Chipotle Mexican Grill Options Trading: A Deep Dive Into Market Sentiment

Chipotle Mexican Grill Options Trading: A Deep Dive Into Market Sentiment

Deep-pocketed investors have adopted a bullish approach towards Chipotle Mexican Grill (NYSE:CMG), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CMG usually suggests something big is about to happen.

資金雄厚的投資者們對Chipotle Mexican Grill(紐交所:CMG)採取看好的態度,市場參與者不應該忽視這一點。我們在Benzinga追蹤公共期權記錄時發現了這一重大舉動。這些投資者的身份仍然未知,但CMG有如此大的動向通常意味着有大事即將發生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 15 extraordinary options activities for Chipotle Mexican Grill. This level of activity is out of the ordinary.

我們從今天的觀察中獲得了這些信息,當Benzinga的期權掃描器突顯Chipotle Mexican Grill的15種非凡期權活動時,這種活動水平是不同尋常的。

The general mood among these heavyweight investors is divided, with 53% leaning bullish and 46% bearish. Among these notable options, 5 are puts, totaling $290,408, and 10 are calls, amounting to $388,894.

這些重量級投資者的整體心情是分裂的,53%傾向於看好,46%看淡。在這些值得注意的期權中,有5種認沽期權,總額爲290,408美元,10種認購期權,總額爲388,894美元。

What's The Price Target?

價格目標是什麼?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $40.0 and $82.0 for Chipotle Mexican Grill, spanning the last three months.

經過對交易成交量和持倉量的評估,顯然市場的主要推動因素是圍繞Chipotle Mexican Grill價格區間在$40.0至$82.0之間,涵蓋了過去三個月。

Insights into Volume & Open Interest

成交量和持倉量分析

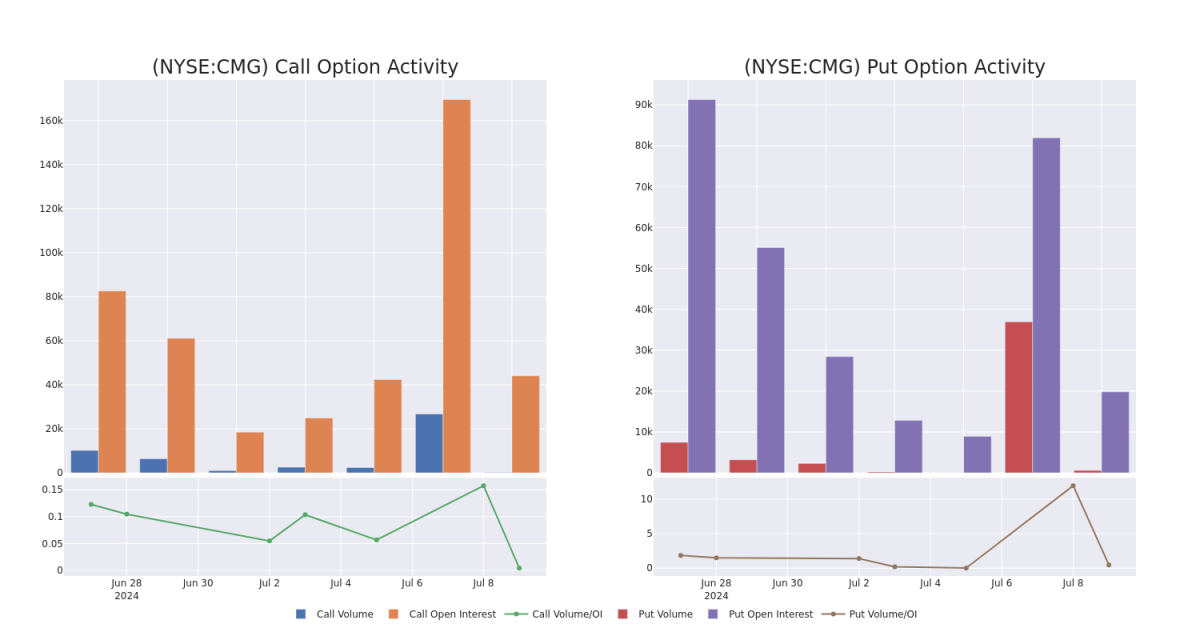

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Chipotle Mexican Grill's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Chipotle Mexican Grill's significant trades, within a strike price range of $40.0 to $82.0, over the past month.

檢查成交量和持倉量可爲股票研究提供至關重要的見解。這些信息對於評估特定執行價格下的Chipotle Mexican Grill期權的流動性和利益水平至關重要。以下是$40.0至$82.0執行價區間內Chipotle Mexican Grill重要交易的認購和認沽期權成交量和持倉量趨勢的一張快照,涵蓋了過去一個月。

Chipotle Mexican Grill Option Volume And Open Interest Over Last 30 Days

奇波雷墨西哥燒烤期權成交量和未平倉量過去30天

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CMG | PUT | SWEEP | BEARISH | 06/20/25 | $4.8 | $4.4 | $4.79 | $56.00 | $96.0K | 4.2K | 200 |

| CMG | PUT | SWEEP | BULLISH | 06/20/25 | $4.9 | $4.7 | $4.8 | $56.00 | $96.0K | 4.2K | 0 |

| CMG | CALL | SWEEP | BEARISH | 07/19/24 | $4.6 | $4.3 | $4.3 | $54.80 | $86.0K | 151 | 0 |

| CMG | CALL | TRADE | BULLISH | 07/19/24 | $1.2 | $1.15 | $1.2 | $60.10 | $57.4K | 271 | 5 |

| CMG | CALL | SWEEP | BEARISH | 01/17/25 | $4.9 | $4.6 | $4.7 | $64.00 | $41.9K | 19.3K | 1 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CMG | 看跌 | SWEEP | 看淡 | 06/20/25 | $4.8 | $4.4 | $4.79 | $56.00 | $96.0K | 4.2千 | 200 |

| CMG | 看跌 | SWEEP | 看好 | 06/20/25 | $4.9 | $4.7 | $4.8 | $56.00 | $96.0K | 4.2千 | 0 |

| CMG | 看漲 | SWEEP | 看淡 | 07/19/24 | $4.6 | $4.3 | $4.3 | $54.80 | $86.0K | 151 | 0 |

| CMG | 看漲 | 交易 | 看好 | 07/19/24 | $1.2 | $1.15 | $1.2 | $60.10 | $57.4千美元 | 271 | 5 |

| CMG | 看漲 | SWEEP | 看淡 | 01/17/25 | $4.9 | $4.6 | $4.7 | $64.00 | $41.9K | 19.3K | 1 |

About Chipotle Mexican Grill

關於奇波雷墨西哥燒烤

Chipotle Mexican Grill is the largest fast-casual chain restaurant in the United States, with systemwide sales of $9.9 billion in 2023. The Mexican concept is predominately company-owned, although it recently inked a development agreement with Alshaya Group in the Middle East. It had a footprint of nearly 3,440 stores at the end of 2023, heavily indexed to the United States, although it maintains a small presence in Canada, the UK, France, and Germany. Chipotle sells burritos, burrito bowls, tacos, quesadillas, and beverages, with a selling proposition built around competitive prices, high-quality food sourcing, speed of service, and convenience. The company generates its revenue entirely from restaurant sales and delivery fees.

奇波雷墨西哥燒烤是美國最大的快餐連鎖餐廳,2023年全系統銷售額爲99億美元。這家墨西哥概念餐廳主要由公司擁有,儘管最近與阿爾沙亞集團簽署了一項發展協議,在中東有着接近3440家店鋪的佔比,更加支點在美國市場,儘管在加拿大、英國、法國和德國也有小規模的業務。Chipotle銷售捲餅、捲餅碗、塔可餅、奶酪玉米脆餅和飲料,其銷售日益增長的主張是基於競爭價格、高質量食品來源、快速服務和便利性。該公司的收入完全來自餐廳銷售和配送費。

In light of the recent options history for Chipotle Mexican Grill, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於 Chipotle Mexican Grill 最近的期權歷史,現在適合關注公司本身。我們旨在探討其當前表現。

Chipotle Mexican Grill's Current Market Status

奇波雷墨西哥燒烤的當前市場狀態

- Currently trading with a volume of 2,275,160, the CMG's price is down by -0.41%, now at $59.27.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 15 days.

- CMG當前交易量爲2,275,160股,股價下跌了-0.41%,目前爲59.27美元。

- RSI讀數表明該股票目前處於中立狀態,處於超買和超賣之間。

- 預計將於15天內發佈收益。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。