Pacira BioSciences, Inc.'s (NASDAQ:PCRX) 30% Dip In Price Shows Sentiment Is Matching Revenues

Pacira BioSciences, Inc.'s (NASDAQ:PCRX) 30% Dip In Price Shows Sentiment Is Matching Revenues

Pacira BioSciences, Inc. (NASDAQ:PCRX) shareholders won't be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 44% in that time.

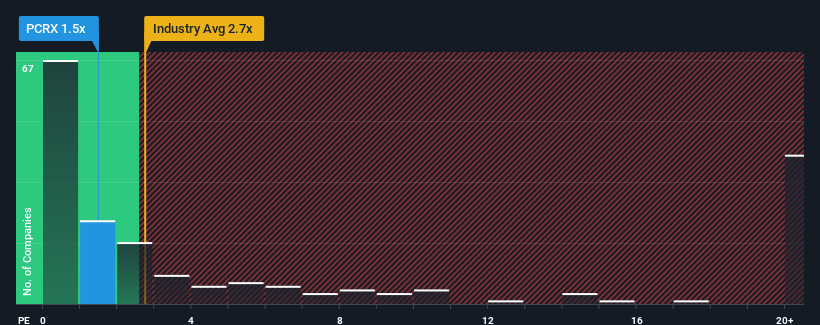

After such a large drop in price, Pacira BioSciences' price-to-sales (or "P/S") ratio of 1.5x might make it look like a buy right now compared to the Pharmaceuticals industry in the United States, where around half of the companies have P/S ratios above 2.7x and even P/S above 11x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Pacira BioSciences' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Pacira BioSciences has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Pacira BioSciences.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Pacira BioSciences would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Although pleasingly revenue has lifted 54% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to climb by 7.4% each year during the coming three years according to the nine analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 18% per annum, which is noticeably more attractive.

With this information, we can see why Pacira BioSciences is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Pacira BioSciences' P/S?

Pacira BioSciences' P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Pacira BioSciences' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Pacira BioSciences with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Pacira BioSciences, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com