The Three-year Loss for Petpal Pet Nutrition Technology (SZSE:300673) Shareholders Likely Driven by Its Shrinking Earnings

The Three-year Loss for Petpal Pet Nutrition Technology (SZSE:300673) Shareholders Likely Driven by Its Shrinking Earnings

While it may not be enough for some shareholders, we think it is good to see the Petpal Pet Nutrition Technology Co., Ltd. (SZSE:300673) share price up 18% in a single quarter. But that doesn't change the fact that the returns over the last three years haven't been great. To be specific, the share price is a full 31% lower, while the market is down , with a return of (-27%)..

While the stock has risen 13% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

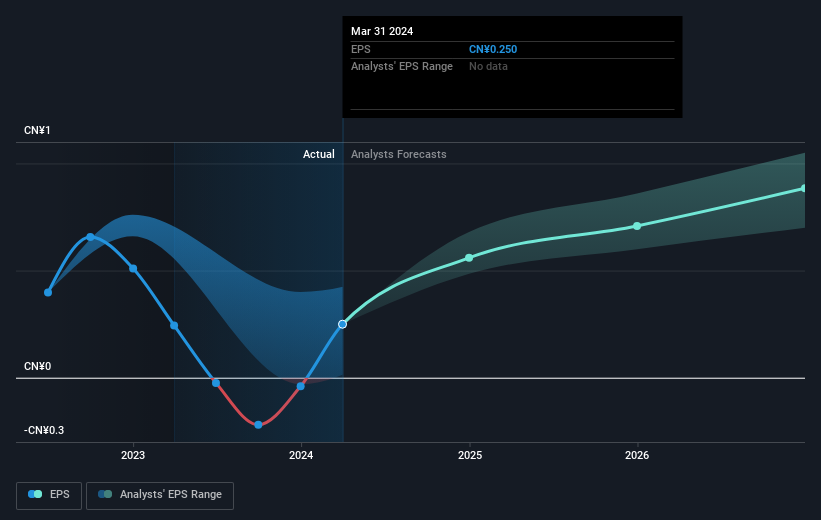

During the three years that the share price fell, Petpal Pet Nutrition Technology's earnings per share (EPS) dropped by 16% each year. In comparison the 12% compound annual share price decline isn't as bad as the EPS drop-off. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term. This positive sentiment is also reflected in the generous P/E ratio of 49.91.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

We're pleased to report that Petpal Pet Nutrition Technology shareholders have received a total shareholder return of 2.2% over one year. Notably the five-year annualised TSR loss of 2% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Before deciding if you like the current share price, check how Petpal Pet Nutrition Technology scores on these 3 valuation metrics.

But note: Petpal Pet Nutrition Technology may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com