Deckers Outdoor Options Trading: A Deep Dive Into Market Sentiment

Deckers Outdoor Options Trading: A Deep Dive Into Market Sentiment

Financial giants have made a conspicuous bullish move on Deckers Outdoor. Our analysis of options history for Deckers Outdoor (NYSE:DECK) revealed 8 unusual trades.

金融巨頭們在Deckers Outdoor股票上採取了明顯的看漲策略。我們分析了Deckers Outdoor (紐交所:DECK)的期權歷史,發現了8個不尋常的交易。

Delving into the details, we found 37% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $310,040, and 4 were calls, valued at $494,700.

進一步深入細節,我們發現37%的交易員看漲,37%的交易員看跌。在我們發現的所有交易中,有4個看跌期權,價值爲$310,040,有4個看漲期權,價值爲$494,700。

Expected Price Movements

預期價格波動

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $980.0 to $1040.0 for Deckers Outdoor over the last 3 months.

考慮到這些合約的成交量和持倉量,看起來過去3個月裏鯨魚們一直在瞄準Deckers Outdoor的價格區間爲$980.0至$1040.0。

Insights into Volume & Open Interest

成交量和持倉量分析

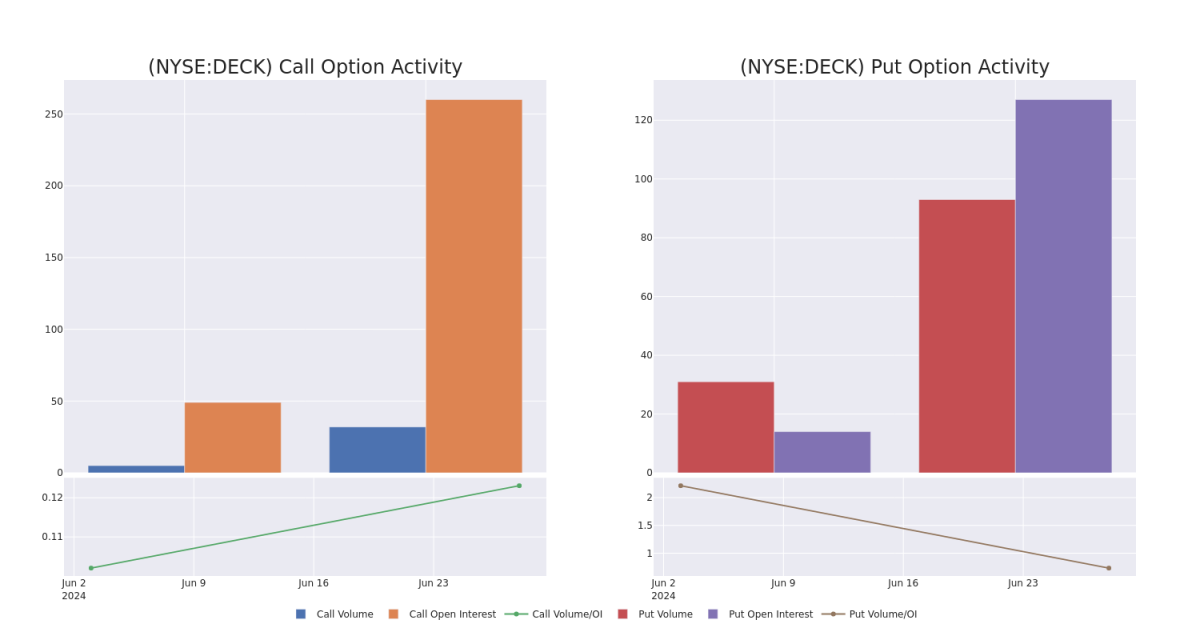

In terms of liquidity and interest, the mean open interest for Deckers Outdoor options trades today is 96.75 with a total volume of 125.00.

就流動性和利益而言 ,Deckers Outdoor期權交易的平均持倉量爲96.75,總成交量爲125.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Deckers Outdoor's big money trades within a strike price range of $980.0 to $1040.0 over the last 30 days.

在下面的圖表中,我們可以跟蹤過去30天內,在$980.0至$1040.0的行權價格範圍內,Deckers Outdoor的看漲和看跌期權的成交量和持倉量的情況。

Deckers Outdoor Option Volume And Open Interest Over Last 30 Days

過去30天內Deckers Outdoor期權成交量和持倉量情況

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DECK | CALL | SWEEP | BULLISH | 12/20/24 | $95.0 | $92.0 | $95.0 | $1030.00 | $209.0K | 31 | 0 |

| DECK | CALL | SWEEP | NEUTRAL | 07/19/24 | $21.0 | $17.6 | $19.0 | $1000.00 | $155.8K | 167 | 10 |

| DECK | CALL | SWEEP | BULLISH | 12/20/24 | $96.0 | $94.0 | $96.0 | $1030.00 | $96.0K | 31 | 22 |

| DECK | PUT | TRADE | BEARISH | 07/19/24 | $56.0 | $53.6 | $56.0 | $1040.00 | $95.2K | 127 | 3 |

| DECK | PUT | TRADE | BULLISH | 07/19/24 | $77.9 | $73.0 | $74.84 | $1040.00 | $74.8K | 127 | 40 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DECK | 看漲 | SWEEP | 看好 | 12/20/24 | 95.0美元 | $92.0 | 95.0美元 | $1030.00 | $209.0K | 31 | 0 |

| DECK | 看漲 | SWEEP | 中立 | 07/19/24 | $21.0 | $17.6 | $19.0 | $1000.00 | $155.8K | 167 | 10 |

| DECK | 看漲 | SWEEP | 看好 | 12/20/24 | $96.0 | $94.0 | $96.0 | $1030.00 | $96.0K | 31 | 22 |

| DECK | 看跌 | 交易 | 看淡 | 07/19/24 | 56.0美元 | $53.6 | 56.0美元 | $1040.00 | $95.2K | 127 | 3 |

| DECK | 看跌 | 交易 | 看好 | 07/19/24 | $77.9 | $73.0 | $74.84 | $1040.00 | $74.8K | 127 | 40 |

About Deckers Outdoor

關於Deckers Outdoor

Deckers Outdoor Corp designs and sells casual and performance footwear, apparel, and accessories. Primary brands include UGG, Teva, and Sanuk. The company distributes Majority of its products through its wholesale business, but it also has a substantial direct-to-consumer business with its company-owned retail stores and websites. Majority of its sales are in the United States, although the company also has retail stores and distributors throughout Europe, Asia, Canada, and Latin America. It has structured their reporting around six segments which inlcudes the wholesale operations of specific brands like UGG, HOKA, Teva, Sanuk, and Other brands, alongside a segment focused on direct-to-consumer (DTC) operations.

Deckers Outdoor Corp設計和銷售休閒和運動鞋類、服裝和配件。主要品牌包括UGG、Teva和Sanuk。公司將大部分產品通過批發業務分銷出去,但也通過其自營零售店和網站擁有實質性的直接消費者業務。其銷售的大部分產品在美國,儘管該公司在歐洲、亞洲、加拿大和拉丁美洲也擁有零售店和經銷商。公司圍繞六個板塊進行報告,其中包括特定品牌(如UGG、HOKA、Teva、Sanuk和其他品牌)的批發業務,以及集中於直接消費者(DTC)業務的板塊。

Where Is Deckers Outdoor Standing Right Now?

Deckers Outdoor現在處於什麼位置?

- Currently trading with a volume of 196,611, the DECK's price is down by -3.03%, now at $969.62.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 27 days.

- 目前交易量爲196,611,DECK的價格下跌了-3.03%,現在爲$969.62。

- RSI讀數表明該股票目前可能被超賣。

- 預期的盈利發佈還有27天。

What The Experts Say On Deckers Outdoor

專家對Deckers Outdoor的看法如何?

In the last month, 1 experts released ratings on this stock with an average target price of $1200.0.

在過去的一個月裏,有1位分析師對該股票發佈了評級,平均目標價格爲$1200.0。

- Consistent in their evaluation, an analyst from BTIG keeps a Buy rating on Deckers Outdoor with a target price of $1200.

- 在評估上保持一貫,BTIG的一位分析師對Deckers Outdoor給予買入評級,目標價格爲$1200.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Deckers Outdoor options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在收益。精明的交易者通過持續教育自己、調整其策略、監控多個因子並密切關注市場動向來管理這些風險。通過來自Benzinga Pro的實時警報了解最新的deckers outdoor期權交易信息。