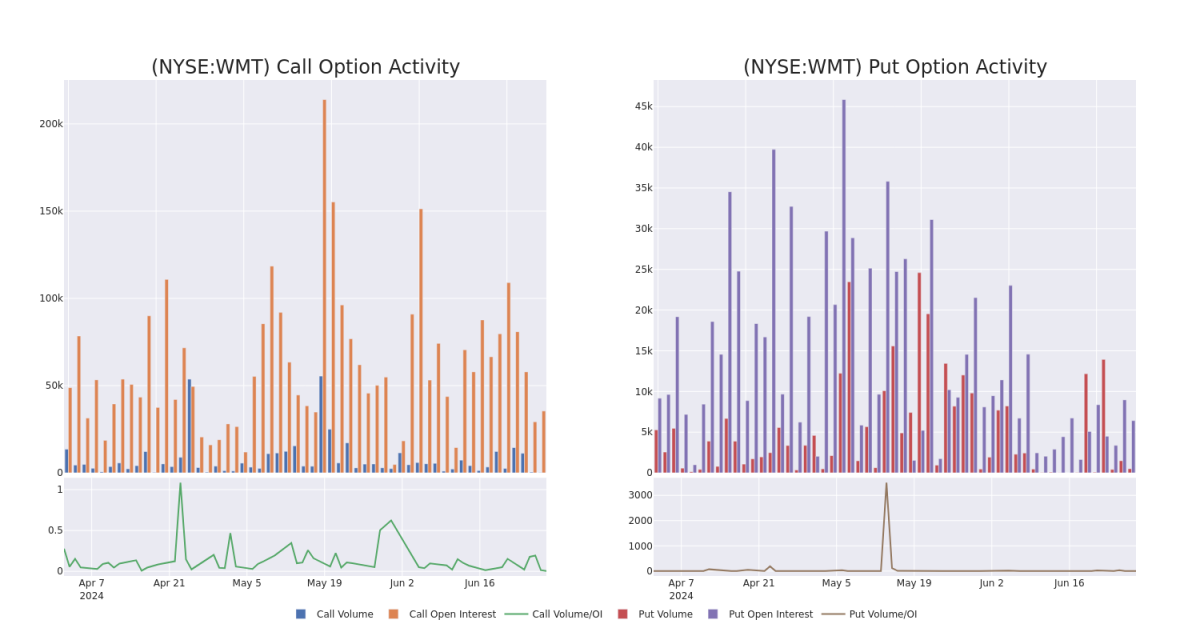

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Walmart's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Walmart's significant trades, within a strike price range of $50.0 to $75.0, over the past month.

審查成交量和持倉量爲股票研究提供了關鍵的見解。這些信息對於在特定行權價格下評估沃爾瑪期權的流動性和利益水平至關重要。以下是我們介紹的一個快照,顯示過去一個月內,在50.0美元到75.0美元之間的行權價範圍內,沃爾瑪看跌期權和看漲期權的成交和持倉量趨勢。

Walmart Option Volume And Open Interest Over Last 30 Days

沃爾瑪期權成交量和持倉量在過去30天內

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WMT | CALL | TRADE | BULLISH | 01/17/25 | $16.35 | $15.7 | $16.35 | $53.33 | $163.5K | 13.3K | 0 |

| WMT | CALL | TRADE | BEARISH | 01/17/25 | $9.9 | $9.75 | $9.8 | $60.00 | $119.5K | 6.2K | 11 |

| WMT | CALL | TRADE | BEARISH | 09/20/24 | $0.66 | $0.64 | $0.64 | $73.33 | $102.4K | 4.5K | 56 |

| WMT | CALL | TRADE | BULLISH | 07/05/24 | $8.65 | $8.5 | $8.6 | $59.00 | $68.8K | 12 | 15 |

| WMT | CALL | TRADE | NEUTRAL | 06/28/24 | $8.75 | $8.4 | $8.55 | $59.00 | $68.4K | 138 | 15 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WMT | 看漲 | 交易 | 看好 | 01/17/25 | $16.35 | 15.7 | $16.35 | $53.33 | $163.5K | 13.3千 | 0 |

| WMT | 看漲 | 交易 | 看淡 | 01/17/25 | $9.9 | $9.75 | $9.8 | $60.00 | $119.5K | 6.2千 | 11 |

| WMT | 看漲 | 交易 | 看淡 | 09/20/24 | $0.66 | $0.64 | $0.64 | $73.33 | $102.4K | 4.5K | 56 |

| WMT | 看漲 | 交易 | 看好 | 07/05/24 | $ 8.65 | $8.5 | $8.6美元 | $59.00 | $68.8K | 12 | 15 |

| WMT | 看漲 | 交易 | 中立 | 06/28/24 | $8.75 | $8.4 | $8.55 | $59.00 | 68,400美元 | 138 | 15 |

About Walmart

關於沃爾瑪

Walmart serves as the preeminent retailer in the United States, with its strategy predicated on superior operating efficiency and offering the lowest priced goods to consumers to drive robust store traffic and product turnover. Walmart augmented its low-price business strategy by offering a convenient one-stop shopping destination with the opening of its first supercenter in 1988.Today, Walmart operates over 4,600 stores in the United States (5,200 including Sam's Club) and over 10,000 stores globally. Walmart generated over $440 billion in domestic namesake sales in fiscal 2024, with Sam's Club contributing another $86 billion to the firm's top line. Internationally, Walmart generated $115 billion in sales. The retailer serves around 240 million customers globally each week.

沃爾瑪是美國卓越的零售商,其業務策略建立在卓越的運營效率和提供給消費者最低價格的商品以推動強勁的店鋪流量和產品週轉上。沃爾瑪通過在1988年開設第一家超市來增加其低價業務策略,以提供方便的一站式購物場所。如今,沃爾瑪在美國擁有超過4,600家門店(包括薩姆會員店)和全球超過10,000家門店。沃爾瑪在2024財年在國內名牌銷售額超過4400億美元,薩姆俱樂部爲公司貢獻了860億美元的營業收入,在國際上實現了1,150億美元的銷售額,並每週爲全球約2.4億客戶提供服務。

Where Is Walmart Standing Right Now?

沃爾瑪當前處於何種地位?

- Currently trading with a volume of 6,772,956, the WMT's price is down by -0.56%, now at $67.5.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 48 days.

- 目前交易量爲6,772,956股,WMT的價格下跌了-0.56%,現在爲67.5美元。

- RSI讀數表明該股目前可能接近超買水平。

- 預計發佈收益爲48天后。

What The Experts Say On Walmart

專家對沃爾瑪的評價

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $76.2.

在過去的一個月中,有5位行業分析師分享了他們對這隻股票的見解,提出了76.2美元的平均目標價格。

- An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Walmart, which currently sits at a price target of $73.

- An analyst from Telsey Advisory Group has decided to maintain their Outperform rating on Walmart, which currently sits at a price target of $75.

- An analyst from Oppenheimer persists with their Outperform rating on Walmart, maintaining a target price of $75.

- An analyst from Jefferies has decided to maintain their Buy rating on Walmart, which currently sits at a price target of $77.

- In a positive move, an analyst from JP Morgan has upgraded their rating to Overweight and adjusted the price target to $81.

- Evercore ISI Group的一位分析師決定維持對沃爾瑪的跑贏行業評級,目前的價格目標爲73美元。

- 一位來自泰西諮詢集團的分析師決定維持他們對沃爾瑪的跑贏大盤評級,目前的價格目標爲75美元。

- Oppenheimer的一位分析師堅持對沃爾瑪持續跑贏大市評級,維持目標價爲75美元。

- Jefferies的一位分析師決定維持對沃爾瑪的買入評級,目前的價格目標爲77美元。

- 積極的是,摩根大通的一個分析師已將其評級升級爲股票增持,並將價格目標調整爲81美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Walmart options trades with real-time alerts from Benzinga Pro.

期權交易帶來了更高的風險和潛在的回報。精明的交易者通過不斷學習、調整策略、監控多種指標並密切關注市場動態來管理這些風險。通過Benzinga Pro獲得最新的沃爾瑪期權交易的實時警報,保持關注。