Looking At Barrick Gold's Recent Unusual Options Activity

Looking At Barrick Gold's Recent Unusual Options Activity

Deep-pocketed investors have adopted a bullish approach towards Barrick Gold (NYSE:GOLD), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in GOLD usually suggests something big is about to happen.

資本雄厚的投資者對巴里克黃金(紐交所:GOLD)採取看好的態度,市場參與者不應忽視。我們在Benzinga的公開期權記錄跟蹤中發現了這一重大舉動。這些投資者的身份尚不可知,但GOLD的如此重大舉動通常意味着即將發生重要事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 21 extraordinary options activities for Barrick Gold. This level of activity is out of the ordinary.

從觀察到的情況來看,Benzinga的期權掃描器今日突顯了21項非凡的巴里克黃金期權活動,這種活躍度超出了尋常。

The general mood among these heavyweight investors is divided, with 47% leaning bullish and 42% bearish. Among these notable options, 6 are puts, totaling $544,481, and 15 are calls, amounting to $1,384,604.

這些財力雄厚的投資者的一般情緒是分歧的,其中47%看好,42%看淡。在這些值得關注的期權中,6項爲認股期權,總金額爲$544,481,而15項是認沽期權,總金額爲$1,384,604。

Predicted Price Range

預測價格區間

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $15.0 to $22.0 for Barrick Gold over the last 3 months.

考慮到這些合約的成交量和未平倉合約的持倉量,似乎過去3個月裏鯨魚們一直在瞄準巴里克黃金的價格區間在$15.0到$22.0之間。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

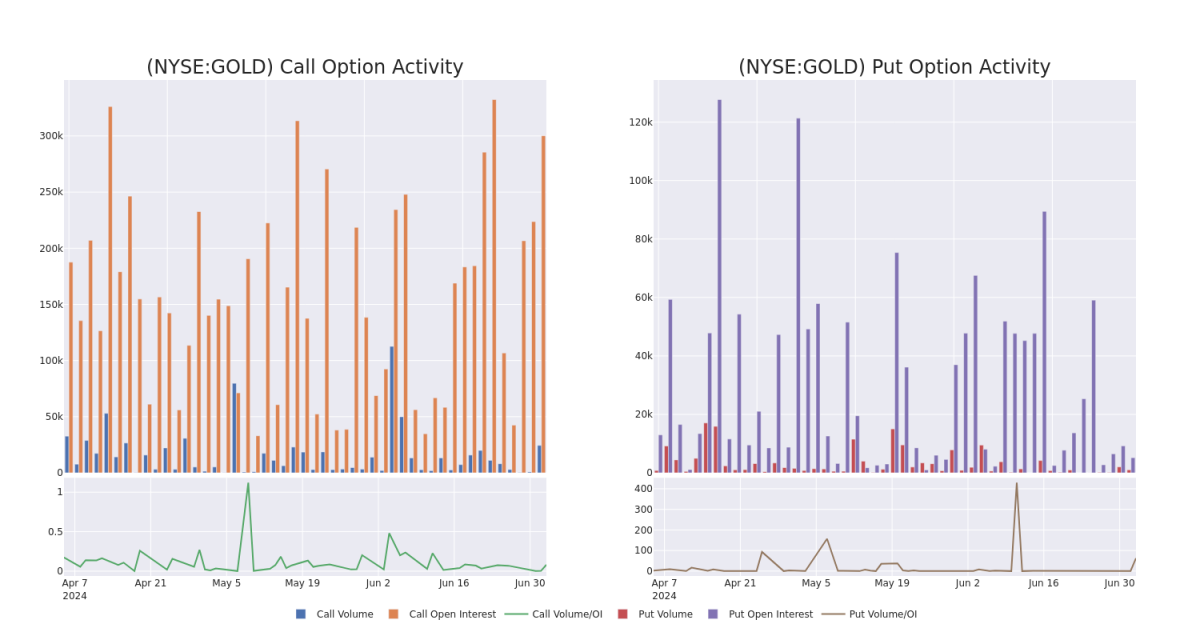

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Barrick Gold's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Barrick Gold's significant trades, within a strike price range of $15.0 to $22.0, over the past month.

檢視成交量和未平倉合約的數量可以提供股票研究中的重要見解。這些信息對於衡量巴里克黃金不同行權價的認購和認沽期權的流動性和興趣水平至關重要。以下是過去一個月內在$15.0到$22.0行權價區間內,巴里克黃金認購和認沽期權的成交量和未平倉合約的趨勢概覽。

Barrick Gold Option Volume And Open Interest Over Last 30 Days

巴里克黃金過去30天的期權成交量和持倉量

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GOLD | PUT | SWEEP | BULLISH | 12/18/26 | $2.83 | $2.08 | $2.07 | $17.00 | $207.0K | 16 | 0 |

| GOLD | CALL | SWEEP | BULLISH | 09/20/24 | $0.44 | $0.43 | $0.44 | $19.00 | $195.0K | 10.8K | 434 |

| GOLD | CALL | SWEEP | BEARISH | 08/16/24 | $0.94 | $0.93 | $0.93 | $17.00 | $186.0K | 8.9K | 707 |

| GOLD | PUT | SWEEP | BULLISH | 02/21/25 | $3.35 | $3.2 | $3.2 | $20.00 | $160.0K | 990 | 0 |

| GOLD | CALL | SWEEP | BULLISH | 01/16/26 | $4.1 | $4.05 | $4.1 | $15.00 | $117.2K | 16.0K | 203 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 黃金 | 看跌 | SWEEP | 看好 | 12/18/26 | 2.83美元 | $2.08 | $2.07 | $17.00 | $207.0K | 16 | 0 |

| 黃金 | 看漲 | SWEEP | 看好 | 09/20/24 | $0.44 | $0.43 | $0.44 | 19.00美元 | $195.0K | 10.8K | 434 |

| 黃金 | 看漲 | SWEEP | 看淡 | 08/16/24 | $0.94 | $0.93 | $0.93 | $17.00 | $186.0K | 8.9K | 707 |

| 黃金 | 看跌 | SWEEP | 看好 | 02/21/25 | $3.35 | $3.2 | $3.2 | $20.00 | $160.0K | 990 | 0 |

| 黃金 | 看漲 | SWEEP | 看好 | 01/16/26 | $4.1 | $4.05 | $4.1 | 15.00美元 | $117.2K | 16.0K | 203 |

About Barrick Gold

關於巴里克黃金

Based in Toronto, Barrick Gold is one of the world's largest gold miners. In 2023, the firm produced nearly 4.1 million attributable ounces of gold and about 420 million pounds of copper. At year-end 2023, Barrick had about two decades of gold reserves along with significant copper reserves. After buying Randgold in 2019 and combining its Nevada mines in a joint venture with competitor Newmont later that year, it operates mines in 19 countries in the Americas, Africa, the Middle East, and Asia. The company also has growing copper exposure. Its potential Reko Diq project in Pakistan, if developed, could double copper production by the end of the decade.

巴里克黃金總部位於多倫多,是世界上最大的黃金礦商之一。2023年,該公司生產了近410萬盎司黃金和約4.2億磅銅。到2023年年底,巴里克黃金擁有約20年的黃金儲備以及大量銅儲備。在2019年收購Randgold後,合併其內華達州礦山與競爭對手紐曼創業公司的合資企業,該公司在美洲、非洲、中東和亞洲的19個國家開採礦山。該公司還有不斷增長的銅業務。如果開發成功,其位於巴基斯坦的Reko Diq項目可能會使銅產量到本十年末翻倍。

In light of the recent options history for Barrick Gold, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考慮到巴里克黃金的最近期權歷史,現在適合關注這家公司本身。我們旨在探究巴里克黃金的當前表現。

Current Position of Barrick Gold

巴里克黃金的當前持倉

- Currently trading with a volume of 12,260,509, the GOLD's price is up by 4.3%, now at $17.34.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 34 days.

- 目前成交量爲12,260,509,巴里克黃金的價格上漲了4.3%,現在爲$17.34。

- RSI讀數表明該股目前可能接近超買水平。

- 預計發佈收益報告還有34天。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Barrick Gold with Benzinga Pro for real-time alerts.

交易期權涉及的風險更大,但也具有更高的利潤潛力。精明的交易者通過持續的教育、戰略性的交易調整、利用各種因子以及關注市場動態來降低這些風險。通過Benzinga Pro獲得巴里克黃金最新的期權交易,以獲取實時警報。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $15.0 to $22.0 for Barrick Gold over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $15.0 to $22.0 for Barrick Gold over the last 3 months.