Boeing's Turbulence Sends Kaiser Aluminum's Short Interest Soaring To 12-Month High

Boeing's Turbulence Sends Kaiser Aluminum's Short Interest Soaring To 12-Month High

In the world of aerospace, when a giant like Boeing Co (NYSE:BA) hits turbulence — the shockwaves are felt far and wide. One such ripple effect has landed squarely on Kaiser Aluminum Corp (NASDAQ:KALU).

在航空航天領域,當像波音公司(NYSE:BA)這樣的巨頭遇到困難時,震波會在遠處感受到。這種波及效應之一正直接影響到凱撒鋁業公司(NASDAQ:KALU)。

Kaiser has a long-term contract with Boeing. Kaiser supplies sheet and light gauge aluminum plate for use in Boeing commercial aircraft products.

凱撒與波音有長期合同。凱撒向波音商用飛機項目提供板材和輕量鋁板。

Read Also: How Boeing's Guilty Plea Could Impact US Defense Contracts

閱讀:波音的有罪認罪如何影響美國國防合同

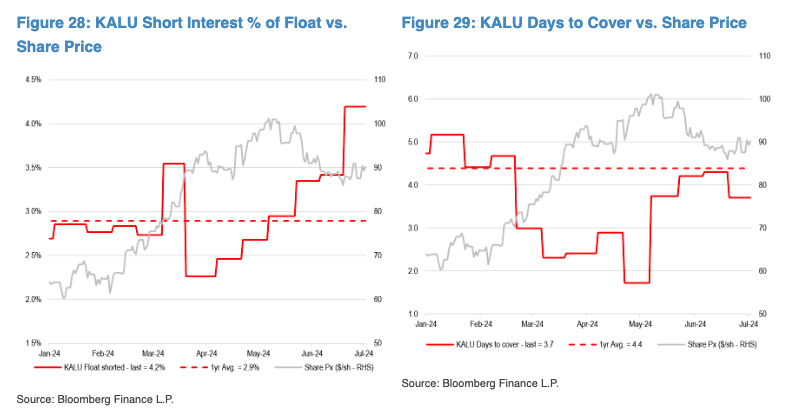

Boeing's plight in recent months has led investors to cast a doubt on its suppliers' prospects. A prime example of this is seen in Kaiser Aluminium's stock. Kaiser's short interest has surged to a 12-month high, according to JPMorgan analyst Bill Peterson's latest Short Interest Tracker.

波音最近幾個月的困境已經讓投資者對其供應商前景產生懷疑,這種漣漪效應可以清晰地看到在分析師比爾・彼得森的最新空頭持倉追蹤器中。凱撒鋁業的空頭持倉已經飆升至12個月的高點。

High-Flying Concerns

重大隱憂

As of the June 28 settlement, Kaiser Aluminum's short interest had rocketed 23% to 4.2% — a significant leap from its one-year average of 2.9%. The reasons? Mounting concerns over Boeing's de-stocking and an overstretched stock momentum have investors on edge.

截至6月28日的清算,凱撒鋁業的空頭持倉已經飆升23%,達到4.2%——遠高於其一年平均水平2.9%的顯著躍升。原因是對波音取消存貨和股票過度活躍的擔憂使得投資者感到不安。

Numbers That Speak

數字說話

- KALU's short interest: 4.2%, up 23% in two weeks, 25% over four weeks

- Stock price (as of July 10): $90.19

- Analyst rating: Neutral (N)

- Price target: $85.00, indicating a 6% downside

- Price movements: +2.2% over one week, -2.1% over one month

- KALU的空頭持倉:4.2%,兩週內上漲23%,四周內上漲25%

- 股票價格(截至7月10日):90.19美元

- 分析師評級:中立(N)

- 價格目標:85.00美元,表明下跌6%

- 價格變動:一週上漲2.2%,一個月下跌2.1%

The Boeing Effect

波音效應

Peterson points out that the catalyst for this spike in short interest is the increased risk surrounding Boeing.

彼得森指出,導致空頭持倉激增的催化劑是有關波音風險的增加。

As Boeing grapples with its own set of challenges, the ripple effect has not only impacted its stock but also put suppliers like Kaiser Aluminum. Boeing's de-stocking fears have made investors wary, prompting them to bet against Kaiser Aluminum stock in anticipation of further declines.

隨着波音應付自身一系列問題,波及效應不僅影響了其股票,還讓像凱撒鋁業這樣的供應商變得也很不穩定,投資者也因此押注對凱撒鋁業的股票看跌,期望進一步下跌。

Short Sellers In The Cockpit

空頭寸西裝革履

With the average days-to-cover falling to 3.3 days from 5.1 days, short sellers are clearly in the cockpit. They are clearly navigating this volatile landscape with heightened activity. The jump in short interest is a stark reminder of the cautious sentiment pervading the market as investors brace for potential fallout from Boeing's woes.

隨着平均借貸天數從5.1天下降到3.3天,空頭交易員顯然在駕駛艙內。他們在這種動盪的市場中明顯提高了活動頻率。空頭持倉的大幅上漲是對市場持謹慎情緒刺痛人心的警醒,投資者正準備應對波音困境可能帶來的潛在影響。

In the ever-turbulent skies of aerospace investments, Kaiser Aluminum finds itself in a precarious position. As Boeing battles its own demons, the reverberations continue to unsettle its suppliers, making Kaiser Aluminum a focal point for short sellers betting on further instability.

在航空航天行業投資中,凱撒鋁業處於一個不穩定的位置。隨着波音自身的鬥爭,這種反響會持續不穩定供應商,使凱撒鋁業成爲看跌投資者押注進一步動盪的焦點。

Whether this turbulence will lead to a smoother landing or more rough skies ahead remains to be seen.

這種波動是否會導致更爲順暢的着陸或不斷變化的局面尚不確定。

- Legal Turbulence Shakes Boeing Stock: Is There More Altitude Ahead?

- 波音股票遭遇法律動盪:未來還會有更多高度嗎?

Boeing's plight in recent months has led investors to cast a doubt on its suppliers' prospects. A prime example of this is seen in Kaiser Aluminium's stock. Kaiser's short interest has surged to a 12-month high, according to JPMorgan analyst Bill Peterson's latest Short Interest Tracker.

Boeing's plight in recent months has led investors to cast a doubt on its suppliers' prospects. A prime example of this is seen in Kaiser Aluminium's stock. Kaiser's short interest has surged to a 12-month high, according to JPMorgan analyst Bill Peterson's latest Short Interest Tracker.