Looking At Bristol-Myers Squibb's Recent Unusual Options Activity

Looking At Bristol-Myers Squibb's Recent Unusual Options Activity

Financial giants have made a conspicuous bearish move on Bristol-Myers Squibb. Our analysis of options history for Bristol-Myers Squibb (NYSE:BMY) revealed 8 unusual trades.

金融巨頭對百時美施貴寶採取了明顯的看跌舉動。我們對百時美施貴寶(紐約證券交易所代碼:BMY)期權歷史的分析顯示了8筆不尋常的交易。

Delving into the details, we found 37% of traders were bullish, while 62% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $222,715, and 5 were calls, valued at $303,050.

深入研究細節,我們發現37%的交易者看漲,而62%的交易者表現出看跌傾向。在我們發現的所有交易中,有3筆是看跌期權,價值爲222,715美元,5筆是看漲期權,價值303,050美元。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $39.0 and $49.0 for Bristol-Myers Squibb, spanning the last three months.

在評估了交易量和未平倉合約之後,很明顯,主要市場走勢者將注意力集中在百時美施貴寶在過去三個月的39.0美元至49.0美元之間的價格區間上。

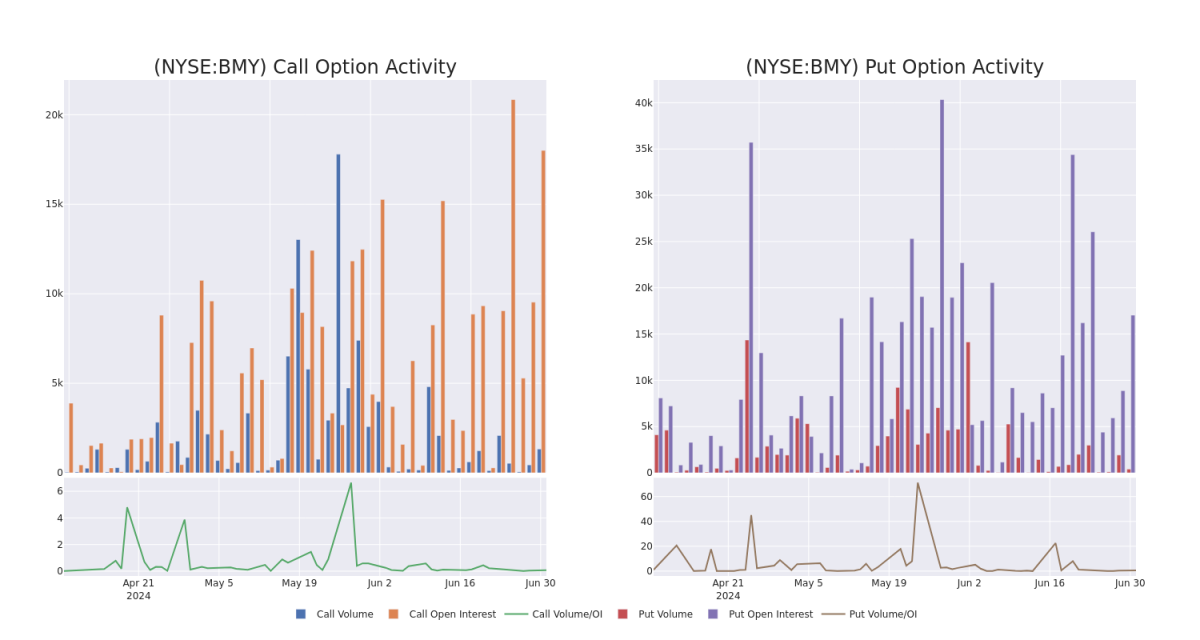

Volume & Open Interest Trends

交易量和未平倉合約趨勢

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Bristol-Myers Squibb's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Bristol-Myers Squibb's substantial trades, within a strike price spectrum from $39.0 to $49.0 over the preceding 30 days.

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了按指定行使價計算的百時美施貴寶期權的流動性和投資者對該期權的興趣。即將發佈的數據可視化了與百時美施貴寶的大量交易相關的看漲期權和未平倉合約的波動,在過去30天的行使價範圍內,從39.0美元到49.0美元不等。

Bristol-Myers Squibb Option Activity Analysis: Last 30 Days

百時美施貴寶期權活動分析:過去 30 天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BMY | CALL | SWEEP | BULLISH | 12/20/24 | $4.0 | $3.9 | $4.0 | $39.00 | $119.6K | 57 | 1 |

| BMY | PUT | SWEEP | BEARISH | 12/20/24 | $9.3 | $9.2 | $9.3 | $49.00 | $105.0K | 121 | 0 |

| BMY | PUT | SWEEP | BEARISH | 09/20/24 | $5.75 | $5.65 | $5.75 | $46.00 | $87.4K | 1.8K | 0 |

| BMY | CALL | SWEEP | BULLISH | 07/19/24 | $1.93 | $1.12 | $1.74 | $39.00 | $64.1K | 445 | 0 |

| BMY | CALL | SWEEP | BEARISH | 07/26/24 | $1.44 | $1.38 | $1.38 | $40.00 | $46.2K | 296 | 261 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BMY | 打電話 | 掃 | 看漲 | 12/20/24 | 4.0 美元 | 3.9 美元 | 4.0 美元 | 39.00 美元 | 119.6 萬美元 | 57 | 1 |

| BMY | 放 | 掃 | 粗魯的 | 12/20/24 | 9.3 美元 | 9.2 美元 | 9.3 美元 | 49.00 美元 | 105.0 萬美元 | 121 | 0 |

| BMY | 放 | 掃 | 粗魯的 | 09/20/24 | 5.75 美元 | 5.65 美元 | 5.75 美元 | 46.00 美元 | 87.4 萬美元 | 1.8K | 0 |

| BMY | 打電話 | 掃 | 看漲 | 07/19/24 | 1.93 美元 | 1.12 美元 | 1.74 | 39.00 美元 | 64.1 萬美元 | 445 | 0 |

| BMY | 打電話 | 掃 | 粗魯的 | 07/26/24 | 1.44 美元 | 1.38 | 1.38 | 40.00 美元 | 46.2 萬美元 | 296 | 261 |

About Bristol-Myers Squibb

關於百時美施貴寶

Bristol-Myers Squibb discovers, develops, and markets drugs for various therapeutic areas, such as cardiovascular, cancer, and immune disorders. A key focus for Bristol is immuno-oncology, where the firm is a leader in drug development. Bristol derives close to 70% of total sales from the U.S., showing a higher dependence on the U.S. market than most of its peer group.

百時美施貴寶發現、開發和銷售用於心血管、癌症和免疫疾病等各種治療領域的藥物。布里斯托爾的重點是免疫腫瘤學,該公司是該領域的藥物開發領導者。布里斯托爾將近70%的總銷售額來自美國,這表明其對美國市場的依賴程度高於大多數同行。

Following our analysis of the options activities associated with Bristol-Myers Squibb, we pivot to a closer look at the company's own performance.

在分析了與百時美施貴寶相關的期權活動之後,我們將轉向仔細研究公司自身的表現。

Bristol-Myers Squibb's Current Market Status

百時美施貴寶目前的市場地位

- With a trading volume of 2,060,715, the price of BMY is down by -1.53%, reaching $40.67.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 24 days from now.

- BMY的交易量爲2,060,715美元,下跌了-1.53%,至40.67美元。

- 當前的RSI值表明,該股目前在超買和超賣之間處於中立狀態。

- 下一份收益報告定於即日起24天后發佈。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。