Check Out What Whales Are Doing With NET

Check Out What Whales Are Doing With NET

Whales with a lot of money to spend have taken a noticeably bullish stance on Cloudflare.

擁有大量資金的鯨魚明顯看好Cloudflare。

Looking at options history for Cloudflare (NYSE:NET) we detected 18 trades.

查看Cloudflare (紐交所:NET)的期權歷史,我們發現有18次交易。

If we consider the specifics of each trade, it is accurate to state that 33% of the investors opened trades with bullish expectations and 27% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,33%的投資者持看多期權,27%持看跌期權。

From the overall spotted trades, 8 are puts, for a total amount of $420,914 and 10, calls, for a total amount of $409,463.

從整體上看,共有8次看跌期權交易,交易總額爲420,914美元;10次看漲期權交易,交易總額爲409,463美元。

What's The Price Target?

價格目標是什麼?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $77.0 to $120.0 for Cloudflare over the recent three months.

根據交易活動,看起來重要的投資者正在瞄準Cloudflare在最近三個月內的價格區間,大致從77.0美元到120.0美元。

Insights into Volume & Open Interest

成交量和持倉量分析

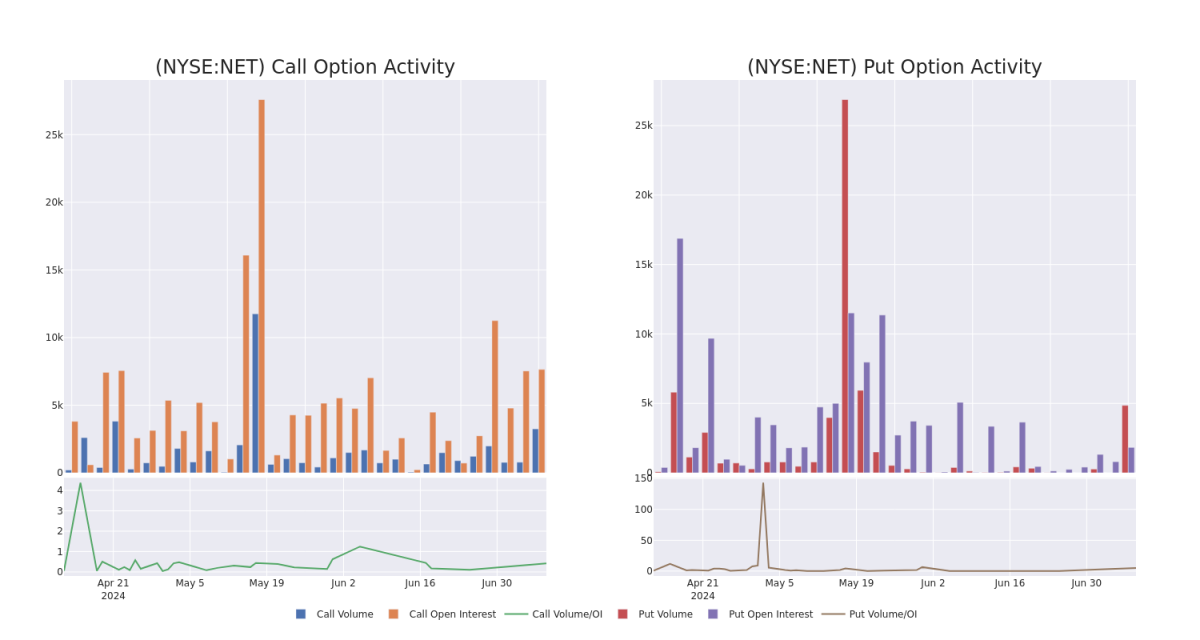

In terms of liquidity and interest, the mean open interest for Cloudflare options trades today is 1052.67 with a total volume of 8,105.00.

就流動性和利益而言,今天的Cloudflare期權交易平均持倉量爲1052.67,總成交量爲8,105.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Cloudflare's big money trades within a strike price range of $77.0 to $120.0 over the last 30 days.

在下面的圖表中,我們可以跟蹤Cloudflare的看漲期權和看跌期權的成交量和持倉量發展情況,該範圍爲77.0美元到120.0美元的行權價格區間,時間跨度爲最近30天。

Cloudflare Option Activity Analysis: Last 30 Days

Cloudflare期權活動分析:過去30天

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NET | PUT | TRADE | BEARISH | 09/20/24 | $37.6 | $36.95 | $37.6 | $120.00 | $94.0K | 4 | 10 |

| NET | CALL | TRADE | NEUTRAL | 07/26/24 | $7.3 | $6.95 | $7.13 | $77.00 | $71.3K | 921 | 3 |

| NET | PUT | SWEEP | NEUTRAL | 08/16/24 | $4.7 | $4.55 | $4.6 | $80.00 | $68.8K | 1.8K | 758 |

| NET | PUT | SWEEP | NEUTRAL | 08/16/24 | $4.7 | $4.55 | $4.6 | $80.00 | $61.7K | 1.8K | 1.5K |

| NET | PUT | SWEEP | BULLISH | 08/16/24 | $4.7 | $4.6 | $4.64 | $80.00 | $53.8K | 1.8K | 1.1K |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NET | 看跌 | 交易 | 看淡 | 09/20/24 | 37.6美元 | $36.95 | 37.6美元 | $120.00 | $94.0K | 4 | 10 |

| NET | 看漲 | 交易 | 中立 | 07/26/24 | $7.3 | $6.95 | $7.13 | $77.00 | $71.3K | 921 | 3 |

| NET | 看跌 | SWEEP | 中立 | 08/16/24 | $4.7 | 4.55 | $4.6 | $80.00 | $68.8K | 1.8K | 758 |

| NET | 看跌 | SWEEP | 中立 | 08/16/24 | $4.7 | 4.55 | $4.6 | $80.00 | $61.7K | 1.8K | 1.5K |

| NET | 看跌 | SWEEP | 看好 | 08/16/24 | $4.7 | $4.6 | $4.64 | $80.00 | $53.8K | 1.8K | 1.1千 |

About Cloudflare

關於Cloudflare

Cloudflare is a software company based in San Francisco, California, that offers security and web performance offerings by utilizing a distributed, serverless content delivery network, or CDN. The firm's edge computing platform, Workers, leverages this network by providing clients the ability to deploy, and execute code without maintaining servers.

Cloudflare是一家總部位於加利福尼亞州舊金山的軟件公司,通過利用分佈式、無服務器內容交付網絡(CDN)提供安全和網頁性能服務。該公司的邊緣計算平台Workers利用這個網絡,爲客戶提供不需要維護服務器就能部署和執行代碼的能力。

After a thorough review of the options trading surrounding Cloudflare, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在仔細審查圍繞Cloudflare的期權交易後,我們繼續對該公司進行更詳細的研究。這包括對其當前市場狀態和表現的評估。

Cloudflare's Current Market Status

Cloudflare的當前市場狀態

- With a volume of 1,799,275, the price of NET is down -2.45% at $82.8.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 23 days.

- 成交量爲1,799,275,NEt的價格下跌了-2.45%,爲82.8美元。

- RSI指標暗示該股票可能要超買了。

- 下一次收益預計在23天內公佈。

What Analysts Are Saying About Cloudflare

關於Cloudflare,分析師們都在說些什麼

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $77.8.

在過去30天內,共有5位專業分析師對這隻股票發表了自己的看法,並設定了平均價格目標爲77.8美元。

- Reflecting concerns, an analyst from Scotiabank lowers its rating to Sector Perform with a new price target of $85.

- In a cautious move, an analyst from Guggenheim downgraded its rating to Sell, setting a price target of $50.

- An analyst from Morgan Stanley has revised its rating downward to Equal-Weight, adjusting the price target to $92.

- An analyst from Cantor Fitzgerald downgraded its action to Neutral with a price target of $80.

- An analyst from UBS upgraded its action to Neutral with a price target of $82.

- 反映出擔憂的是,Scotiabank的一位分析師將Coudflare的評級降至板塊表現,並設定了新的價格目標爲85美元。

- 大摩資源lof的一位分析師採取謹慎的行動,下調了其評級至賣出,並設定了50美元的目標價。

- 大摩資源lof的一位分析師將評級下調至等重,並將目標價調整至92美元。

- Cantor Fitzgerald的一位分析師將其行動下調爲中立,目標價爲$80。

- UBS的一位分析師將其評級升至中立,並設定價格目標爲82美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。