Shanghai W-Ibeda High Tech.Group Co.,Ltd.'s (SHSE:688071) 26% Cheaper Price Remains In Tune With Revenues

Shanghai W-Ibeda High Tech.Group Co.,Ltd.'s (SHSE:688071) 26% Cheaper Price Remains In Tune With Revenues

Unfortunately for some shareholders, the Shanghai W-Ibeda High Tech.Group Co.,Ltd. (SHSE:688071) share price has dived 26% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 65% share price decline.

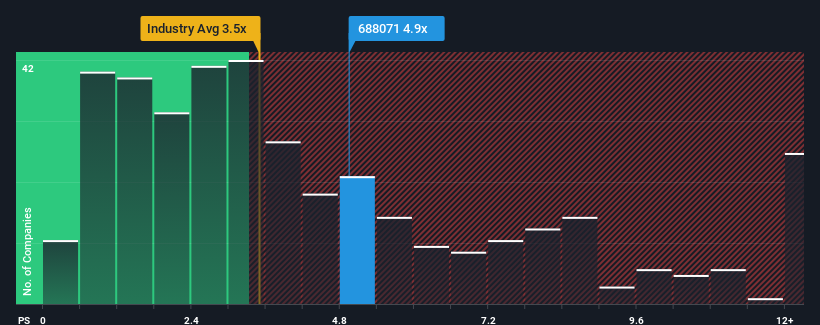

In spite of the heavy fall in price, given close to half the companies operating in China's Electronic industry have price-to-sales ratios (or "P/S") below 3.5x, you may still consider Shanghai W-Ibeda High Tech.GroupLtd as a stock to potentially avoid with its 4.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

How Has Shanghai W-Ibeda High Tech.GroupLtd Performed Recently?

Shanghai W-Ibeda High Tech.GroupLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shanghai W-Ibeda High Tech.GroupLtd.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Shanghai W-Ibeda High Tech.GroupLtd would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 12% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 165% as estimated by the dual analysts watching the company. With the industry only predicted to deliver 25%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Shanghai W-Ibeda High Tech.GroupLtd's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Shanghai W-Ibeda High Tech.GroupLtd's P/S?

Shanghai W-Ibeda High Tech.GroupLtd's P/S remain high even after its stock plunged. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Shanghai W-Ibeda High Tech.GroupLtd maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electronic industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you take the next step, you should know about the 2 warning signs for Shanghai W-Ibeda High Tech.GroupLtd (1 is concerning!) that we have uncovered.

If you're unsure about the strength of Shanghai W-Ibeda High Tech.GroupLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com