United Company RUSAL, International Public Joint-Stock Company's (HKG:486) Popularity With Investors Is Under Threat From Overpricing

United Company RUSAL, International Public Joint-Stock Company's (HKG:486) Popularity With Investors Is Under Threat From Overpricing

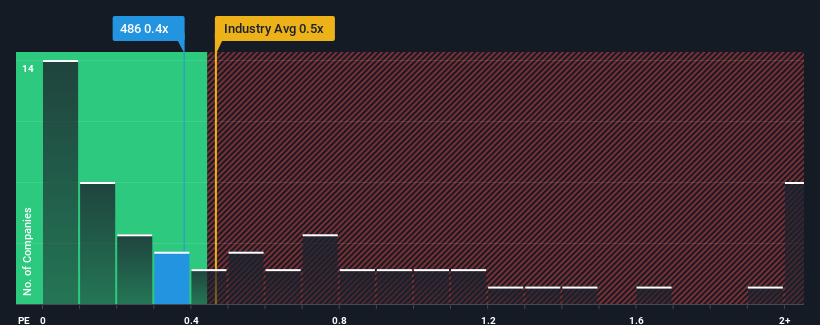

There wouldn't be many who think United Company RUSAL, International Public Joint-Stock Company's (HKG:486) price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S for the Metals and Mining industry in Hong Kong is similar at about 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does United Company RUSAL International's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, United Company RUSAL International's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on United Company RUSAL International.Is There Some Revenue Growth Forecasted For United Company RUSAL International?

The only time you'd be comfortable seeing a P/S like United Company RUSAL International's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. Even so, admirably revenue has lifted 43% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 5.4% over the next year. Meanwhile, the rest of the industry is forecast to expand by 13%, which is noticeably more attractive.

With this in mind, we find it intriguing that United Company RUSAL International's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given that United Company RUSAL International's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

You need to take note of risks, for example - United Company RUSAL International has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com