Insiders At D.R. Horton Sold US$6.2m In Stock, Alluding To Potential Weakness

Insiders At D.R. Horton Sold US$6.2m In Stock, Alluding To Potential Weakness

The fact that multiple D.R. Horton, Inc. (NYSE:DHI) insiders offloaded a considerable amount of shares over the past year could have raised some eyebrows amongst investors. When evaluating insider transactions, knowing whether insiders are buying is usually more beneficial than knowing whether they are selling, as the latter can be open to many interpretations. However, shareholders should take a deeper look if several insiders are selling stock over a specific time period.

在過去的一年裏,多位D.R. Horton (紐交所:DHI)公司內部人士大量拋售股票,這可能引起了投資者的關注。在評估內部交易時,了解內部人士是否買入通常比了解他們是否賣出更有益,因爲後者可能有很多解釋。但是,如果有幾位內部人士在一個特定時間段內拋售股票,股東應該進一步深入評估。

Although we don't think shareholders should simply follow insider transactions, we do think it is perfectly logical to keep tabs on what insiders are doing.

雖然我們不認爲股東應該簡單地跟隨內部交易,但我們認爲監控內部人士的行動是很合理的。

D.R. Horton Insider Transactions Over The Last Year

D.R. Horton內部交易在過去一年內

Over the last year, we can see that the biggest insider sale was by the Executive Chairman, David Auld, for US$3.9m worth of shares, at about US$156 per share. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. The silver lining is that this sell-down took place above the latest price (US$140). So it may not tell us anything about how insiders feel about the current share price.

過去一年中,我們可以看到執行董事David Auld出售了總價值390萬美元的股票,每股價格約爲156美元。雖然內部人士的賣出是一個負面因素,但對我們來說,如果股票價格較低時拋售更爲負面。好的一面是,這次拋售是在最新價格之上(140美元),所以它可能無法告訴我們內部人士對當前股價的看法。

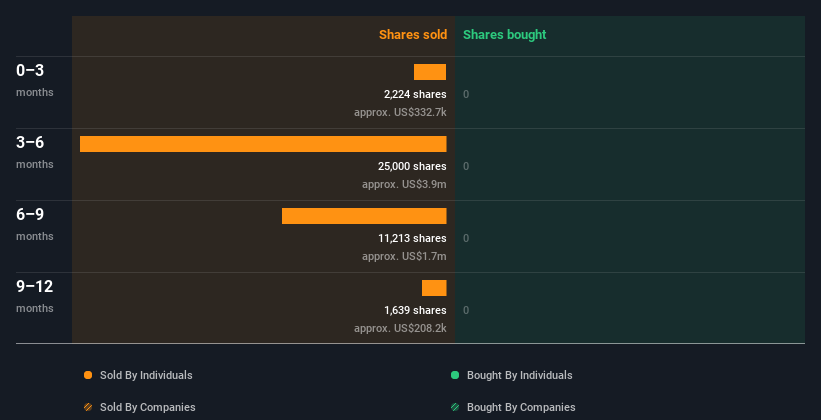

In the last year D.R. Horton insiders didn't buy any company stock. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

在過去一年中,D.R. Horton的內部人士沒有買入任何公司的股票。您可以在下面的圖表中看到過去一年(按公司和個人)的內部交易情況。如果您單擊圖表,可以查看所有個人交易,包括股價、個人和日期!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: Most of them are flying under the radar).

如果你喜歡購買內部人員正在購買而不是銷售的股票,那麼你可能會喜歡這份免費的公司列表。(提示:它們中的大部分都被忽視了。)

D.R. Horton Insiders Are Selling The Stock

D.R. Horton的內部人士正在拋售股票

The last quarter saw substantial insider selling of D.R. Horton shares. In total, insiders sold US$335k worth of shares in that time, and we didn't record any purchases whatsoever. In light of this it's hard to argue that all the insiders think that the shares are a bargain.

最近一個季度D.R. Horton的內部人士大量拋售了股票。總共,內部人士在那段時間內出售了33.5萬美元的股票,我們沒有記錄任何購買。考慮到這一點,很難說所有內部人士都認爲股票是良心價位。

Does D.R. Horton Boast High Insider Ownership?

D.R. Horton擁有高股東持股比例嗎?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. A high insider ownership often makes company leadership more mindful of shareholder interests. It's great to see that D.R. Horton insiders own 1.0% of the company, worth about US$426m. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

查看一家公司的內部股權總數可以幫助你了解它們是否與普通股東保持良好的對齊。內部股東佔比較高通常能使公司領導更關注股東利益。很高興看到D.R. Horton的內部股東持有公司的1.0%,約價值4,2600萬美元。大多數股東會很高興看到這種內部持股比例,因爲它表明管理層的激勵與其他股東的利益得到了很好的對齊。

So What Does This Data Suggest About D.R. Horton Insiders?

那麼,這些數據對D.R. Horton的內部人士意味着什麼?

Insiders haven't bought D.R. Horton stock in the last three months, but there was some selling. Looking to the last twelve months, our data doesn't show any insider buying. While insiders do own a lot of shares in the company (which is good), our analysis of their transactions doesn't make us feel confident about the company. Of course, the future is what matters most. So if you are interested in D.R. Horton, you should check out this free report on analyst forecasts for the company.

在過去的三個月內,內部人士沒有購買D.R. Horton的股票,但有一些拋售。在過去的十二個月中,我們的數據沒有顯示出任何內部人士購買。雖然內部人士擁有很多公司的股份(這是好事),但我們對他們的交易分析並不讓我們對公司感到自信。當然,未來才是最重要的。因此,如果您對D.R. Horton感興趣,您應該查看此免費報告以了解分析師對該公司的預測。

But note: D.R. Horton may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

但請注意:D.R. Horton可能不是最好的買入股票。所以請看看這份免費清單,其中列出了高ROE和低負債的有趣公司。

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

對於本文而言,內部人是指向相關監管機構報告其交易的個人。我們目前僅考慮公開市場交易和直接利益的私人處置,但不包括衍生交易或間接利益。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有反饋?關注內容?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

對本文有反饋? 對內容感到擔憂? 請直接與我們聯繫。 或者,發送電子郵件至editorial-team@simplywallst.com。