What the Options Market Tells Us About Pfizer

What the Options Market Tells Us About Pfizer

Financial giants have made a conspicuous bearish move on Pfizer. Our analysis of options history for Pfizer (NYSE:PFE) revealed 8 unusual trades.

金融巨頭們對輝瑞採取了明顯的看淡策略。我們對輝瑞(NYSE:PFE)期權歷史進行分析後發現8筆異常交易。

Delving into the details, we found 37% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $184,039, and 4 were calls, valued at $142,082.

具體而言,我們發現37%的交易者看好,50%的交易者看淡。在我們發現的所有交易中,有4筆看跌期權交易,價值爲$184,039,有4筆看漲期權交易,價值爲$142,082。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $22.5 and $35.0 for Pfizer, spanning the last three months.

在評估交易量和持倉量後,我們發現市場主要參與者正在關注輝瑞的價格區間,該區間爲$22.5至$35.0,時間跨度爲三個月。

Insights into Volume & Open Interest

成交量和持倉量分析

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for Pfizer's options for a given strike price.

這些數據可以幫助您跟蹤某個行權價格下輝瑞期權的流動性和利率。

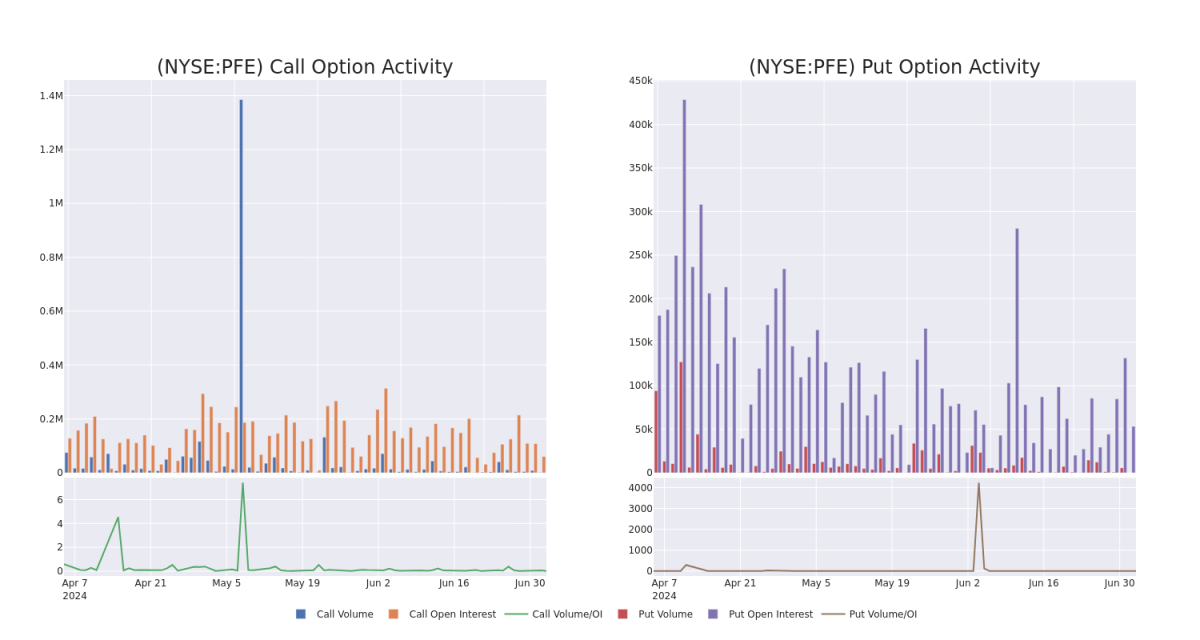

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Pfizer's whale activity within a strike price range from $22.5 to $35.0 in the last 30 days.

下面,我們可以看到上一個月,行權價格爲$22.5至$35.0的所有輝瑞期權鯨魚活動的看漲期權和看跌期權成交量和持倉量的變化情況。

Pfizer Call and Put Volume: 30-Day Overview

輝瑞看漲期權和看跌期權成交量:30天概覽

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PFE | PUT | SWEEP | BEARISH | 12/20/24 | $2.09 | $2.08 | $2.09 | $28.00 | $61.6K | 7.1K | 12 |

| PFE | PUT | SWEEP | BEARISH | 01/16/26 | $9.55 | $8.2 | $8.2 | $35.00 | $49.1K | 9.6K | 32 |

| PFE | PUT | SWEEP | BEARISH | 01/17/25 | $7.65 | $7.65 | $7.65 | $35.00 | $45.9K | 32.9K | 0 |

| PFE | CALL | SWEEP | BULLISH | 07/05/24 | $0.15 | $0.12 | $0.15 | $28.00 | $45.0K | 5.4K | 1.1K |

| PFE | CALL | TRADE | BULLISH | 01/17/25 | $4.1 | $3.4 | $3.83 | $25.00 | $38.3K | 36.9K | 0 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 輝瑞 | 看跌 | SWEEP | 看淡 | 12/20/24 | $2.09 | $2.08 | $2.09 | $28.00 | $61.6K | 7.1K | 12 |

| 輝瑞 | 看跌 | SWEEP | 看淡 | 01/16/26 | $9.55 | $8.2 | $8.2 | 35.00美元 | $49.1K | 9.6千 | 32 |

| 輝瑞 | 看跌 | SWEEP | 看淡 | 01/17/25 | $7.65 | $7.65 | $7.65 | 35.00美元 | $45.9K | 32.9K | 0 |

| 輝瑞 | 看漲 | SWEEP | 看好 | 07/05/24 | 0.15美元 | $0.12 | 0.15美元 | $28.00 | $45.0K | 5,400 | 1.1千 |

| 輝瑞 | 看漲 | 交易 | 看好 | 01/17/25 | $4.1 | $3.4 | $3.83 | $25.00 | $38.3K | 36.9K | 0 |

About Pfizer

關於輝瑞

Pfizer is one of the world's largest pharmaceutical firms, with annual sales close to $50 billion (excluding COVID-19 product sales). While it historically sold many types of healthcare products and chemicals, now prescription drugs and vaccines account for the majority of sales. Top sellers include pneumococcal vaccine Prevnar 13, cancer drug Ibrance, and cardiovascular treatment Eliquis. Pfizer sells these products globally, with international sales representing close to 50% of total sales. Within international sales, emerging markets are a major contributor.

輝瑞是全球最大的製藥公司之一,年銷售額接近500億美元(不包括COVID-19產品銷售)。它歷史上銷售過許多種醫療保健產品和化學品,現在處方藥和疫苗佔據了銷售額的大部分。暢銷產品包括肺炎球菌疫苗Prevnar 13,癌症藥物Ibrance和心血管治療藥Eliquis。輝瑞在全球範圍內銷售這些產品,國際銷售佔總銷售額的近50%。其中,新興市場是主要貢獻者。

Following our analysis of the options activities associated with Pfizer, we pivot to a closer look at the company's own performance.

在我們分析了與輝瑞相關的期權活動之後,我們轉向更近距離地觀察公司的表現。

Where Is Pfizer Standing Right Now?

輝瑞現在處於何種狀態?

- With a trading volume of 12,361,622, the price of PFE is down by -0.18%, reaching $27.78.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 27 days from now.

- 交易量爲12,361,622,輝瑞的股價下跌了-0.18%,達到$27.78。

- 當前RSI值表明該股票可能即將超賣。

- 下一個業績將在27天后發佈。

Expert Opinions on Pfizer

對輝瑞的專家意見

4 market experts have recently issued ratings for this stock, with a consensus target price of $45.0.

4位市場專家最近對這隻股票進行評級,達成了$45.0的一致目標價。

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $45.

- An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $45.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $45.

- An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $45.

- 反映擔憂,Cantor Fitzgerald的一位分析師將評級下調至超配,並設立新的價格目標爲45美元。

- 來自Cantor Fitzgerald的一位分析師已經將評級下調爲Overweight,並將目標價調整爲$45。

- 反映擔憂,Cantor Fitzgerald的一位分析師將評級下調至超配,並設立新的價格目標爲45美元。

- 卡能特菲茨傑拉德的一位分析師將其行動評級下調至超配,目標價爲$45。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Pfizer with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高的利潤潛力。精明的交易者通過持續教育、戰略性的交易調整、利用各種因子並關注市場動態來減輕這些風險。通過Benzinga Pro實時警報跟上輝瑞的最新期權交易。