The Market Doesn't Like What It Sees From Pieris Pharmaceuticals, Inc.'s (NASDAQ:PIRS) Revenues Yet As Shares Tumble 30%

The Market Doesn't Like What It Sees From Pieris Pharmaceuticals, Inc.'s (NASDAQ:PIRS) Revenues Yet As Shares Tumble 30%

Unfortunately for some shareholders, the Pieris Pharmaceuticals, Inc. (NASDAQ:PIRS) share price has dived 30% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 56% loss during that time.

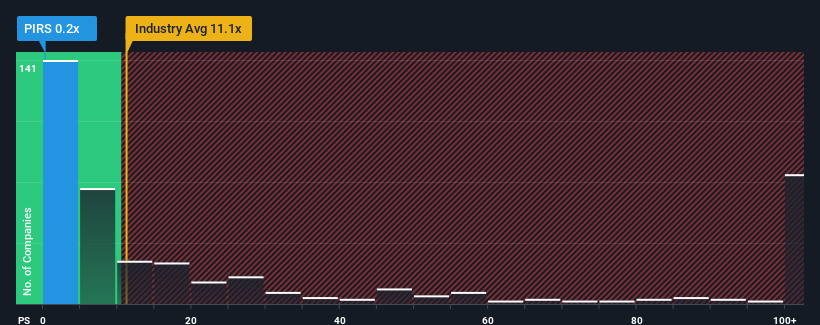

Following the heavy fall in price, Pieris Pharmaceuticals' price-to-sales (or "P/S") ratio of 0.2x might make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 11.1x and even P/S above 59x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

How Pieris Pharmaceuticals Has Been Performing

Pieris Pharmaceuticals certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Pieris Pharmaceuticals' earnings, revenue and cash flow.How Is Pieris Pharmaceuticals' Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Pieris Pharmaceuticals' to be considered reasonable.

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Pieris Pharmaceuticals' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 143% last year. The latest three year period has also seen a 29% overall rise in revenue, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 282% shows it's noticeably less attractive.

With this information, we can see why Pieris Pharmaceuticals is trading at a P/S lower than the industry. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On Pieris Pharmaceuticals' P/S

Shares in Pieris Pharmaceuticals have plummeted and its P/S has followed suit. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

In line with expectations, Pieris Pharmaceuticals maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 3 warning signs for Pieris Pharmaceuticals (2 are concerning!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com