Unpacking the Latest Options Trading Trends in Exxon Mobil

Unpacking the Latest Options Trading Trends in Exxon Mobil

Financial giants have made a conspicuous bearish move on Exxon Mobil. Our analysis of options history for Exxon Mobil (NYSE:XOM) revealed 10 unusual trades.

Delving into the details, we found 40% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $63,315, and 8 were calls, valued at $538,877.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $70.0 to $125.0 for Exxon Mobil over the recent three months.

Analyzing Volume & Open Interest

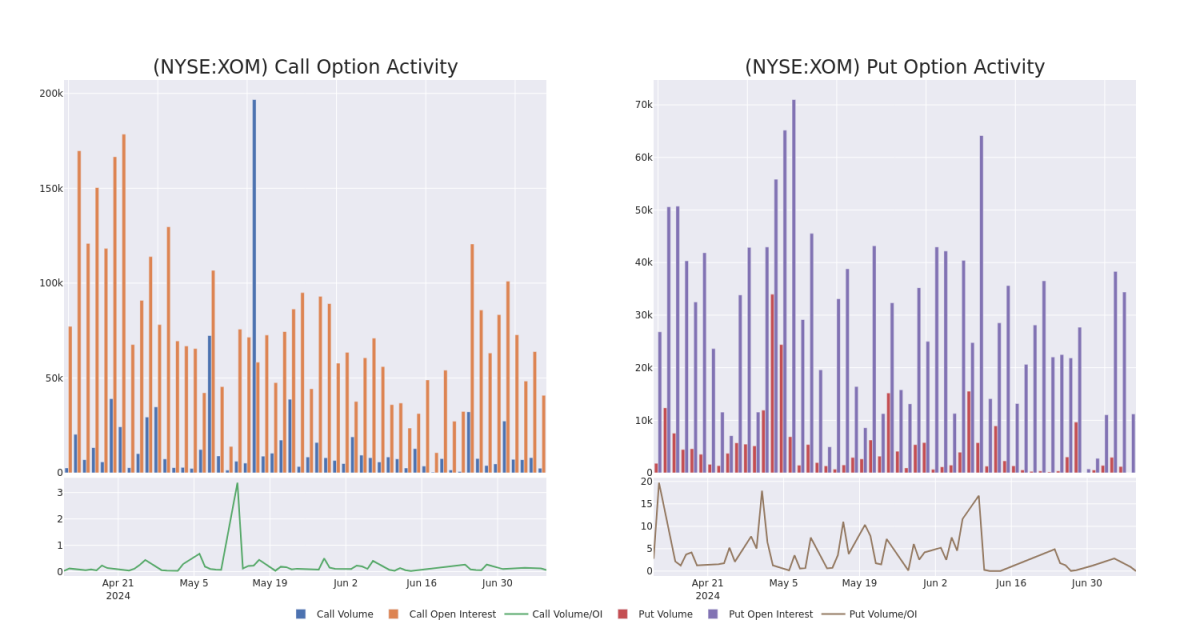

In today's trading context, the average open interest for options of Exxon Mobil stands at 5783.89, with a total volume reaching 2,418.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Exxon Mobil, situated within the strike price corridor from $70.0 to $125.0, throughout the last 30 days.

Exxon Mobil Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| XOM | CALL | TRADE | BEARISH | 08/23/24 | $2.87 | $2.48 | $2.56 | $113.00 | $198.9K | 20 | 21 |

| XOM | CALL | SWEEP | BEARISH | 08/16/24 | $1.69 | $1.65 | $1.65 | $115.00 | $132.0K | 10.5K | 1.2K |

| XOM | CALL | SWEEP | NEUTRAL | 12/20/24 | $7.5 | $7.35 | $7.45 | $110.00 | $37.9K | 1.8K | 2 |

| XOM | CALL | TRADE | BULLISH | 01/16/26 | $7.55 | $7.35 | $7.48 | $125.00 | $37.4K | 10.4K | 15 |

| XOM | CALL | TRADE | BULLISH | 01/16/26 | $34.0 | $33.7 | $34.0 | $80.00 | $34.0K | 552 | 10 |

About Exxon Mobil

ExxonMobil is an integrated oil and gas company that explores for, produces, and refines oil around the world. In 2023, it produced 2.4 million barrels of liquids and 7.7 billion cubic feet of natural gas per day. At the end of 2023, reserves were 16.9 billion barrels of oil equivalent, 66% of which were liquids. The company is one the world's largest refiners with a total global refining capacity of 4.5 million barrels of oil per day and is one of the world's largest manufacturers of commodity and specialty chemicals.

Current Position of Exxon Mobil

- Trading volume stands at 5,994,584, with XOM's price down by -0.65%, positioned at $111.45.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 17 days.

What The Experts Say On Exxon Mobil

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $143.66666666666666.

- An analyst from RBC Capital has revised its rating downward to Sector Perform, adjusting the price target to $135.

- An analyst from Barclays has decided to maintain their Overweight rating on Exxon Mobil, which currently sits at a price target of $142.

- Maintaining their stance, an analyst from UBS continues to hold a Buy rating for Exxon Mobil, targeting a price of $154.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.