A Closer Look at Caterpillar's Options Market Dynamics

A Closer Look at Caterpillar's Options Market Dynamics

Investors with a lot of money to spend have taken a bearish stance on Caterpillar (NYSE:CAT).

擁有大量資金的投資者對卡特彼勒(紐交所:CAT)採取了看淡態度。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

我們在這裏追蹤的公開期權歷史記錄中發現,今天這些頭寸已經出現了。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CAT, it often means somebody knows something is about to happen.

無論這些是機構還是富有的個人,我們都不知道。但當卡特彼勒的事情如此之大時,通常意味着有人知道即將發生的事情。

Today, Benzinga's options scanner spotted 11 options trades for Caterpillar.

今天,Benzinga的期權掃描儀發現了11筆卡特彼勒的期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 18% bullish and 72%, bearish.

這些大資金交易者的總體情緒分爲18%看漲和72%看跌。

Out of all of the options we uncovered, there was 1 put, for a total amount of $31,834, and 10, calls, for a total amount of $464,105.

在我們發現的所有期權中,有1個看跌期權,總金額爲31,834美元,有10個看漲期權,總金額爲464,105美元。

Predicted Price Range

預測價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $250.0 and $380.0 for Caterpillar, spanning the last three months.

經過交易量和持倉量的評估,很明顯主要的市場推手正在關注卡特彼勒的價格區間,該區間介於250.0美元和380.0美元之間,持續了最近三個月。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

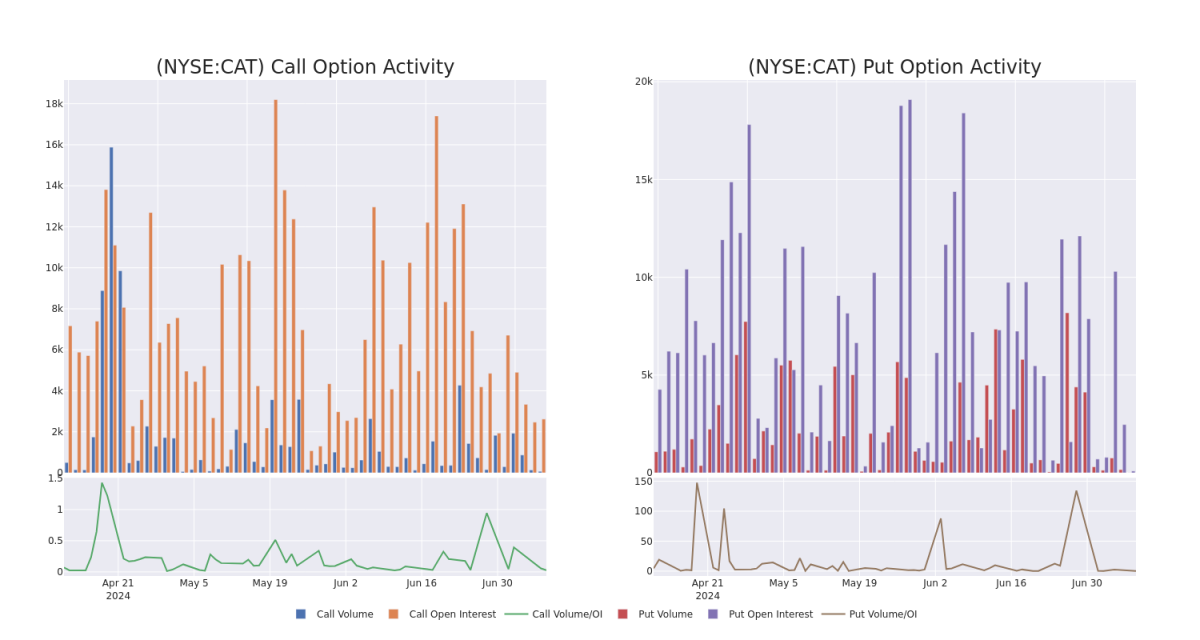

In today's trading context, the average open interest for options of Caterpillar stands at 339.0, with a total volume reaching 72.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Caterpillar, situated within the strike price corridor from $250.0 to $380.0, throughout the last 30 days.

在今天的交易背景下,卡特彼勒期權的平均持倉量爲339.0,總成交量達到72.00。附圖概述了在過去30天內,高價值的卡特彼勒看漲和看跌期權成交量和持倉量的進展,這些期權位於罷工價格走廊250.0美元至380.0美元之間。

Caterpillar Option Volume And Open Interest Over Last 30 Days

卡特彼勒過去30天的期權成交量和持倉量

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CAT | CALL | TRADE | BULLISH | 01/16/26 | $30.6 | $30.0 | $30.4 | $370.00 | $91.2K | 130 | 0 |

| CAT | CALL | TRADE | BEARISH | 01/16/26 | $27.6 | $26.45 | $26.87 | $380.00 | $80.6K | 78 | 0 |

| CAT | CALL | TRADE | BULLISH | 01/17/25 | $86.1 | $83.65 | $85.2 | $250.00 | $76.6K | 1.1K | 0 |

| CAT | CALL | TRADE | NEUTRAL | 01/17/25 | $75.8 | $74.1 | $75.0 | $260.00 | $37.5K | 609 | 5 |

| CAT | CALL | SWEEP | BEARISH | 01/17/25 | $75.25 | $74.0 | $74.48 | $260.00 | $37.2K | 609 | 0 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 卡特彼勒 | 看漲 | 交易 | 看好 | 01/16/26 | $30.6 | $30.0應該是指目標價$30.0。 | $30.4 | $370.00 | $91.2K | 130 | 0 |

| 卡特彼勒 | 看漲 | 交易 | 看淡 | 01/16/26 | $27.6 | $26.45 | $26.87 | $380.00 | $80.6K | 78 | 0 |

| 卡特彼勒 | 看漲 | 交易 | 看好 | 01/17/25 | $86.1 | $83.65 | $85.2 | $250.00 | $76.6K | 1.1千 | 0 |

| 卡特彼勒 | 看漲 | 交易 | 中立 | 01/17/25 | $75.8 | $74.1 | $75.0 | $260.00 | $37.5千美元 | 609 | 5 |

| 卡特彼勒 | 看漲 | SWEEP | 看淡 | 01/17/25 | $75.25 | $74.0 | $74.48 | $260.00 | $37.2千美元 | 609 | 0 |

About Caterpillar

關於卡特彼勒

Caterpillar is the top manufacturer of heavy equipment, power solutions, and locomotives. It is currently the world's largest manufacturer of heavy equipment. The company is divided into four reportable segments: construction industries, resource industries, energy and transportation, and Cat Financial. Its products are available through a dealer network that covers the globe with about 2,700 branches maintained by 160 dealers. Cat Financial provides retail financing for machinery and engines to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Caterpillar product sales.

卡特彼勒是重型機械、動力解決方案和機車製造商。它目前是世界上最大的重型設備製造商。該公司分爲四個可報告業務部門:建築產業、資源產業、能源和運輸、卡特金融。其產品可以通過全球約2,700個分支機構的160個經銷商網絡獲得。卡特金融爲其客戶提供機械和發動機的零售融資,此外還爲經銷商提供批發融資,增加了卡特彼勒產品銷售的可能性。

After a thorough review of the options trading surrounding Caterpillar, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對卡特彼勒周圍的期權交易進行徹底審核之後,我們轉而更詳細地檢查公司的情況。這包括對其當前市場狀態和表現的評估。

Caterpillar's Current Market Status

卡特彼勒當前的市場狀態

- With a trading volume of 632,249, the price of CAT is down by -0.22%, reaching $328.35.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 21 days from now.

- 隨着成交量達到632,249,CAt的價格下跌了-0.22%,達到328.35美元。

- 當前RSI值表明該股票可能接近超買狀態。

- 下次盈利報告計劃在21天后。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。