- 要聞

- 利源股份股價下跌26%(股票代碼SZSE:002501),但仍物有所值。

With A 26% Price Drop For Jilin Liyuan Precision Manufacturing Co., Ltd. (SZSE:002501) You'll Still Get What You Pay For

With A 26% Price Drop For Jilin Liyuan Precision Manufacturing Co., Ltd. (SZSE:002501) You'll Still Get What You Pay For

Jilin Liyuan Precision Manufacturing Co., Ltd. (SZSE:002501) shares have had a horrible month, losing 26% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 28% in that time.

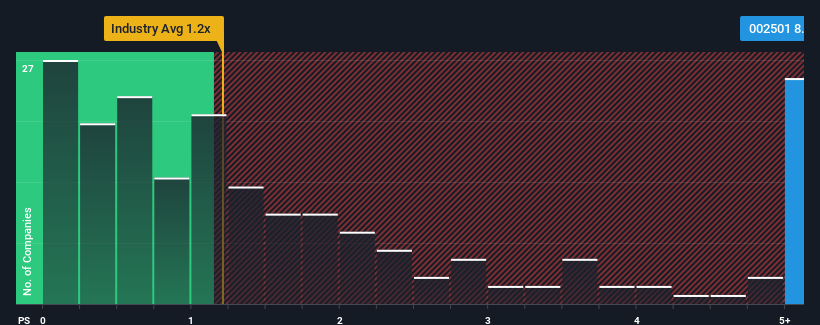

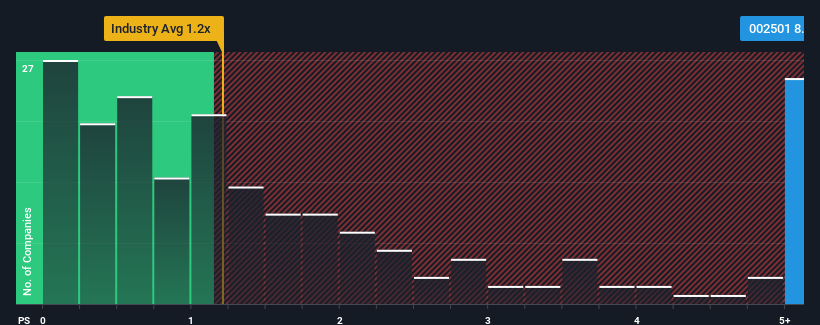

Even after such a large drop in price, when almost half of the companies in China's Metals and Mining industry have price-to-sales ratios (or "P/S") below 1.2x, you may still consider Jilin Liyuan Precision Manufacturing as a stock not worth researching with its 8.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Has Jilin Liyuan Precision Manufacturing Performed Recently?

For instance, Jilin Liyuan Precision Manufacturing's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Jilin Liyuan Precision Manufacturing will help you shine a light on its historical performance.How Is Jilin Liyuan Precision Manufacturing's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Jilin Liyuan Precision Manufacturing's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Jilin Liyuan Precision Manufacturing's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. Even so, admirably revenue has lifted 220% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 14% shows it's noticeably more attractive.

In light of this, it's understandable that Jilin Liyuan Precision Manufacturing's P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

A significant share price dive has done very little to deflate Jilin Liyuan Precision Manufacturing's very lofty P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Jilin Liyuan Precision Manufacturing revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

It is also worth noting that we have found 2 warning signs for Jilin Liyuan Precision Manufacturing (1 shouldn't be ignored!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

利源股份股票在之前一段時間表現良好,但是在最近的一個月中股價持續下跌,累計下跌26%。股價下跌嚴重影響了股東的利益,一年中股價下跌28%。

儘管利源股份的市銷率高達8.3倍,仍然有近一半的中國貴金屬礦業板塊公司的市銷率低於1.2倍,你可能認爲利源股份並不值得研究。不過,不能僅僅爲了市銷率就否定這支股票,因爲這種高市銷率的原因可能有解釋。

利源股份最近的表現如何?

利源股份最近的營業收入下降需要引起關注,因爲如果這個趨勢繼續下去,股東可能因買入股票時過高的市銷率而遭受損失。

想了解利源股份的收益、營業收入和現金流的全貌嗎?我們的免費報告將爲您展示其歷史業績。利源股份的營業收入增長趨勢如何?

一般而言,如果一個公司的市銷率像利源股份這樣高,就應該遠遠超過行業平均水平。

一般而言,如果一個公司的市銷率像利源股份這樣高,就應該遠遠超過行業平均水平。

利源股份的營業收入在過去一年中出現了明顯的下降,但是在此之前的三年中營業收入總體上增長了220%,儘管過去一年很不穩定,但公司的營收增長仍然足夠。

將最近的中期營收軌跡與行業的一年增長預測相比較,發現其更具吸引力。

考慮到這一點,利源股份的市銷率低於其他大多數公司是可以理解的。大多數投資者都預計這種高速增長會繼續下去,因此願意爲這支股票支付更高的價格。

重要提示

股票價格的大幅下跌並沒有過多影響利源股份的高市銷率。市銷率被認爲是某些行業價值的次要指標,但卻是一個強有力的商業情緒指標。

我們的研究表明,利源股份的營收增長潛力比行業預期更好,這是導致其市銷率居高不下的原因之一。目前股東對市銷率比較滿意,因爲他們相信公司的營收不會出現大問題。除非公司能力出現重大變化,否則股價應該會繼續得到支撐。

需要注意的是,我們發現利源股份有2個警示信號(1個不能忽視!)需要考慮。

當然,盈利良好,具有長期強勁盈利增長曆史的公司通常是較爲安全的選擇。因此,你可能希望查看這些具有合理市盈率和強勁盈利增長表現的其他公司的免費數據合集。

對本文有反饋?關於內容有所顧慮?直接和我們聯繫。或者,發送電子郵件至editorial-team (at) simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

對本文有反饋?關於內容有所顧慮?直接和我們聯繫。或者發送電子郵件至editorial-team@simplywallst.com。

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Moomoo Securities Australia Limited提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Moomoo Securities Australia Limited, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

風險及免責聲明

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Moomoo Securities Australia Limited提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Moomoo Securities Australia Limited, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用瀏覽器的分享功能,分享給你的好友吧