Salesforce's Options: A Look at What the Big Money Is Thinking

Salesforce's Options: A Look at What the Big Money Is Thinking

Deep-pocketed investors have adopted a bearish approach towards Salesforce (NYSE:CRM), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CRM usually suggests something big is about to happen.

深謀遠慮的投資者對Salesforce (紐交所:CRM) 採取了看淡的態度,市場參與者不應忽視此舉。我們在Benzinga跟蹤公開期權記錄時揭示了這一重大舉動。這些投資者的身份尚未確定,但CRM的如此大規模的行爲通常意味着即將發生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for Salesforce. This level of activity is out of the ordinary.

我們從觀察中獲得了這些信息,當Benzinga的期權掃描器突出了Salesforce的9種非凡的期權活動時。這種活動水平是不同尋常的。

The general mood among these heavyweight investors is divided, with 22% leaning bullish and 44% bearish. Among these notable options, 4 are puts, totaling $154,500, and 5 are calls, amounting to $248,595.

這些重量級投資者的總體情緒存在分歧,22%看好,44%看淡。在這些值得注意的期權中,有4個認購期權,總額爲$154,500,5個認沽期權,總額爲$248,595。

Predicted Price Range

預測價格區間

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $225.0 to $260.0 for Salesforce over the last 3 months.

考慮到這些合同的成交量和未平倉量,似乎鯨魚們在過去的3個月裏一直瞄準Salesforce在$225.0至$260.0的價格區間內。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for Salesforce's options for a given strike price.

這些數據可以幫助您跟蹤給定執行價格下Salesforce期權的流動性和興趣。

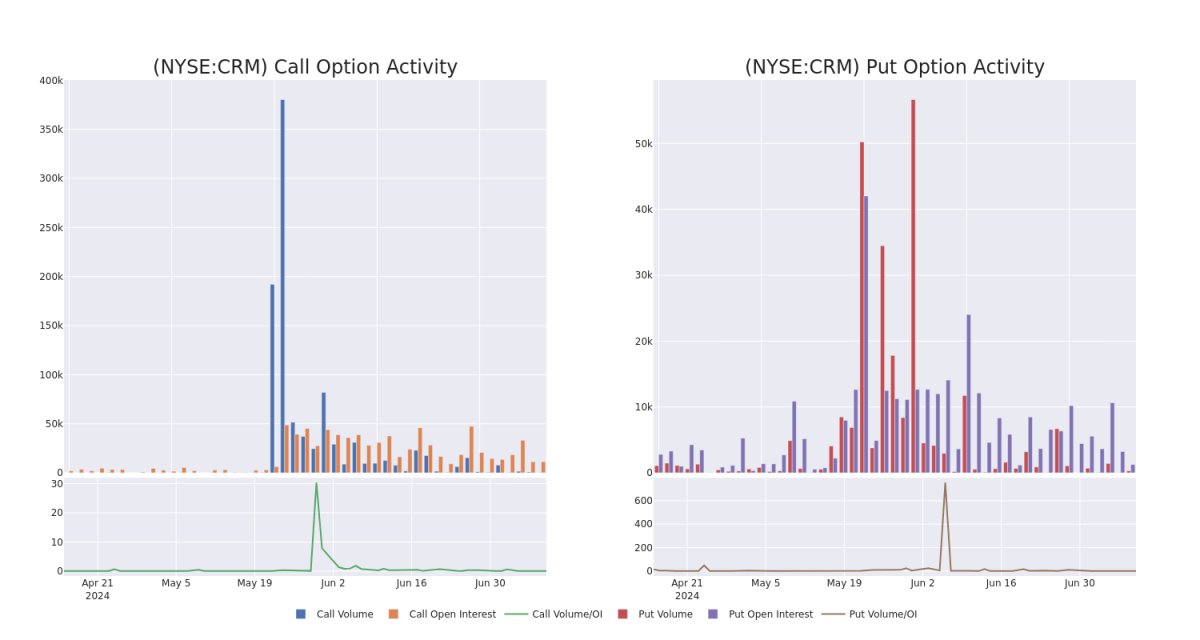

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Salesforce's whale activity within a strike price range from $225.0 to $260.0 in the last 30 days.

下面,我們可以觀察Salesforce的所有鯨魚活動,在最近30天期權行權價格範圍從$225.0到$260.0,調用和認沽期權的成交量和未平倉量的演變。

Salesforce Option Volume And Open Interest Over Last 30 Days

賽富時期權成交量和持倉量(過去30天內)

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRM | CALL | TRADE | BEARISH | 06/18/26 | $59.65 | $57.85 | $57.85 | $240.00 | $69.4K | 6.4K | 19 |

| CRM | PUT | TRADE | BEARISH | 08/09/24 | $5.75 | $4.95 | $5.75 | $250.00 | $57.5K | 53 | 0 |

| CRM | CALL | TRADE | BULLISH | 08/16/24 | $4.1 | $4.05 | $4.1 | $260.00 | $53.7K | 3.9K | 120 |

| CRM | CALL | TRADE | NEUTRAL | 07/12/24 | $26.7 | $23.35 | $24.71 | $225.00 | $49.4K | 30 | 0 |

| CRM | CALL | TRADE | NEUTRAL | 08/16/24 | $4.2 | $4.1 | $4.15 | $260.00 | $42.7K | 3.9K | 120 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRM | 看漲 | 交易 | 看淡 | 06/18/26 | $59.65 | $57.85 | $57.85 | $240.00 | $69.4K | 6.4千 | 19 |

| CRM | 看跌 | 交易 | 看淡 | 08/09/24 | $5.75 | $4.95 | $5.75 | $250.00 | $57.5K | 53 | 0 |

| CRM | 看漲 | 交易 | 看好 | 08/16/24 | $4.1 | $4.05 | $4.1 | $260.00 | $53.7K | 3.9K | 120 |

| CRM | 看漲 | 交易 | 中立 | 07/12/24 | $26.7 | $23.35 | $24.71 | $225.00 | 49,400 美元 | 30 | 0 |

| CRM | 看漲 | 交易 | 中立 | 08/16/24 | $4.2 | $4.1 | $4.15 | $260.00 | $42.7千 | 3.9K | 120 |

About Salesforce

關於賽富時

Salesforce provides enterprise cloud computing solutions. The company offers customer relationship management technology that brings companies and customers together. Its Customer 360 platform helps the group to deliver a single source of truth, connecting customer data across systems, apps, and devices to help companies sell, service, market, and conduct commerce. It also offers Service Cloud for customer support, Marketing Cloud for digital marketing campaigns, Commerce Cloud as an e-commerce engine, the Salesforce Platform, which allows enterprises to build applications, and other solutions, such as MuleSoft for data integration.

賽富時提供企業級雲計算解決方案。該公司提供客戶關係管理技術,將公司和客戶聯繫在一起。其客戶360平台幫助集團提供單一的數據來源,連接客戶數據跨系統、應用和設備,幫助公司銷售、服務、市場和開展商業。它還爲客戶支持提供服務雲,爲數字營銷活動提供營銷雲,作爲電子商務引擎的商業雲,提供賽富時平台,以允許企業構建應用程序和其他解決方案,例如用於數據集成的MuleSoft。

Having examined the options trading patterns of Salesforce, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了賽富時的期權交易情況之後,現在我們的重點轉向這家公司。這種轉變使我們能夠深入了解其當前的市場地位和業績。

Salesforce's Current Market Status

Salesforce的當前市場狀態

- Currently trading with a volume of 599,856, the CRM's price is down by -1.1%, now at $249.65.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 49 days.

- 目前交易量爲599,856,CRM的價格下跌了-1.1%,現在爲$249.65。

- RSI讀數表明該股目前可能接近超買水平。

- 預計還有49天就要發佈收益報告了。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Salesforce options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在收益。精明的交易者通過持續教育自己、調整策略、監控多種因子並密切關注市場動向來管理這些風險。通過Benzinga Pro的實時提醒,及時了解最新的賽富時期權交易。