Applied Mat Unusual Options Activity

Applied Mat Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on Applied Mat.

資金充裕的鯨魚們對應用材料公司採取了明顯的看跌態度。

Looking at options history for Applied Mat (NASDAQ:AMAT) we detected 11 trades.

查看應用材料(納斯達克:AMAT)期權歷史,我們檢測到11次交易。

If we consider the specifics of each trade, it is accurate to state that 27% of the investors opened trades with bullish expectations and 45% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,27%的投資者看漲,45%的投資者看淡。

From the overall spotted trades, 5 are puts, for a total amount of $208,641 and 6, calls, for a total amount of $325,498.

從所有被發現的交易中,有5個看跌期權,總金額爲208,641美元,也有6個看漲期權,總金額爲325,498美元。

Projected Price Targets

預計價格目標

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $140.0 to $260.0 for Applied Mat over the last 3 months.

考慮到這些合同的成交量和持倉量,似乎過去3個月中,鯨魚們一直在以140.0至260.0美元的價格區間內瞄準應用材料。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

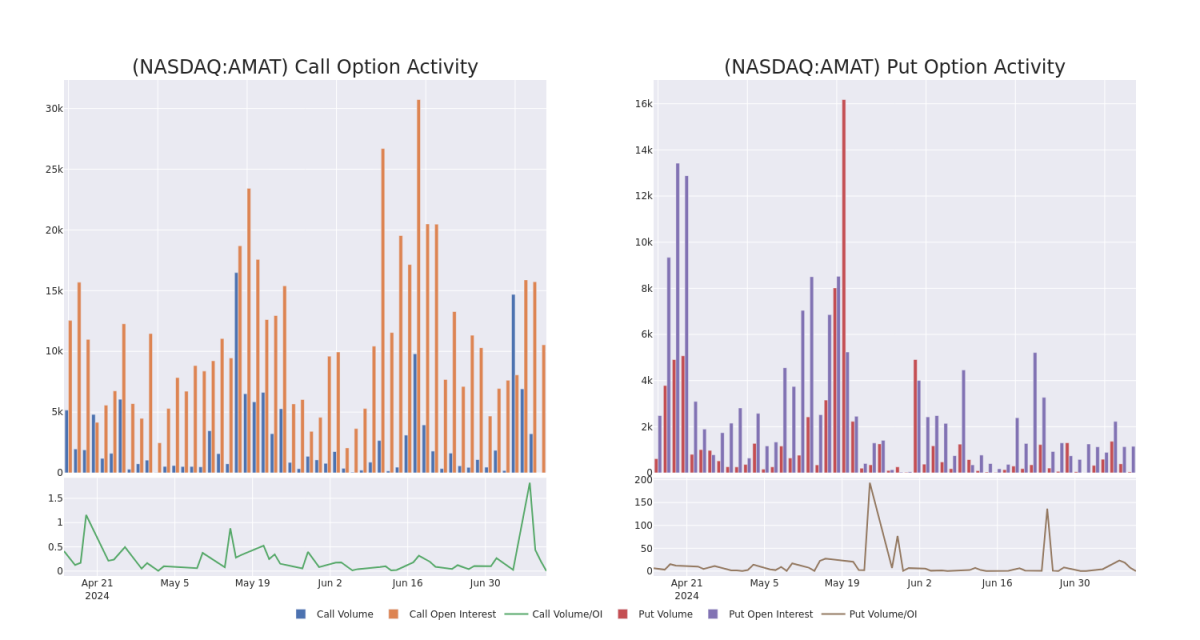

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for Applied Mat's options for a given strike price.

這些數據可以幫助你跟蹤應用材料在給定行權價的期權的流動性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Applied Mat's whale activity within a strike price range from $140.0 to $260.0 in the last 30 days.

下面我們可以看到在過去30天內,對應用材料的所有鯨魚活動的看漲期權和看跌期權的成交量和持倉量的演變,都在$140.0至$260.0的行權價區間內。

Applied Mat Call and Put Volume: 30-Day Overview

應用材料看漲和看跌期權成交量:30天概覽

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMAT | CALL | TRADE | NEUTRAL | 06/20/25 | $38.75 | $36.3 | $37.55 | $260.00 | $75.1K | 1.3K | 1 |

| AMAT | CALL | SWEEP | NEUTRAL | 01/17/25 | $118.75 | $115.45 | $117.1 | $140.00 | $58.5K | 1.3K | 0 |

| AMAT | CALL | TRADE | BULLISH | 01/16/26 | $53.0 | $52.45 | $52.85 | $250.00 | $58.1K | 906 | 0 |

| AMAT | CALL | TRADE | BULLISH | 01/16/26 | $57.9 | $56.65 | $57.52 | $240.00 | $57.5K | 200 | 0 |

| AMAT | PUT | SWEEP | BEARISH | 07/19/24 | $2.1 | $2.01 | $2.08 | $245.00 | $54.7K | 414 | 40 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMAT | 看漲 | 交易 | 中立 | 06/20/25 | $38.75 | $36.3 | $37.55 | $260.00 | $75.1K | 1.3K | 1 |

| AMAT | 看漲 | SWEEP | 中立 | 01/17/25 | $118.75 | $115.45 | $117.1 | $140.00 | $58.5K | 1.3K | 0 |

| AMAT | 看漲 | 交易 | 看好 | 01/16/26 | $53.0 | $52.45 | $52.85 | $250.00 | $58.1K | 906 | 0 |

| AMAT | 看漲 | 交易 | 看好 | 01/16/26 | $57.9 | $56.65 | $57.52 | $240.00 | $57.5K | 200 | 0 |

| AMAT | 看跌 | SWEEP | 看淡 | 07/19/24 | $2.1 | $2.01 | $2.08 | 245.00美元 | $54.7K | 414 | 40 |

About Applied Mat

關於應用材料

Applied Materials is the largest semiconductor wafer fabrication equipment, or WFE, manufacturer in the world. Applied Materials has a broad portfolio spanning nearly every corner of the WFE ecosystem. Specifically, Applied Materials holds a market share leadership position in deposition, which entails the layering of new materials on semiconductor wafers. It is more exposed to general-purpose logic chips made at integrated device manufacturers and foundries. It counts the largest chipmakers in the world as customers, including TSMC, Intel, and Samsung.

應用材料是全球最大的半導體硅片製造設備或WFE製造商。應用材料擁有廣泛的產品組合,幾乎涵蓋了WFE生態系統中的每個角落。具體而言,應用材料在沉積領域佔據市場份額領先地位,該領域包括在半導體晶片上堆疊新材料。它更多地暴露於集成器件製造商和代工廠製造的通用邏輯芯片。它將全球最大的芯片製造商(包括台積電,英特爾和三星)視爲客戶。

Following our analysis of the options activities associated with Applied Mat, we pivot to a closer look at the company's own performance.

在我們對應用材料相關期權活動的分析之後,我們轉向更仔細地觀察該公司的業績。

Current Position of Applied Mat

應用材料當前位置

- With a volume of 146,254, the price of AMAT is down -0.68% at $253.24.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 35 days.

- 以146,254的成交量來看,AMAt的價格下跌了-0.68%至253.24美元。

- RSI指標暗示該股票可能要超買了。

- 下次盈利預計將在35天后發佈。

What The Experts Say On Applied Mat

關於應用材料的專家意見

In the last month, 2 experts released ratings on this stock with an average target price of $290.0.

在過去的一個月裏,有2位專家對這支股票進行了評級,平均目標價爲290.0美元。

- Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Applied Mat, targeting a price of $280.

- An analyst from B. Riley Securities has decided to maintain their Buy rating on Applied Mat, which currently sits at a price target of $300.

- 維持其態度,富國銀行的分析師繼續維持應用材料的股票評級爲超額表現,目標價爲280美元。

- B. Riley Securities的一位分析師已決定維持對Applied Mat的買入評級,目前的價格目標爲300美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。