Nvidia, Amazon And 2 Other Stocks Insiders Are Selling

Nvidia, Amazon And 2 Other Stocks Insiders Are Selling

The Nasdaq 100 closed higher by around 1% on Friday. Investors, meanwhile, focused on some notable insider trades.

納斯達克100指數週五收盤上漲約1%。同時,投資者將注意力集中在一些值得注意的內幕交易上。

When insiders sell shares, it could be a preplanned sale, or could indicate their concern in the company's prospects or that they view the stock as being overpriced. Insider sales should not be taken as the only indicator for making an investment or trading decision. At best, it can lend conviction to a selling decision.

當內部人士出售股票時,這可能是預先計劃的出售,也可能表明他們對公司前景的擔憂,或者他們認爲股票定價過高。不應將內幕銷售視爲做出投資或交易決策的唯一指標。充其量,它可以爲賣出決策提供信心。

Below is a look at a few recent notable insider sales. For more, check out Benzinga's insider transactions platform.

以下是最近一些值得注意的內幕銷售。欲了解更多信息,請訪問Benzinga的內幕交易平台。

NVIDIA

NVIDIA

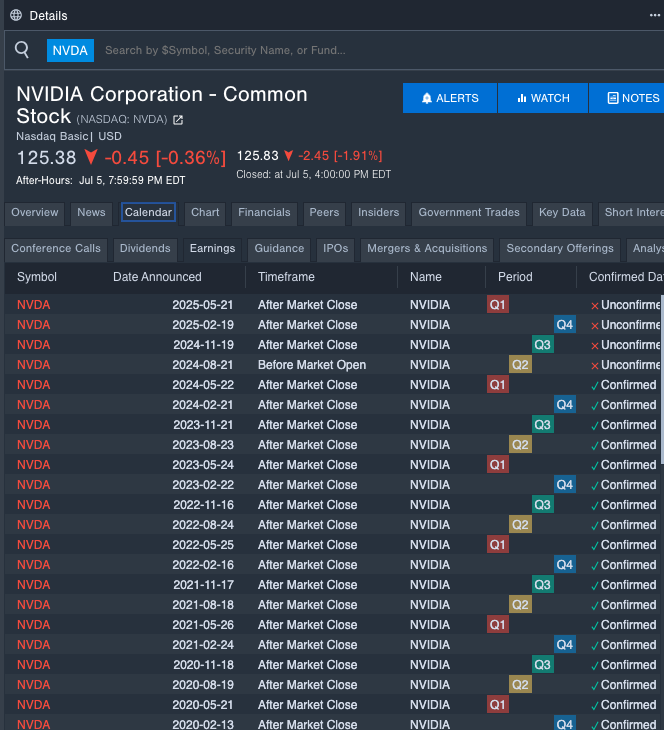

- The Trade: NVIDIA Corporation (NASDAQ:NVDA) President and CEO Jen Hsun Huang sold a total of 240,000 shares at an average price of $123.26. The insider received around $29.58 million from selling those shares.

- What's Happening: On July 5, New Street Research analyst Pierre Ferragu downgraded NVIDIA from Buy to Neutral.

- What NVIDIA Does: Nvidia is a leading developer of graphics processing units.

- Benzinga Pro's earnings calendar was used to track NVDA's upcoming earnings report.

- 交易:英偉達公司(納斯達克股票代碼:NVDA)總裁兼首席執行官黃仁勳共出售了24萬股股票,平均價格爲123.26美元。知情人士通過出售這些股票獲得了約2958萬美元。

- 發生了什麼:7月5日,新街研究分析師皮埃爾·費拉古將NVIDIA的評級從買入下調至中性。

- NVIDIA 做什麼:Nvidia 是圖形處理單元的領先開發商。

- Benzinga Pro的業績日曆被用來追蹤NVDA即將發佈的收益報告。

Have a look at our premarket coverage here

在這裏看看我們的上市前報道

Amazon.com

亞馬遜

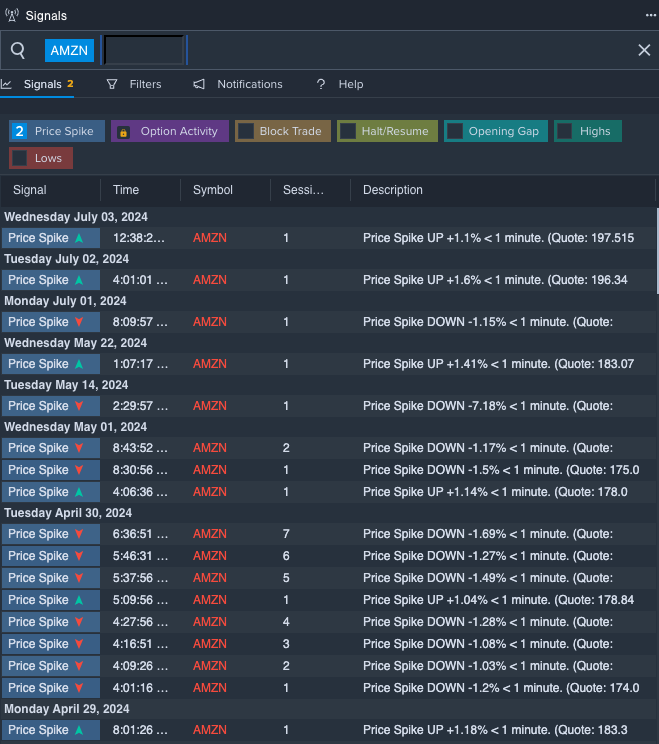

- The Trade: Amazon.com, Inc. (NASDAQ:AMZN) Executive Chair Jeffrey P Bezos sold a total of 1,664,886 shares at an average price of $200.07. The insider received around $333.1 million from selling those shares.

- What's Happening: Australia's top-secret intelligence data will be migrated to the cloud under a $2 billion deal with Amazon.com's cloud service Amazon Web Services. This decision is expected to enhance the country's defense force interoperability with the United States.

- What Amazon.com Does: Amazon is the leading online retailer and marketplace for third party sellers.

- Benzinga Pro's signals feature notified of a potential breakout in AMZN's shares.

- 交易:亞馬遜公司(納斯達克股票代碼:AMZN)執行主席傑弗裏·貝佐斯共出售了1,664,886股股票,平均價格爲200.07美元。知情人士通過出售這些股票獲得了約3.331億美元。

- 發生了什麼:根據與亞馬遜雲服務亞馬遜網絡服務達成的20億美元協議,澳大利亞的絕密情報數據將遷移到雲端。預計這一決定將增強該國國防軍與美國的互操作性。

- 亞馬遜的所作所爲:亞馬遜是領先的在線零售商和第三方賣家市場。

- Benzinga Pro的信號功能被告知AMZN的股票可能出現突破。

Paycom Software

Paycom 軟件

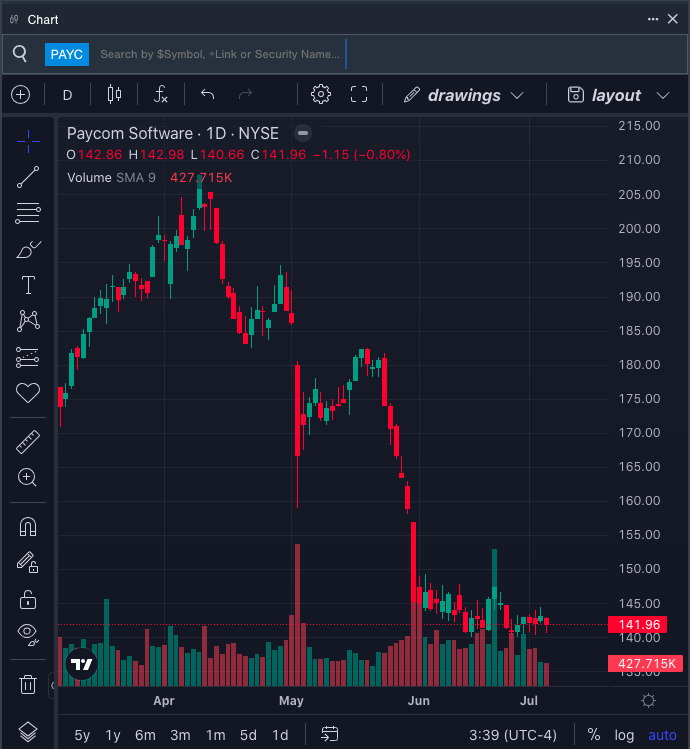

- The Trade: Paycom Software, Inc. (NYSE:PAYC) Director, CEO, President and Chairman Chad R. Richison sold a total of 3,900 shares at an average price of $143.30. The insider received around $558,887 from selling those shares.

- What's Happening: On June 24, Jefferies analyst Samad Samana maintained Paycom Software with a Hold and lowered the price target from $170 to $145.

- What Paycom Software Does: Paycom is a fast-growing provider of payroll and human capital management software primarily targeting clients with 50-10,000 employees in the United States.

- Benzinga Pro's charting tool helped identify the trend in PAYC's stock.

- 交易:Paycom Software, Inc.(紐約證券交易所代碼:PAYC)董事、首席執行官、總裁兼董事長查德·裏奇森共出售了3,900股股票,平均價格爲143.30美元。知情人士通過出售這些股票獲得了約558,887美元。

- 發生了什麼:6月24日,傑富瑞分析師薩馬德·薩馬納維持對Paycom Software的持有,並將目標股價從170美元下調至145美元。

- Paycom軟件的作用:Paycom是一家快速增長的薪資和人力資本管理軟件提供商,主要面向在美國擁有50-10,000名員工的客戶。

- Benzinga Pro的圖表工具幫助確定了PAYC股票的走勢。

Blackstone

黑石集團

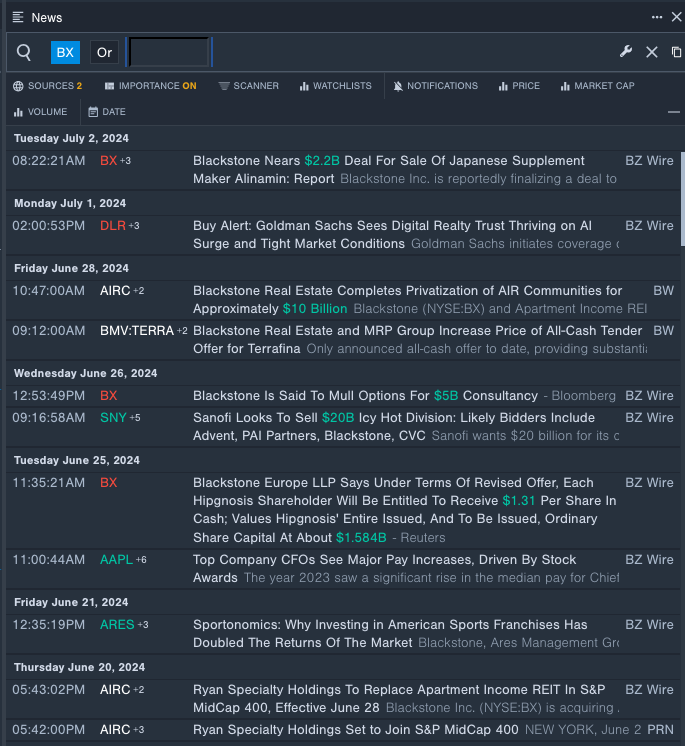

- The Trade: Blackstone Inc. (NYSE:BX) Director Joseph Baratta sold a total of 116,448 shares at an average price of $123.00. The insider received around $14.32 million from selling those shares.

- What's Happening: Blackstone is reportedly close to finalizing a deal to sell Alinamin Pharmaceutical, a Japanese supplement maker, to North Asian buyout fund MBK Partners for 350 billion yen ($2.17 billion).

- What Blackstone Does: Blackstone is the world's largest alternative-asset manager with $1.040 trillion in total asset under management, including $762.6 billion in fee-earning assets under management, at the end of 2023.

- Benzinga Pro's real-time newsfeed alerted to latest BX news.

- 交易:黑石公司(紐約證券交易所代碼:BX)董事約瑟夫·巴拉塔共出售了116,448股股票,平均價格爲123.00美元。知情人士通過出售這些股票獲得了約1432萬美元。

- 發生了什麼:據報道,黑石集團即將敲定一項協議,將日本補品生產商愛利納明製藥以3500日元(合21.7億美元)的價格出售給北亞收購基金mBK Partners。

- 黑石集團的所作所爲:黑石集團是全球最大的另類資產管理公司,截至2023年底,管理的總資產爲1.040萬億美元,其中包括管理的7,626億美元收費資產。

- Benzinga Pro的實時新聞提醒了最新的BX新聞。

Have a look at our premarket coverage here

Have a look at our premarket coverage here