Behind the Scenes of Enphase Energy's Latest Options Trends

Behind the Scenes of Enphase Energy's Latest Options Trends

Investors with a lot of money to spend have taken a bullish stance on Enphase Energy (NASDAQ:ENPH).

有很多資金的投資者對Enphase能源化工(納斯達克:ENPH)採取了看好的態度。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我們在這裏追蹤的公開期權歷史記錄上看到交易時發現了這一點。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ENPH, it often means somebody knows something is about to happen.

無論是機構還是有錢人,我們並不清楚。但當出現這種重大事件時,通常意味着有人知道即將發生的事情。

So how do we know what these investors just did?

那麼我們如何知道這些投資者剛剛做了什麼呢?

Today, Benzinga's options scanner spotted 22 uncommon options trades for Enphase Energy.

今日,Benzinga的期權掃描器發現Enphase Energy有22個不尋常的期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 59% bullish and 31%, bearish.

這些大額資金交易者的整體情緒分爲59%看好和31%看淡。

Out of all of the special options we uncovered, 6 are puts, for a total amount of $280,459, and 16 are calls, for a total amount of $972,082.

在我們發現的所有特殊期權中,共有6個看跌,金額總計爲280,459美元,16個看漲,金額總計爲972,082美元。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $55.0 and $185.0 for Enphase Energy, spanning the last three months.

經過對成交量和未平倉合約量的評估,顯然主要市場動向集中在55美元到185美元之間的價格區間,這跨越了Enphase Energy的過去三個月。

Volume & Open Interest Trends

成交量和未平倉量趨勢

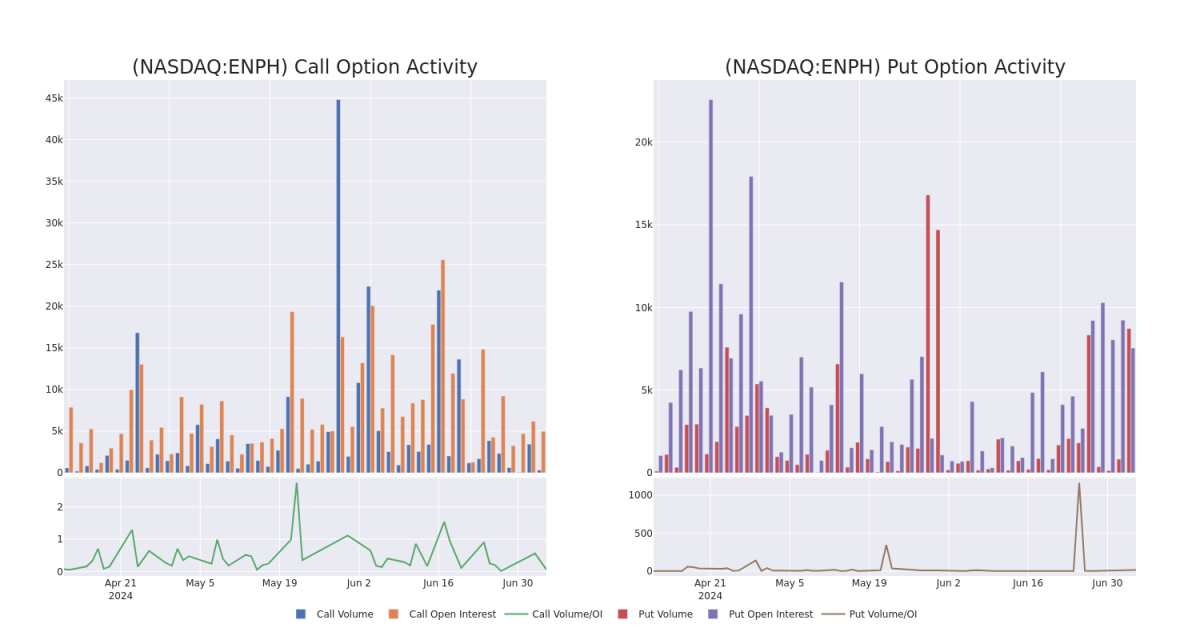

In today's trading context, the average open interest for options of Enphase Energy stands at 754.53, with a total volume reaching 1,846.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Enphase Energy, situated within the strike price corridor from $55.0 to $185.0, throughout the last 30 days.

在今天的交易背景下,Enphase Energy期權的平均未平倉合約量爲754.53,總成交量達到1,846.00。隨附的圖表描繪了Enphase Energy高價值交易中看跌和看漲期權成交量和未平倉合約量的進展情況,這些期權均處於55美元至185美元的行使價格走廊內,時間跨度爲30天。

Enphase Energy Call and Put Volume: 30-Day Overview

Enphase Energy看漲和看跌期權成交量:30天概述

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ENPH | CALL | TRADE | NEUTRAL | 06/20/25 | $35.05 | $16.5 | $26.2 | $105.00 | $157.2K | 52 | 0 |

| ENPH | CALL | TRADE | BULLISH | 01/16/26 | $13.4 | $11.2 | $13.4 | $185.00 | $134.0K | 409 | 0 |

| ENPH | PUT | SWEEP | BULLISH | 06/20/25 | $22.1 | $21.65 | $21.65 | $100.00 | $86.6K | 1.2K | 18 |

| ENPH | CALL | TRADE | BULLISH | 06/20/25 | $27.7 | $26.3 | $27.55 | $100.00 | $82.6K | 193 | 0 |

| ENPH | CALL | TRADE | BULLISH | 06/20/25 | $27.7 | $26.9 | $27.46 | $100.00 | $82.3K | 193 | 30 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ENPH | 看漲 | 交易 | 中立 | 06/20/25 | $35.05 | $16.5 | $26.2 | $105.00 | $157.2K | 52 | 0 |

| ENPH | 看漲 | 交易 | 看好 | 01/16/26 | $13.4 | $11.2 | $13.4 | $185.00 | $134.0K | 409 | 0 |

| ENPH | 看跌 | SWEEP | 看好 | 06/20/25 | $22.1 | $21.65 | $21.65 | $100.00。 | $86.6K | 1.2K | 18 |

| ENPH | 看漲 | 交易 | 看好 | 06/20/25 | $27.7 | $26.3美元 | $27.55 | $100.00。 | $82.6K | 193 | 0 |

| ENPH | 看漲 | 交易 | 看好 | 06/20/25 | $27.7 | $26.9 | $27.46 | $100.00。 | $82.3K | 193 | 30 |

About Enphase Energy

關於Enphase能源化工

Enphase Energy is a global energy technology company. The company delivers smart, easy-to-use solutions that manage solar generation, storage, and communication on one platform. The company's microinverter technology primarily serves the rooftop solar market and produces a fully integrated solar-plus-storage solution. Geographically, it derives a majority of revenue from the United States.

Enphase能源化工是一家全球能源科技公司。該公司提供智能易用的解決方案,其中一站式管理太陽能發電、儲能和通信。該公司的微逆變器技術主要服務於屋頂太陽能市場,並生產一種完全集成的太陽能+儲能解決方案。地理上,它從美國獲得了大部分收入。

After a thorough review of the options trading surrounding Enphase Energy, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

經過全面審查Enphase Energy期權交易後,我們進一步研究該公司。這包括對其當前市場狀況和表現的評估。

Current Position of Enphase Energy

Enphase Energy目前的位置

- Trading volume stands at 1,601,794, with ENPH's price up by 1.64%, positioned at $104.5.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 14 days.

- 交易量爲1,601,794,ENPH的價格上漲1.64%,位於104.5美元。

- RSI指標顯示該股票可能正接近超賣。

- 預計在14天內公佈收益聲明。

What The Experts Say On Enphase Energy

關於Enphase Energy,專家的看法

In the last month, 3 experts released ratings on this stock with an average target price of $111.94.

在過去的一個月裏,有3位專家對這支股票發表了評級,平均目標價爲111.94美元。

- In a positive move, an analyst from HSBC has upgraded their rating to Buy and adjusted the price target to $166.

- Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Enphase Energy with a target price of $124.

- An analyst from GLJ Research downgraded its action to Sell with a price target of $45.

- 積極的是,來自匯豐銀行的分析師已將其評級上調爲買入並將目標價調整至166美元。

- 在其評估中保持一致,摩根大通分析師對Enphase Energy給予超配評級,目標價爲124美元。

- GLJ Research的分析師下調了其行動爲賣出並給出了45美元的目標價。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Enphase Energy options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和回報潛力。敏銳的交易者通過不斷學習、調整策略、監控多種因子並密切關注市場行情來管理這些風險。使用Benzinga Pro即時提醒了解最新的Enphase Energy期權交易信息。