There's Reason For Concern Over Tango Therapeutics, Inc.'s (NASDAQ:TNGX) Massive 27% Price Jump

There's Reason For Concern Over Tango Therapeutics, Inc.'s (NASDAQ:TNGX) Massive 27% Price Jump

Tango Therapeutics, Inc. (NASDAQ:TNGX) shares have had a really impressive month, gaining 27% after a shaky period beforehand. The last month tops off a massive increase of 158% in the last year.

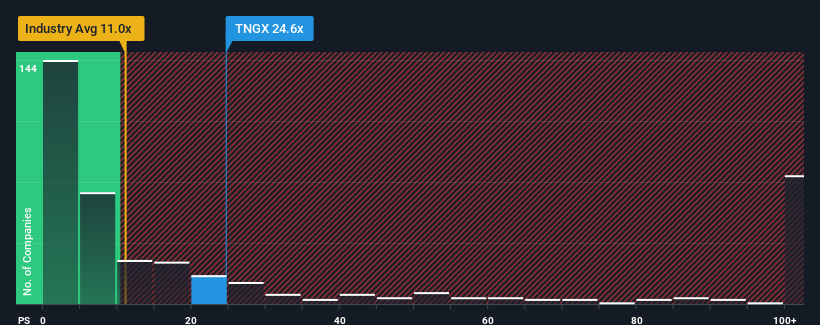

After such a large jump in price, Tango Therapeutics may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 24.6x, when you consider almost half of the companies in the Biotechs industry in the United States have P/S ratios under 11x and even P/S lower than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Tango Therapeutics' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Tango Therapeutics has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Tango Therapeutics will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Tango Therapeutics' is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 50%. The latest three year period has also seen an excellent 299% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 5.8% per year over the next three years. That's shaping up to be materially lower than the 199% per year growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Tango Therapeutics' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

Tango Therapeutics' P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It comes as a surprise to see Tango Therapeutics trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Tango Therapeutics (1 can't be ignored) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com