ServiceNow's Options Frenzy: What You Need to Know

ServiceNow's Options Frenzy: What You Need to Know

Financial giants have made a conspicuous bullish move on ServiceNow. Our analysis of options history for ServiceNow (NYSE:NOW) revealed 21 unusual trades.

金融巨頭在ServiceNow上做出了明顯的看好舉動。我們分析了ServiceNow (NYSE:NOW)期權歷史,發現了21筆不尋常的交易。

Delving into the details, we found 47% of traders were bullish, while 28% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $320,442, and 13 were calls, valued at $559,904.

深入了解後,我們發現47%的交易員看漲,28%的交易員表現出看淡的傾向。我們發現所有交易中有8單看跌期權,價值320442美元,13單看漲期權,價值559904美元。

Expected Price Movements

預期價格波動

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $400.0 to $1140.0 for ServiceNow over the last 3 months.

考慮到這些合約的成交量和未平倉量,過去3個月這些鯨魚一直在針對ServiceNow的價格範圍爲400.0美元至1140.0美元。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

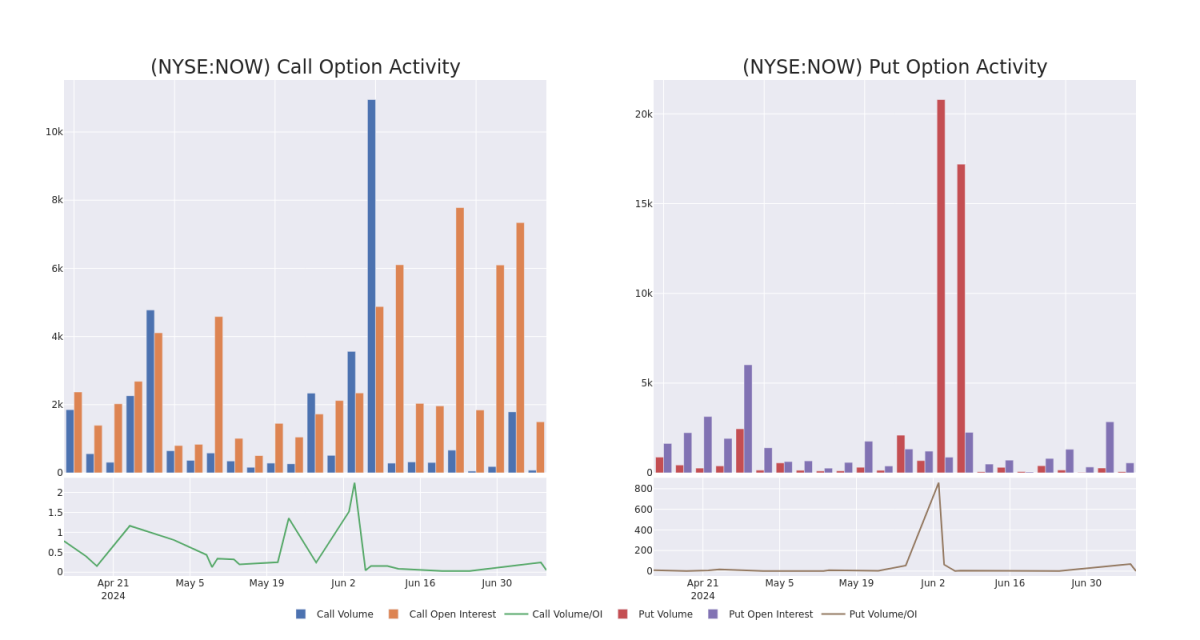

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in ServiceNow's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to ServiceNow's substantial trades, within a strike price spectrum from $400.0 to $1140.0 over the preceding 30 days.

評估成交量和未平倉合約在期權交易中是一個戰略性的步驟。這些指標揭示了投資者對於ServiceNow期權的持倉量和流動性。在這個特定行權價的選項中,下面的數據可視化了從400.0美元到1140.0美元的調用和放置的成交量和未平倉合約的波動,以鏈接ServiceNow的重大交易,以及在過去30天內的期權交易量和未平倉合約。

ServiceNow Option Volume And Open Interest Over Last 30 Days

ServiceNow過去30天的期權成交量和未平倉合約情況

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NOW | CALL | SWEEP | BULLISH | 08/02/24 | $10.1 | $5.2 | $10.0 | $825.00 | $100.0K | 82 | 0 |

| NOW | CALL | TRADE | BULLISH | 01/16/26 | $168.0 | $158.0 | $168.0 | $730.00 | $67.2K | 31 | 0 |

| NOW | PUT | TRADE | BEARISH | 08/16/24 | $39.0 | $36.4 | $39.0 | $770.00 | $58.5K | 133 | 0 |

| NOW | PUT | SWEEP | BEARISH | 08/16/24 | $40.1 | $39.3 | $40.1 | $760.00 | $52.1K | 81 | 2 |

| NOW | CALL | TRADE | BULLISH | 01/16/26 | $102.0 | $97.8 | $101.1 | $880.00 | $50.5K | 80 | 0 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| servicenow | 看漲 | SWEEP | 看好 | 08/02/24 | $10.1 | $5.2 | $10.0 | $825.00 | $100.0K | 82 | 0 |

| servicenow | 看漲 | 交易 | 看好 | 01/16/26 | $168.0 | $158.0 | $168.0 | 730.00美元 | $67.2K | 31 | 0 |

| servicenow | 看跌 | 交易 | 看淡 | 08/16/24 | $39.0 | 36.4美元 | $39.0 | $770.00 | $58.5K | 133 | 0 |

| servicenow | 看跌 | SWEEP | 看淡 | 08/16/24 | $40.1 | $39.3 | $40.1 | $760.00 | $52.1K | 81 | 2 |

| servicenow | 看漲 | 交易 | 看好 | 01/16/26 | $102.0 | $97.8 | $101.1 | $880.00 | $50.5K | 80 | 0 |

About ServiceNow

關於servicenow

ServiceNow Inc provides software solutions to structure and automate various business processes via a SaaS delivery model. The company primarily focuses on the IT function for enterprise customers. ServiceNow began with IT service management, expanded within the IT function, and more recently directed its workflow automation logic to functional areas beyond IT, notably customer service, HR service delivery, and security operations. ServiceNow also offers an application development platform as a service.

ServiceNow Inc提供軟件解決方案,通過SaaS交付模式構建和自動化各種業務流程。該公司主要關注企業客戶的IT功能。ServiceNow始於IT服務管理,在IT功能內部擴展,並最近將其工作流自動化邏輯擴展到IT以外的功能領域,尤其是客戶服務、HR服務交付和安全運營。ServiceNow還提供作爲服務的應用程序開發平台。

Where Is ServiceNow Standing Right Now?

ServiceNow現在的情況在哪裏?

- Currently trading with a volume of 711,194, the NOW's price is down by -2.78%, now at $744.88.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 15 days.

- 目前正在交易中,成交量爲711,194,NOW的價格下跌了-2.78%,現在爲744.88美元。

- RSI讀數表明該股目前可能接近超買水平。

- 預計將於15天內發佈收益。

Expert Opinions on ServiceNow

ServiceNow專家意見

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $836.0.

在過去30天中,共有5位專業分析師對該股票發表了意見,設定了一個平均目標價爲836.0美元。

- An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $900.

- An analyst from Guggenheim downgraded its action to Sell with a price target of $640.

- An analyst from Stifel has decided to maintain their Buy rating on ServiceNow, which currently sits at a price target of $820.

- An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $900.

- An analyst from Keybanc persists with their Overweight rating on ServiceNow, maintaining a target price of $920.

- Needham的一位分析師已經將評級下調到買入,調整價格目標至900美元。

- Guggenheim的一位分析師將其行動下調爲賣出,目標價爲640美元。

- Stifel的一位分析師決定維持其對ServiceNow的買入評級,目前的目標價爲820美元。

- Needham的一位分析師已經將評級下調到買入,調整價格目標至900美元。

- Keybanc的一位分析師堅持對ServiceNow的超重評級,維持目標價爲920美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。