Micron Technology's Options: A Look at What the Big Money Is Thinking

Micron Technology's Options: A Look at What the Big Money Is Thinking

Whales with a lot of money to spend have taken a noticeably bearish stance on Micron Technology.

有很多錢可以花的鯨魚對美光科技採取了明顯的看跌立場。

Looking at options history for Micron Technology (NASDAQ:MU) we detected 11 trades.

查看美光科技(納斯達克股票代碼:MU)的期權歷史記錄,我們發現了11筆交易。

If we consider the specifics of each trade, it is accurate to state that 36% of the investors opened trades with bullish expectations and 54% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,36%的投資者以看漲的預期開盤,54%的投資者持看跌預期。

From the overall spotted trades, 4 are puts, for a total amount of $188,510 and 7, calls, for a total amount of $425,205.

在已發現的全部交易中,有4筆是看跌期權,總額爲188,510美元,7筆看漲期權,總額爲425,205美元。

Predicted Price Range

預測的價格區間

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $100.0 to $150.0 for Micron Technology over the recent three months.

根據交易活動,看來重要投資者的目標是在最近三個月中將美光科技的價格範圍從100.0美元擴大到150.0美元。

Volume & Open Interest Development

交易量和未平倉合約的發展

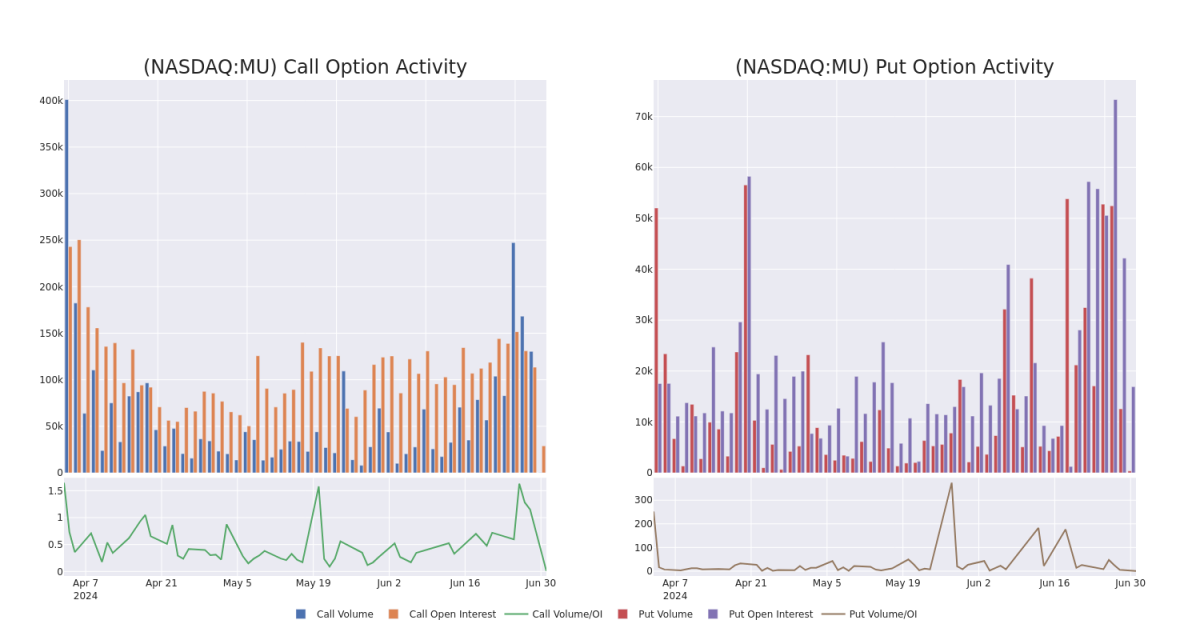

In today's trading context, the average open interest for options of Micron Technology stands at 4169.27, with a total volume reaching 547.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Micron Technology, situated within the strike price corridor from $100.0 to $150.0, throughout the last 30 days.

在今天的交易背景下,美光科技期權的平均未平倉合約爲4169.27,總成交量達到547.00。隨附的圖表描繪了過去30天美光科技高價值交易的看漲和看跌期權交易量以及未平倉合約的變化,行使價走勢從100.0美元到150.0美元不等。

Micron Technology Option Activity Analysis: Last 30 Days

美光科技期權活動分析:過去 30 天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MU | CALL | TRADE | BULLISH | 08/16/24 | $4.95 | $4.8 | $4.9 | $140.00 | $98.0K | 11.2K | 99 |

| MU | CALL | SWEEP | BEARISH | 07/05/24 | $2.67 | $2.53 | $2.56 | $131.00 | $77.5K | 1.0K | 72 |

| MU | CALL | SWEEP | BEARISH | 01/17/25 | $39.2 | $37.45 | $37.93 | $100.00 | $75.8K | 8.5K | 0 |

| MU | CALL | SWEEP | BULLISH | 07/26/24 | $4.65 | $4.6 | $4.65 | $134.00 | $73.0K | 522 | 9 |

| MU | PUT | SWEEP | BULLISH | 07/05/24 | $1.16 | $1.07 | $1.07 | $128.00 | $71.2K | 2.6K | 230 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 畝 | 打電話 | 貿易 | 看漲 | 08/16/24 | 4.95 美元 | 4.8 美元 | 4.9 美元 | 140.00 美元 | 98.0 萬美元 | 11.2K | 99 |

| 畝 | 打電話 | 掃 | 粗魯的 | 07/05/24 | 2.67 美元 | 2.53 美元 | 2.56 美元 | 131.00 美元 | 77.5 萬美元 | 1.0K | 72 |

| 畝 | 打電話 | 掃 | 粗魯的 | 01/17/25 | 39.2 美元 | 37.45 美元 | 37.93 美元 | 100.00 美元 | 75.8 萬美元 | 8.5K | 0 |

| 畝 | 打電話 | 掃 | 看漲 | 07/26/24 | 4.65 美元 | 4.6 美元 | 4.65 美元 | 134.00 美元 | 73.0 萬美元 | 522 | 9 |

| 畝 | 放 | 掃 | 看漲 | 07/05/24 | 1.16 美元 | 1.07 | 1.07 | 128.00 美元 | 71.2 萬美元 | 2.6K | 230 |

About Micron Technology

關於美光科技

Micron is one of the largest semiconductor companies in the world, specializing in memory and storage chips. Its primary revenue stream comes from dynamic random access memory, or DRAM, and it also has minority exposure to not-and or NAND, flash chips. Micron serves a global customer base, selling chips into data centers, mobile phones, consumer electronics, and industrial and automotive applications. The firm is vertically integrated.

美光是世界上最大的半導體公司之一,專門生產存儲和存儲芯片。它的主要收入來源來自動態隨機存取存儲器(DRAM),並且在非AND或NAND閃存芯片方面也佔少數份額。美光爲全球客戶群提供服務,向數據中心、手機、消費電子產品以及工業和汽車應用銷售芯片。該公司是垂直整合的。

Having examined the options trading patterns of Micron Technology, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了美光科技的期權交易模式之後,我們的注意力現在直接轉向了該公司。這種轉變使我們能夠深入研究其目前的市場地位和表現

Current Position of Micron Technology

美光科技的當前位置

- Trading volume stands at 1,435,473, with MU's price down by -0.09%, positioned at $131.41.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 86 days.

- 交易量爲1,435,473美元,其中MU的價格下跌了-0.09%,爲131.41美元。

- RSI指標顯示該股可能接近超買。

- 預計將在86天內公佈業績。

What Analysts Are Saying About Micron Technology

分析師對美光科技的看法

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $166.4.

在過去的一個月中,5位行業分析師分享了他們對該股的見解,提出平均目標價爲166.4美元。

- An analyst from Needham persists with their Buy rating on Micron Technology, maintaining a target price of $150.

- An analyst from Baird persists with their Outperform rating on Micron Technology, maintaining a target price of $172.

- Maintaining their stance, an analyst from Cantor Fitzgerald continues to hold a Overweight rating for Micron Technology, targeting a price of $180.

- An analyst from Keybanc persists with their Overweight rating on Micron Technology, maintaining a target price of $160.

- Consistent in their evaluation, an analyst from Wedbush keeps a Outperform rating on Micron Technology with a target price of $170.

- 來自尼德姆的一位分析師堅持對美光科技的買入評級,將目標價維持在150美元。

- 貝爾德的一位分析師堅持對美光科技的跑贏大盤評級,將目標價維持在172美元。

- 坎託·菲茨傑拉德的一位分析師保持立場,繼續維持美光科技的增持評級,目標股價爲180美元。

- Keybanc的一位分析師堅持對美光科技的增持評級,將目標價維持在160美元。

- Wedbush的一位分析師在評估中保持了對美光科技跑贏大盤的評級,目標價爲170美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Micron Technology with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了獲得更高利潤的可能性。精明的交易者通過持續的教育、戰略交易調整、利用各種指標以及隨時關注市場動態來降低這些風險。通過 Benzinga Pro 了解美光科技的最新期權交易,實時提醒。