Spotlight on American Airlines Gr: Analyzing the Surge in Options Activity

Spotlight on American Airlines Gr: Analyzing the Surge in Options Activity

Investors with a lot of money to spend have taken a bearish stance on American Airlines Gr (NASDAQ:AAL).

資金雄厚的投資者對美國航空公司股票(NASDAQ:AAL)持謹慎看法。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我們在這裏追蹤的公開期權歷史記錄上看到交易時發現了這一點。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AAL, it often means somebody knows something is about to happen.

無論這些投資者是機構還是富人,我們都不清楚。但當AAL發生這種大事情時,往往意味着有人知道即將發生的事情。

So how do we know what these investors just did?

那麼我們如何知道這些投資者剛剛做了什麼呢?

Today, Benzinga's options scanner spotted 8 uncommon options trades for American Airlines Gr.

今天,Benzinga的期權掃描器發現了8個美國航空公司的非常規期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 25% bullish and 62%, bearish.

這些大手交易者的整體情緒分別爲25%看好和62%看淡。

Out of all of the special options we uncovered, 6 are puts, for a total amount of $1,037,522, and 2 are calls, for a total amount of $90,360.

在我們發現的所有特殊期權中,有6個看跌期權,總金額爲1037522美元,還有2個看漲期權,總金額爲90360美元。

Predicted Price Range

預測價格區間

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $9.0 to $25.0 for American Airlines Gr over the last 3 months.

考慮到這些合約的成交量和未平倉合約數,過去3個月來鯨魚一直瞄準美國航空公司的目標價區間在9.0到25.0美元之間。

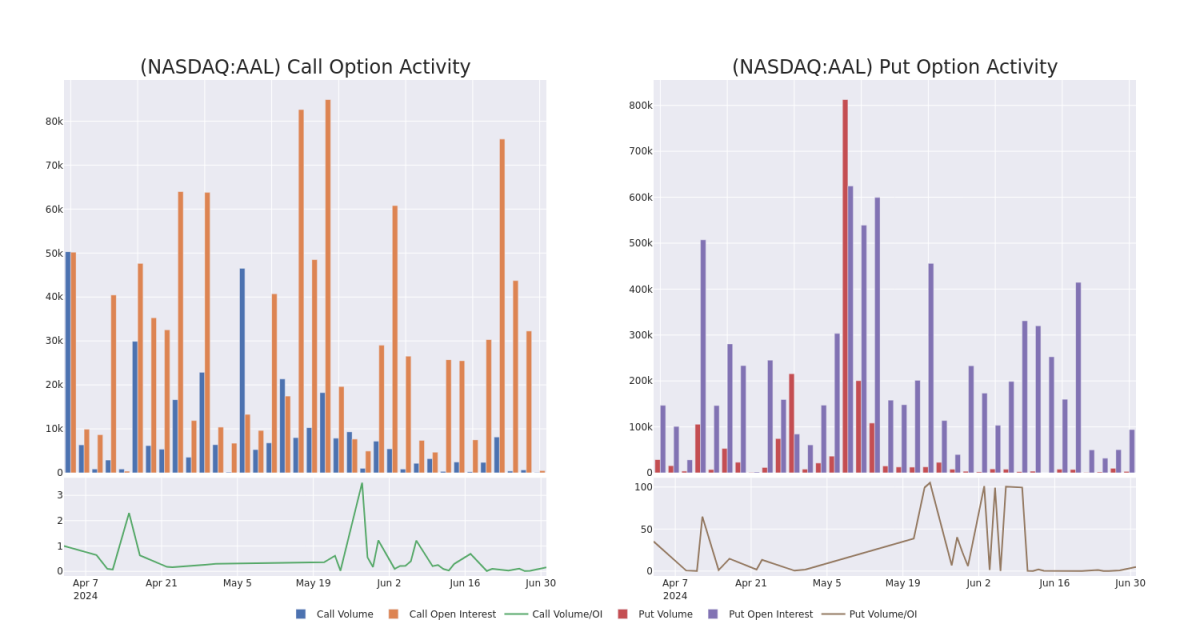

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

In today's trading context, the average open interest for options of American Airlines Gr stands at 13524.71, with a total volume reaching 3,188.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in American Airlines Gr, situated within the strike price corridor from $9.0 to $25.0, throughout the last 30 days.

在今天的交易背景下,美國航空公司期權的平均未平倉合約數爲13524.71,總成交量達到3188.00。隨附的圖表描述了過去30天內,美國航空公司高價值交易的看漲和看跌期權的成交量和未平倉合約數的走勢,位於9.0到25.0美元的行權價格區間內。

American Airlines Gr Call and Put Volume: 30-Day Overview

美國航空公司看漲和看跌期權成交量的30天概覽

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AAL | PUT | TRADE | NEUTRAL | 01/16/26 | $13.85 | $13.75 | $13.8 | $25.00 | $409.8K | 3 | 0 |

| AAL | PUT | TRADE | BEARISH | 07/26/24 | $0.41 | $0.39 | $0.41 | $11.00 | $318.2K | 3.8K | 2.4K |

| AAL | PUT | SWEEP | BEARISH | 09/20/24 | $0.14 | $0.12 | $0.14 | $9.00 | $140.0K | 59.2K | 7 |

| AAL | PUT | SWEEP | BEARISH | 07/26/24 | $0.41 | $0.4 | $0.4 | $11.00 | $89.5K | 3.8K | 220 |

| AAL | CALL | TRADE | BEARISH | 07/12/24 | $0.38 | $0.37 | $0.37 | $11.00 | $47.3K | 309 | 77 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 美國航空 | 看跌 | 交易 | 中立 | 01/16/26 | $13.85 | $13.75 | $13.8 | $25.00 | $409.8K | 3 | 0 |

| 美國航空 | 看跌 | 交易 | 看淡 | 07/26/24 | $0.41 | 0.39美元 | $0.41 | 11.00美元 | $318.2K | 3.8K | 2.4K |

| 美國航空 | 看跌 | SWEEP | 看淡 | 09/20/24 | 0.14美元 | $0.12 | 0.14美元 | 。該公司的股票上週五收盤價爲$4.19。 | 140,000美元 | 59.2K | 7 |

| 美國航空 | 看跌 | SWEEP | 看淡 | 07/26/24 | $0.41 | $0.4 | $0.4 | 11.00美元 | $89.5K | 3.8K | 220 |

| 美國航空 | 看漲 | 交易 | 看淡 | 07/12/24 | $0.38 | $0.37 | $0.37 | 11.00美元 | $47.3K | 309 | 77 |

About American Airlines Gr

關於美國航空

American Airlines is the world's largest airline by aircraft, capacity, and scheduled revenue passenger miles. Its major US hubs are Charlotte, Chicago, Dallas/Fort Worth, Los Angeles, Miami, New York, Philadelphia, Phoenix, and Washington, D.C. It generates over 30% of US airline revenue connecting Latin America with destinations in the United States. After completing a major fleet renewal, the company has the youngest fleet of US legacy carriers.

美國航空是全球最大的航空公司,以機隊、運力和定期營業收入乘客英里數而著稱。其主要美國樞紐機場爲夏洛特、芝加哥、達拉斯/沃斯堡、洛杉磯、邁阿密、紐約、費城、鳳凰城和華盛頓特區。它通過連接拉丁美洲和美國的目的地而產生了美國航空業營業額的30%以上。經過了一次重大的機隊更新後,該公司擁有美國傳統航空公司中最年輕的機隊。

Following our analysis of the options activities associated with American Airlines Gr, we pivot to a closer look at the company's own performance.

在我們分析與美國航空公司相關的期權交易活動之後,我們轉向更近一步地關注該公司的業績情況。

American Airlines Gr's Current Market Status

美國航空公司當前的市場狀態幣

- With a volume of 16,155,838, the price of AAL is down -2.25% at $11.07.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 17 days.

- 美國航空股票的成交量爲16,155,838,目前下跌2.25%,報價爲11.07美元。

- RSI指標暗示基礎股票可能接近超賣。

- 預計下次業績發佈還有17天。

Expert Opinions on American Airlines Gr

關於美國航空公司的專家意見

1 market experts have recently issued ratings for this stock, with a consensus target price of $18.0.

1位市場專家最近對該股票發表了評級意見,共識目標價爲18.0美元。

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on American Airlines Gr with a target price of $18.

- 在對其進行評估時,摩根士丹利的分析師給予美國航空公司超配評級,目標價爲18.0美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest American Airlines Gr options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在回報。精明的交易員通過不斷學習、調整策略、監測多個指標並密切關注市場變化來管理這些風險。通過Benzinga Pro的實時警報及時了解最新的美國航空集團期權交易動態。