Check Out What Whales Are Doing With VRT

Check Out What Whales Are Doing With VRT

Deep-pocketed investors have adopted a bullish approach towards Vertiv Hldgs (NYSE:VRT), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in VRT usually suggests something big is about to happen.

資金雄厚的投資者採取了看好的態度對待Vertiv Hldgs(紐交所:VRT),這是市場參與者不應忽視的事情。我們在Benzinga上追蹤公開期權記錄時發現了這一重大舉動。這些投資者的身份仍然未知,但是VRt的這樣大規模的舉動通常意味着即將發生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 28 extraordinary options activities for Vertiv Hldgs. This level of activity is out of the ordinary.

我們從Benzinga的期權掃描儀今天的觀察中獲得了這些信息,發現Vertiv Hldgs有28項非凡的期權活動。這種活動水平是不同尋常的。

The general mood among these heavyweight investors is divided, with 42% leaning bullish and 39% bearish. Among these notable options, 4 are puts, totaling $259,187, and 24 are calls, amounting to $3,116,110.

這些重量級投資者之間的總體情緒被分爲兩派,42%偏向看好,39%看淡。在這些顯着的期權中,有4項買入看跌期權,總計259,187美元,有24項買入看漲期權,總金額爲3,116,110美元。

Predicted Price Range

預測價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $52.5 and $120.0 for Vertiv Hldgs, spanning the last three months.

在評估了成交量和未平倉合約之後,顯然主要市場運作商將焦點集中在Vertiv Hldgs的價格區間$52.5至$120.0之間,時間跨度爲過去三個月。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

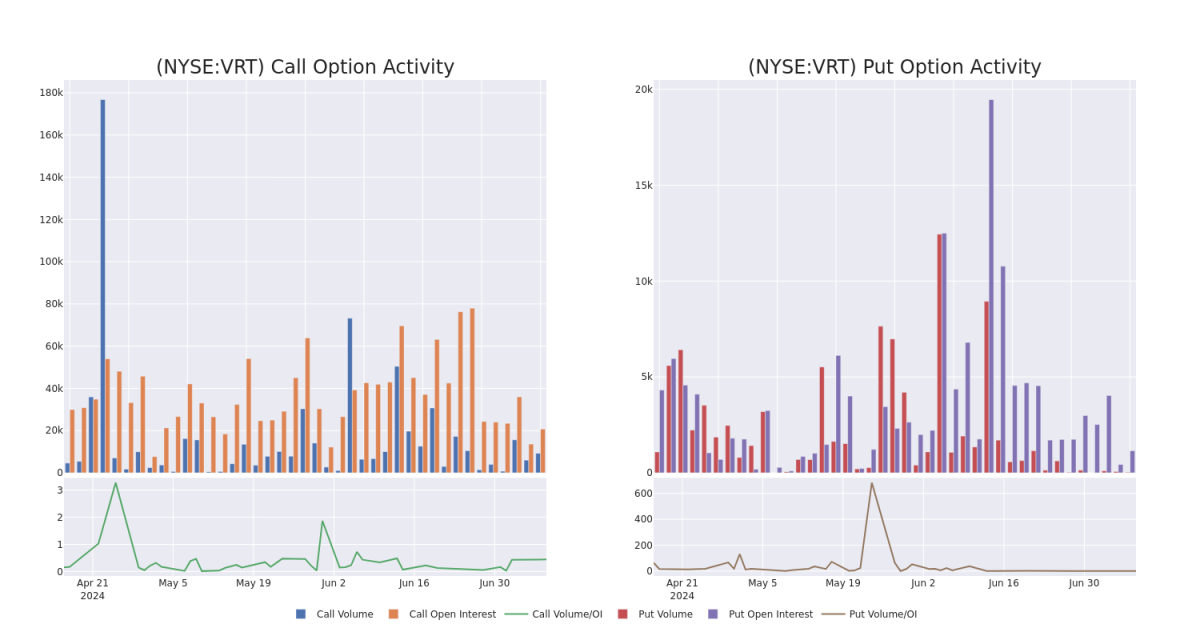

In today's trading context, the average open interest for options of Vertiv Hldgs stands at 1683.0, with a total volume reaching 9,254.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Vertiv Hldgs, situated within the strike price corridor from $52.5 to $120.0, throughout the last 30 days.

在今天的交易背景下,Vertiv Hldgs期權的平均未平倉合約爲1683.0,總成交量達到9254.00。下圖描述了過去30天Vertiv Hldgs在價值高的交易中的買入看漲和買入看跌期權量和未平倉合約的進展,位於$52.5到$120.0的行權價格走廊內。

Vertiv Hldgs Call and Put Volume: 30-Day Overview

Vertiv Hldgs看漲期權和看跌期權成交量:30天總覽

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRT | CALL | SWEEP | NEUTRAL | 06/20/25 | $15.1 | $14.9 | $15.1 | $120.00 | $483.2K | 8 | 1.0K |

| VRT | CALL | TRADE | BEARISH | 06/20/25 | $15.8 | $14.9 | $15.11 | $120.00 | $453.3K | 8 | 1.3K |

| VRT | CALL | SWEEP | BULLISH | 07/19/24 | $14.0 | $14.0 | $14.0 | $80.00 | $361.2K | 7.2K | 24 |

| VRT | CALL | SWEEP | BEARISH | 06/20/25 | $15.2 | $15.0 | $15.2 | $120.00 | $348.1K | 8 | 0 |

| VRT | CALL | SWEEP | BULLISH | 07/19/24 | $14.1 | $13.6 | $13.97 | $80.00 | $279.4K | 7.2K | 782 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRT | 看漲 | SWEEP | 中立 | 06/20/25 | $15.1 | $14.9 | $15.1 | $120.00 | $483.2千美元 | 8 | 1.0K |

| VRT | 看漲 | 交易 | 看淡 | 06/20/25 | $15.8 | $14.9 | $15.11 | $120.00 | $453.3千美元 | 8 | 1.3K |

| VRT | 看漲 | SWEEP | 看好 | 07/19/24 | $14.0 | $14.0 | $14.0 | $80.00 | $361.2千美元 | 7,200 | 24 |

| VRT | 看漲 | SWEEP | 看淡 | 06/20/25 | $15.2 | $15.0 | $15.2 | $120.00 | $348.1千美元 | 8 | 0 |

| VRT | 看漲 | SWEEP | 看好 | 07/19/24 | $14.1 | 13.6美元 | $13.97 | $80.00 | $279.4千美元 | 7,200 | 782 |

About Vertiv Hldgs

關於Vertiv Hldgs

Vertiv Holdings Co brings together hardware, software, analytics and ongoing services to ensure its customers vital applications run continuously, perform optimally and grow with their business needs. The company solves the important challenges faced by data centers, communication networks and commercial and industrial facilities with a portfolio of power, cooling and IT infrastructure solutions and services that extends from the cloud to the edge of the network. Its services include critical power, thermal management, racks and enclosures, monitoring and management, and other services. Its three business segments include the Americas, Asia Pacific; and Europe, Middle East & Africa.

Vertiv Holdings Co整合了硬體、軟件、分析以及持續服務,確保其客戶的重要應用程序連續運行、執行最佳,並隨其業務需求增長。公司通過一系列在雲端到網絡邊緣的電力、冷卻和IT基礎設施解決數據中心、通信網絡及商業和工業設施面臨的重大挑戰。其服務包括關鍵電源、熱管理、機櫃和機箱、監控和管理以及其他服務。其三個業務領域分別爲美洲、亞太地區和歐洲、中東和非洲。

After a thorough review of the options trading surrounding Vertiv Hldgs, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

經過對圍繞Vertiv Hldgs的期權交易的徹底審查後,我們轉而更詳細地研究該公司。這包括對它當前的市場狀態和業績的評估。

Current Position of Vertiv Hldgs

Vertiv Hldgs的當前持倉量

- With a trading volume of 3,499,678, the price of VRT is up by 2.99%, reaching $95.09.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 22 days from now.

- 由於成交量達3499678股,VRt的價格上漲2.99%,至95.09美元。

- 當前RSI值表明該股票可能接近超買狀態。

- 下一個業績將於22天后發佈。

Professional Analyst Ratings for Vertiv Hldgs

Vertiv Hldgs的專業分析師評級

In the last month, 1 experts released ratings on this stock with an average target price of $105.0.

在過去的一個月中,有1位專家就該股發表了評級,平均目標價爲105.0美元。

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Vertiv Hldgs, targeting a price of $105.

- 維持其觀點,Evercore ISI Group的一位分析師繼續爲Vertiv Hldgs持有超買評級,目標價爲105美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Vertiv Hldgs with Benzinga Pro for real-time alerts.

交易期權涉及更高的風險,但也提供了更高的利潤潛力。明智的交易者通過持續的教育、戰略性的交易調整、使用各種指標以及保持敏銳地關注市場動態來減輕這些風險。通過Benzinga Pro的實時警報,及時了解緯創資訊股份有限公司的最新期權交易。